ESG Initiatives: How to Prioritize Sustainability and Avoid Legal and Financial Pitfalls

When it comes to society-wide initiatives growing in popularity, sustainability has an outward focus, while environmental, social and governance (ESG) issues have an inward focus.

“Sustainability is the right thing to do, while ESG is the smart thing to do,” said Phillip Ludvigsen, senior associate for green finance and litigation support at First Environment, an environmental engineering and consulting firm.

“Comprehensive risk management [can] result in financial benefits such as lower cost of capital, lower frictional cost, lower insurance costs — especially directors and officers — and higher return on equity.”

Ludvigsen was the lead speaker for webinar “ESG – Building a Program, Insuring the Risks,” addressing the insurance implications of ESG on insurance sponsored by the law firm Anderson Kill.

For a definition of sustainability, Ludvigsen cited the 1987 World Commission on Environment and Development. It issued a report formally titled Our Common Future, but is commonly known as the Brundtland Report.

It stated that sustainability is “meeting the needs of the present without compromising the ability of future generations to meet their own needs.”

Under those needs, he included economic, environmental, and social.

From Individuals to the Corporate World

Many date awareness of how human activity affects the environment to 1962, when Rachel Carson published Silent Spring.

While recognizing the landmark importance of that work, Ludvigsen cited written accounts of environmental awareness in the early 16th century.

He also noted just a few years after Carson’s expose, President Lyndon Johnson stated that the current generation “has altered the composition of the atmosphere on a global scale through radiation and a steady increase in carbon dioxide from the burning of fossil fuels.”

Referring to that declaration, Ludvigsen said, “when people tell me, ‘well, we just didn’t know’ [about environmental degradation]; we did know. And it’s been studied for a long time.”

That length of study has yielded a strong business case for ESG, Ludvigsen asserted.

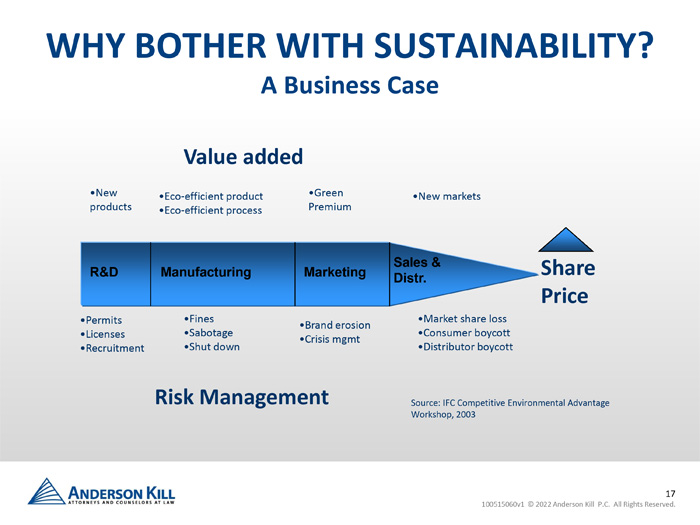

“There is enterprise value brought to bear, both in value added to the enterprise, and in risk management. For companies that can do those things well you would expect their share price to increase over time.” (See image below.)

Businesses Enter the ESG Game

The global capital markets clearly concur, and as evidence, Ludvigsen noted there are 3,800 signatories to the international Principles for Responsible Investing, representing $103 trillion in assets under management. Furthermore, net flows into ESG funds that are available to U.S. investors “skyrocketed to “$20.6 billion in 2019, four times the level of 2018.”

Stressing that nearly 60% of ESG funds outperformed the wider market over the past decade, Ludvigsen cautioned, “You do not want to be on the wrong side of ESG where you are putting at risk your access to capital.”

Ludvigsen also takes issue with the broad assertion that there are insufficient global standards for ESG reporting.

He noted that more than 400 technical standards established by the International Organization for Standardization have been mapped for to ESG, some in great detail.

For example, ISO 14030 for green bonds and other debt instruments.

“I see directors and officers who issue large debt say, ‘we’re not having third-party verification or assurance over this because there is no global standard.’ Well, that’s not true. In my opinion that is an error, it is an omission, and it could be a misrepresentation.”

Another webinar speaker, Enrique R. Ubarri senior managing director at FTI Consulting, who has implemented ESG programs at several large public companies, concurred.

“A successful program can drive access to a wider pool of capital, lower the cost of capital, enhanced value creation, improved employee morale and talent recruitment, and an enhanced and differentiated corporate brand.”

Dennis J. Artese, chair of the climate change and disaster recovery practice group, shareholder, Anderson Kill

William G. Passannante is a shareholder and co-chair of Anderson Kill’s insurance recovery group and also spoke during the two-hour webinar on ESG. Passannante noted the evolution of corporate governance from shareholder primacy, advanced by Milton Friedman in 1962, to a more comprehensive view comprising other stakeholders including the community, customers and employees. That was championed by the Business Roundtable in 2019.

With circumspection Passanante added that the change “complicates D&O liability.”

Amy Barnes, head of sustainability and climate change strategy at Marsh, addressed during the webinar some of the ways that ESG is affecting insurance, stressing that “for underwriters, ESG is a measure of sustainability,” and that “insurers are interested in both sides of the balance sheet.”

That is in their underwriting selection, including philosophical alignment in their client and investment portfolios.

“We have a hypothesis that there is a strong correlation between ESG and risk,” said Barnes. “We think we are going to find that companies that have strong ESG will have a better risk profile than others. We have started to test those relationships.”

The first was D&O. Using publicly available data from the U.S. Securities & Exchange Commission, and third-party ESG assessment frameworks, Marsh found a strong correlation, especially in governance.

“Companies with strong governance had fewer, or less severe D&O losses that those without.”

Putting an even finer point on it, she added that it was likely “anyone with responsible for D&O will have increased curiosity from their D&O underwriters around ESG.”

There were also finding in liability and property.

Pivoting back to climate, Barnes explained that “a huge amount of capital deployed in the U.S. is from European insurers, and the trend is accelerating.” She added that many insurers are members of the UN-convened Net Zero Asset Owners Alliance, and that the UN has also created the Net Zero Insurance Alliance.

The latter “now has more than 27 members, and at the start of 2022 had more than 40% of the listed non-life insurance capacity in Europe, and more than 2/3 of listed non-life re-insurance capacity. So it’s massive. All of those insurers have collectively said that they are steering their portfolios to net zero.”

What Should Happen Next

For all those lofty intentions, the devil, as always, is in the details.

Barnes cautioned that “the insurance industry needs to develop underwriting systems before it’s got the data. And the insurance industry — which I think is a fantastically innovative industry — does not always innovate quite at the speed we need it to. If you are a risk managers or buyer, you need to be really demanding and clear with your insurers, where you need them to innovate and where you need support.”

To that point final speaker on the webinar panel Dennis J. Artese, shareholder with Anderson Kill and chair of the firm’s climate change and disaster recovery practice group, encouraged owners to assemble their response and claims teams in advance of any losses, particularly natural catastrophe.

“Establish those relationships well in advance of the storm.”

That team should include outside coverage counsel and the insurance broker, to help ensure perspectives and expertise beyond those of the insured company. It can also include a public adjuster, structural engineer, or forensic accountant for a business-interruption plan. &