2017 Teddy Award Winner

Carrots, Not Sticks

When Monica Manske does rounds at Rochester Regional Health’s five hospitals and six long-term care facilities, she looks at shoes, among other things.

Her interest is safety — not fashion. However, offering employees more fashionable options helped increase the compliance rate in RRH’s mandatory safety shoe program from 35 percent a few years ago to 85 percent in 2016, said Manske, RRH’s senior manager of workers’ compensation and employee safety.

Safety shoes are an important factor in preventing slips and falls, which are a major loss driver for health care facilities, especially for employees in food service, environmental and housekeeping and direct patient care.

In the five years since its inception, the safety shoe program contributed to a 42 percent reduction in lost-time claims and a 46 percent reduction in employee injuries.

That change came only with deliberate and concerted use of one-on-one communications, surveys, budget adjustments and historical claims data, Manske said.

By virtue of mergers and acquisitions, RRH grew during the past decade from about 10,000 employees to almost 17,000.

As it grew, the workers’ comp and safety team — three employees dedicated to workers’ compensation, two for ergonomics, plus physical therapy and clinical education staff partners and 150 safety champions — educated waves of new employees in safety protocols, including the shoe program.

The team is strategic in its approach to shoe compliance. Rather than punish non-compliant employees, it launched a survey asking workers to disclose why they chose not to wear the safety shoes. The responses helped facilitate program refinements.

Monica Manske, senior manager of workers’ compensation and employee safety, Rochester Regional Health

As a result of the feedback, the shoe subsidy grew substantially, as did the quality and variety, including more-fashionable Sketchers and Reeboks. Compliance now approaches 90 percent, Manske said.

When she does rounds and sees a non-compliant employee, “I introduce myself in a friendly way and ask about the shoes.” Maybe they don’t fit right. Maybe the employee is new and hasn’t been fitted yet.

The same process applies to other programs, she said, such as direct patient care where soft tissue and musculoskeletal disorders are common and largely avoidable. Housekeeping is a key focus as well due to its potential factor in infections such as MRSA.

Frequent, direct employee contact is essential to spreading the safety gospel, said Laurie Muratore, injury prevention clinic manager, RRH. “We don’t just train at first hire and then cut them loose. It takes daily involvement.”

Sometimes she puts on scrubs and spends a few days on a unit to immerse herself in the staff’s struggles and challenges. “If you’re not out there in the mix, it’s hard to teach and preach and be accepted.”

“I like to be the carrot. Not the stick. We don’t punish mistakes. This is fact finding, not fault finding.” — Monica Manske, senior manager of workers’ compensation and employee safety, Rochester Regional Health

The safety team works hard to cultivate its image as “good cops” rather than “bad cops.” It encourages individuals to report mistakes so the precursors to errors can be better understood to fix system issues.

“I like to be the carrot. Not the stick,” said Manske. “We don’t punish mistakes. This is fact finding, not fault finding.”

“When they see me coming, they say, ‘Here’s the back lady!’ ” said Muratore, who has a background in physical therapy. Back injuries are the scourge of nurses, who lift, pull, push and shift patients, often in 12-hour shifts.

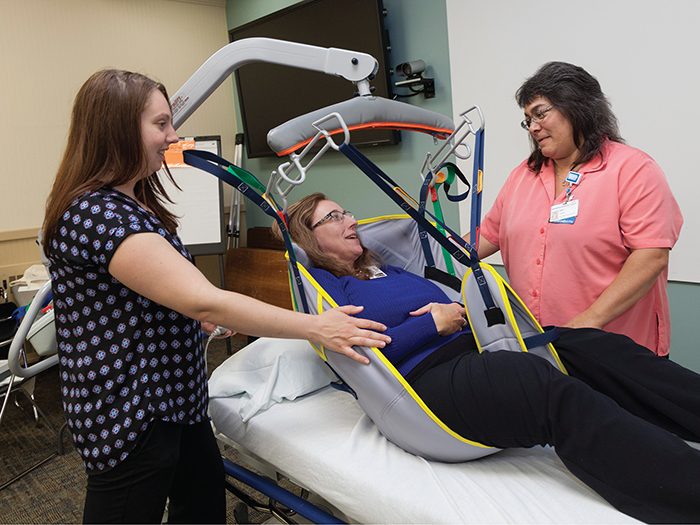

Sometimes Muratore shows up with new safety devices, such as slings and straps that RRH is thinking of buying. “They say, ‘Got any new toys for us?’ ”

What Gets Measured

A measure of a good workers’ compensation safety program is how quickly claims are reported, said Charles Bolesh, senior account executive, PMA Management Corporation, the health system’s TPA.

Delays, he said, are understandable since each hospital’s first priority is to care for patients. But delays are often symptoms of stretched resources and lack of leadership focus. They’re a red flag for weak injury prevention. “Delays can lead to bad outcomes.”

For example, he said, injured workers facing a long reporting delay may not have a return-to-work plan, let alone testing, medical care and therapies. They may retain an attorney.

“There’s a direct correlation between reporting delays and higher-cost claims,” he said.

When PMA first partnered with RRH in 2000, claims reporting could take a full month. Bolesh offered some advice: Report faster. “They ran with it,” he said. Now, reporting to PMA takes place within a few days, and injured workers get treatment and a return-to-work plan in short order.

Incident reports are detailed, Manske said. RRH measures every department, the day of week, the shift, the time of the event.

“Do weekend nights appear to have more injuries? Where do we lose money and time? That’s where we focus time and effort.”

Marsh, RRH’s broker, performs a gap analysis to measure the company’s practices against industry best practices. PMA reports back to RRH and provides monthly and quarterly benchmarks to executive committee, line managers and supervisors.

Initial analysis of incident reports showed two primary loss leaders: slips and falls and safe patient handling. The data then identified the departments and shifts with frequent incidents.

To effectively communicate the data as well as its implications, RRH managers meet with supervisors and employee groups of affected cohorts and train them to use the safety tools available. When necessary, RRH adds internal float pool personnel and/or equipment to help reduce claims.

Communication and collaboration are essential to creating a safe workplace, Manske said. “We’re high-engagement leaders.” Daily department huddles address safety issues, as well as other concerns. And rather than delegating communications responsibilities to department leaders, the safety team meets one-on-one with supervisors and staff. “We want to hear what the issues are. I want to see and hear.”

“What gets measured gets done.” — Charles Bolesh, senior account executive, PMA Management Corporation

Manske said she’s not always “the solutions person.” Often that role goes to the front-line manager in a department or a staff member.

“We collaborate. If a remedy doesn’t work, we reconvene. It’s a check-back cycle.”

These communications and a willingness to learn from failure, Manske said, are best practices among high-reliability organizations, those that avoid catastrophes in high-risk and complex areas.

And RRH reduced claims dramatically over the years, Bolesh said. “What gets measured gets done.”

ROI on Safe Patient Handling

RRH utilizes a different species of technology — some very low-tech — for safe patient handling. It may use slide boards, friction-reducing sheets and air mats to reduce wear and tear on staff involved in direct patient care, said Muratore.

Most equipment is close at hand, outside patients’ rooms, in accordance with fire code.

Typically, hospital floors are equipped with one patient lift per eight patients. Some rooms are equipped with expensive overhead lifts for safe transfer of heavier patients, and every intensive care unit has at least one.

Nursing homes, where patients are more dependent, may have two or three lifts per unit.

Is this prohibitively expensive for leaner facilities? No, said Muratore.

RRH, a community-based hospital system, shops strategically to find equipment that’s well within budget while still achieving safety goals.

Even cash-poor hospitals “do have funding but don’t realize it,” Muratore said. Yes, they must invest in the equipment, but “ROI is very quick. We realized savings in patient and staff safety right away.”

Do some staff skip safety steps because of time pressure or old habits?

“Yes, and then we participate with them,” Muratore said. She may perform patient care alongside the resistant staff member to demonstrate. “Once they practice the safe way, a lightbulb goes off.”

With luck, the lightbulb goes off before injury, she said, but “sometimes an injured colleague is the best safety advocate on the floor. We want staff to work smarter, not harder.” &

_______________________________________________________

More coverage of the 2017 Teddy Award Winners and Honorable Mentions:

Advocacy Takes Off: At Delta Air Lines, putting employees first is the right thing to do, for employees and employer alike.

Advocacy Takes Off: At Delta Air Lines, putting employees first is the right thing to do, for employees and employer alike.

Proactive Approach to Employee Safety: The Valley Health System shifted its philosophy on workers’ compensation, putting employee and patient safety at the forefront.

Proactive Approach to Employee Safety: The Valley Health System shifted its philosophy on workers’ compensation, putting employee and patient safety at the forefront.

Getting It Right: Better coordination of workers’ compensation risk management spelled success for the Massachusetts Port Authority.

Getting It Right: Better coordination of workers’ compensation risk management spelled success for the Massachusetts Port Authority.

Carrots: Not Sticks: At Rochester Regional Health, the workers’ comp and safety team champion employee engagement and positive reinforcement.

Carrots: Not Sticks: At Rochester Regional Health, the workers’ comp and safety team champion employee engagement and positive reinforcement.

Fit for Duty: Recognizing parallels between athletes and public safety officials, the city of Denver made tailored fitness training part of its safety plan.

Fit for Duty: Recognizing parallels between athletes and public safety officials, the city of Denver made tailored fitness training part of its safety plan.

Triage, Transparency and Teamwork: When the City of Surprise, Ariz. got proactive about reining in its claims, it also took steps to get employees engaged in making things better for everyone.

Triage, Transparency and Teamwork: When the City of Surprise, Ariz. got proactive about reining in its claims, it also took steps to get employees engaged in making things better for everyone.

A Lesson in Leadership: Shared responsibility, data analysis and a commitment to employees are the hallmarks of Benco Dental’s workers’ comp program.

A Lesson in Leadership: Shared responsibility, data analysis and a commitment to employees are the hallmarks of Benco Dental’s workers’ comp program.