Commercial Insurance Leaders, Are You Doing All You Can to End Slave Labor?

Many industries have become more self-aware in recent years, intent on making our world a better place by focusing on social responsibility.

The insurance industry is no exception.

Carriers are finding innovative ways to build social responsibility into their policies, using conditions and exclusions to drive more ethical behavior from their policyholders’ suppliers. In recent years, carriers have divested from insuring coal producers, tobacco companies and the National Rifle Association, for example.

Now insurance companies are setting their sights on ending slave labor in supply chains as many industries have come under fire for not doing enough to identify and remove slave labor throughout the supply chains.

Insurance companies have unique leverage to compel insureds to do better. If an insured with problematic supply chains cannot find affordable coverage, they may be forced to improve. An insurance company could face reputational damage if they ignored supply chain problems, so they cannot afford to remain neutral about this critical human rights issue.

It is not enough to tackle supply chain issues only within one’s own company — now businesses must also be concerned with the supply chains of their vendors and suppliers. Knowingly using a supplier that has been accused of human trafficking and modern slavery reflects guilt on both the supplier and the business using them. Ignorance of a supplier’s conditions is not an excuse — transparency in supply chains means knowing and exposing good and bad practices along the way.

The Evolution of Insurance in Ending Salve Labor

Ending slave labor in supply chains is an important ESG value, because it is simply the right thing to do.

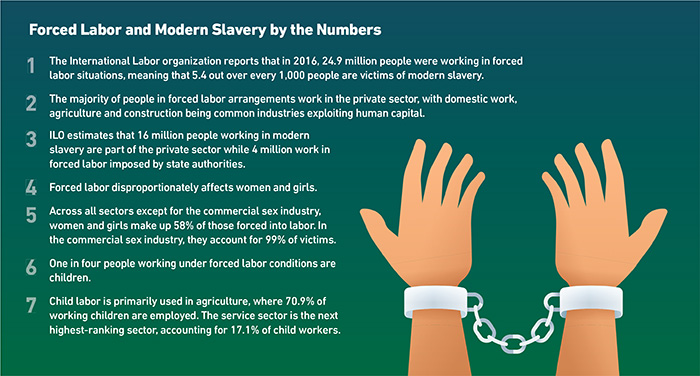

The International Labour Organization (ILO) estimated close to 25 million people worldwide were living in modern slavery through forced labor in 2016. They noted children comprised a quarter of the victims of modern slavery.

The ILO defines modern slavery as “traditional practices of forced labor, such as vestiges of slavery or slave-like practices, and various forms of debt bondage, as well as new forms of forced labor that have emerged in recent decades, such as human trafficking.”

Some industries are more prone to modern slavery, but it should be a concern in all businesses — especially as supply chains become more complex with links to suppliers and vendors in many diverse locations.

There are well-known examples of potential forced labor in manufacturing of retail products like mobile phones or in food supply production such as coffee producers, but even insurance companies themselves are not exempt — many carriers have call centers or IT and other operations spreading outside the U.S. As they expand, so too does the potential risk within their supply chain.

Insurance companies are improving their efforts.

In 2020, Allianz developed its ESG Guide for NonLife Insurance in partnership with the Principles for Sustainable Insurance to tackle these issues. Chubb has focused on responsible underwriting to use policy exclusions and conditions to manage ESG issues. AXA XL has committed to onsite risk reviews of suppliers and vendors throughout its supply chain.

Legislation Supports Carrier Initiatives

In 2015, the UK passed the Modern Slavery Act, which contains the Transparency in Supply Chains provision.

This provision is aimed at preventing modern slavery in supply chains and requires organizations to file a slavery and human trafficking statement for each financial year. This statement asserts how the organization is managing this risk within its own walls and those of its vendors and suppliers.

Some critics of the Modern Slavery Act felt it lacked enforcement power and therefore had not done enough to drive change. A 2019 revision was added to increase enforcement measures to act as a deterrent to those who may ignore the Act.

In the U.S., California leads the way in efforts for improvement of supply chain transparency. The California Transparency in Supply Chain Act (2012) sheds light on company practices to end slavery and human trafficking within their supply chains. Consumers can make more educated decisions knowing how the companies they work with are acting to improve human conditions around the world.

California’s act is a little different — it compels businesses only to disclose their actions. They are not required to change their behavior as it relates to ESG issues, only to report it publicly on their website. The public can then decide which business to work with — a true “vote with your wallet” philosophy.

In 2015, the U.S. enacted the Business Supply Chain Transparency on Trafficking and Slavery Act to require disclosures regarding measures taken to reduce or eliminate modern slavery in supply chains.

Best Practices Carriers Should Adopt Going Forward

Chris Bonnet, head of ESG business services at Allianz Global Corporate & Specialty, recommends a proactive partnership approach between carrier and clients.

Chris Bonnet, head of ESG business services, Allianz Global Corporate & Specialty

“Taking action on modern slavery can reduce liability exposures, enhance public and brand reception, and/or prevent or repair previous reputational damage in those clients who have faced such problems in the past,” he said.

“By collaborating with our clients and brokers, we can not only raise awareness of the benefits of addressing modern slavery but also build up and share expertise on best practice approaches.”

In addition to this proactive approach, there are several other best practices carriers should employ going forward to eliminate slave labor in supply chains:

1) Build in consequences for policyholders that do not attempt to drive slave labor from their supply chains.

Companies and carriers alike face reputational risk and loss of goodwill if they ignore abusive conditions in their supply chains. Bonnet noted, “Mitigating modern slavery is an important issue for all companies, regardless of the industry.”

2) Add clauses, conditions and exclusions in policies that support ESG policies, specifically aimed at removing modern slavery from the supply chain.

Carriers should require their policyholders do their due diligence in researching at least their tier one suppliers and perhaps even tiers two and three. Conditions can be added to enforce this required due diligence, and carriers can review their policyholders’ compliance with this condition during risk reviews.

3) Educate clients and insurance company employees about ESG issues.

Make sure they understand what modern slavery looks like and how to raise issues. Carriers can build steps into the underwriting process to ensure a thorough review of these concerns. If it is added as a formal step in a process, it is much more likely to happen.

4) Support underwriters and clients to create an atmosphere where concerns can be safely raised.

Empowering underwriters to spotlight human safety concerns means more visibility to the issue across levels. When issues are known they can be fixed.

“Within Allianz, the group-level ESG guidelines for sensitive business sectors support our underwriters to identify human rights issues, including modern slavery in our insurance portfolio across all sectors,” Bonnet said. “At Allianz, we support our underwriters and clients to identify and assess any potential ESG issues and develop recommendations on how to mitigate these risks.”

Long-term Impact of Insurance Companies’ Efforts

Insurance companies have a rich history of helping people and society.

The issue of ending slave labor is no different — carriers can take on human rights and other ESG issues, and everyone wins.

Insurance companies are uniquely positioned to improve human conditions around the world due to their exposure and access to many layers of the supply chain. Leveraging their financial position, carriers can influence policyholders to make positive changes throughout their supply chains and around the globe.

This is another legacy of our industry. We should be proud of the role insurance is taking in ending slave labor. &