FM Global’s Annual Resilience Index Ranks Economic and Supply Chain Strength

FM Global released its annual 2020 Resilience Index, and this year’s report had a little bit more meaning considering the global challenge presented by the current pandemic.

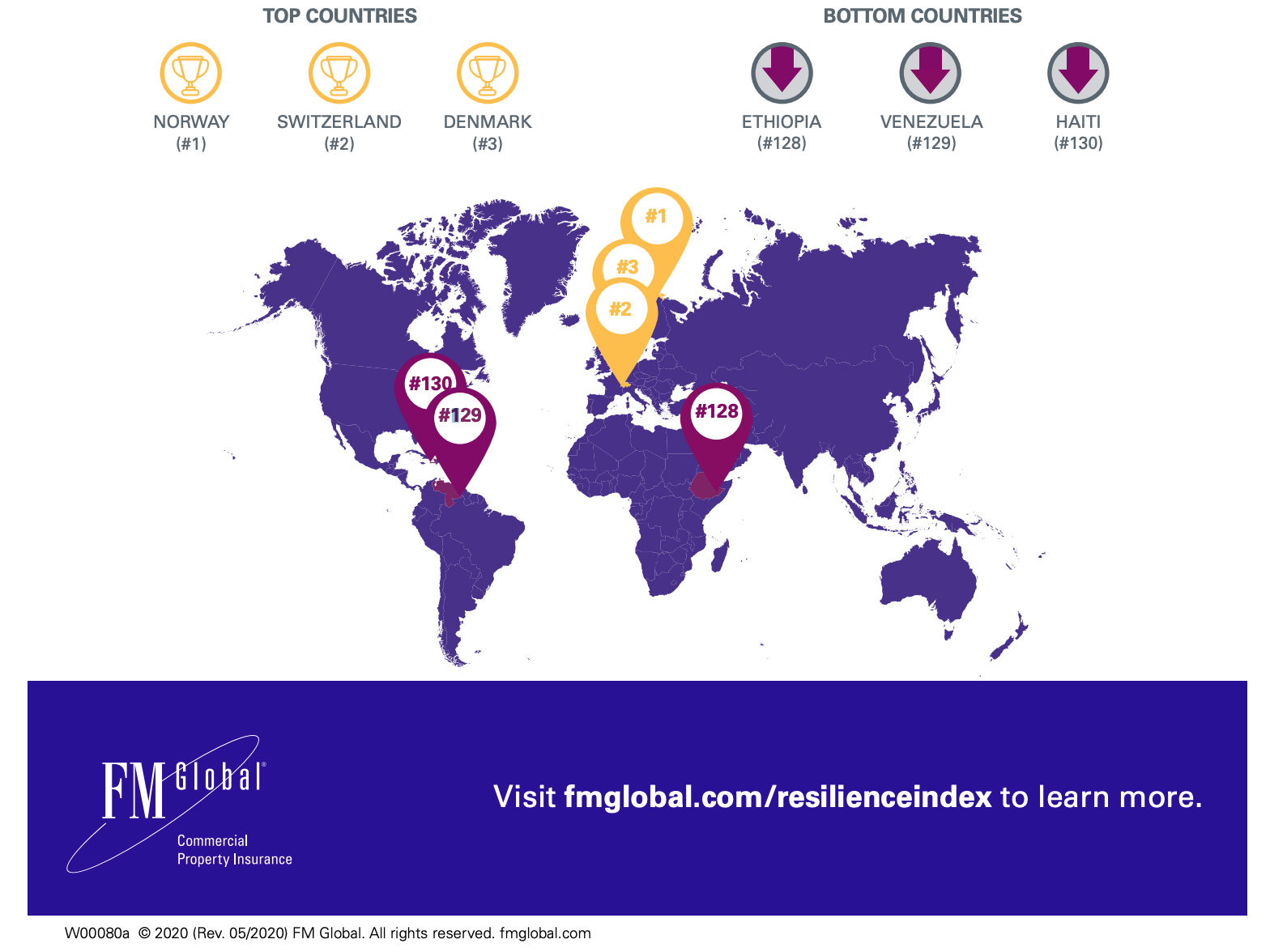

The annual index, which was released on May 19, ranks nearly 130 countries based on three factors: economic resilience, supply chain resilience, and risk quality. The report provides information on how businesses are positioned to financially recover post-COVID-19 based on the rank of the country they operate in.

The index’s top-ranked regions, in descending order, are Norway, Switzerland, Denmark, Germany, Sweden, Finland, Luxembourg, Austria and the Central and Eastern United States.

The purpose of the index is to act as a guide for CEOs and business leaders to make decisions based on facilities, supply chains and partnerships to regain investor confidence and plan for the future.

Drivers that Determine Resilience

According to the index, each of the three factors has four main drivers:

- Economic: productivity, political risk, oil intensity, urbanization rate

- Risk quality: exposure to natural hazard, natural hazard risk quality, fire risk quality, inherent cyber risk

- Supply chain: control of corruption, quality of infrastructure, corporate governance, supply chain visibility

According to Steve Zenofsky, assistant vice president, FM Global, the data is sourced annually from a variety of governmental and non-governmental agencies.

“These include, the International Monetary Fund, U.S. Energy Information Administration, World Bank, World Economic Forum, the United Nations, Freedom House – a non-profit watchdog; and from FM Global’s own RiskMark benchmarking algorithm that calculates risk at more than 100,000 properties insured by FM Global worldwide,” said Zenofsky.

While the index is not modeled to measure a country’s resilience to a pandemic, it measures the ability to respond to disruptive events. In order to respond to events as unpredictable as a pandemic, organizations must first be prepared to respond to more common threats such as natural disasters.

“A unique event like a contagious viral disease unfortunately does not preclude other terrible events,” said Zenofsky.

“Being prepared for traditional risks, like natural hazards, cyber and fire for example, is critical. The adverse impact of ever-present risks can be exacerbated by the pandemic if organizations are not fully prepared.”

The U.S. In Comparison

As previously stated, Norway leads the resiliency ranks due to factors such as low corruption and heavy investments in reducing carbon emissions.

Venezuela is ranked 129 and Haiti is ranked 130 due to corruption and high exposure to natural hazards, respectively.

The United States is broken into three parts within the index.

- Zone 1 includes the Eastern coast and is ranked 10

- Zone 2 includes the Western coast and is ranked 23

- Zone 3 includes the Central U.S. and is ranked 9

The Western coast ranks low in comparison due to it’s high threat to natural disasters and climate change threatening greater storm surges and heavier rain in the future.

For business leaders making decisions in eastern, coastal cities, “That’s worth remembering on the eve of an Atlantic hurricane season projected to see above-normal activity,” stated an FM Global press release that accompanied the report.

“Especially after a crisis like COVID-19, resilience is critical for people, countries and businesses,” said Kevin Ingram, executive vice president and chief financial officer of FM Global in the press release.

“A country’s ranking in the 2020 FM Global Resilience Index is a good indication of how its business environment will fare and how quickly organizations there might rebound after taking the economic blow of the coronavirus. These are critical insights for businesses making far-reaching choices as they build facilities, extend supply chains and cultivate new markets.” &