Insurance Industry

Chubb Brings Ground Zero Flag Back Home

Hours after the World Trade Center towers fell, newspaper photographer Thomas E. Franklin hitched a ride on a rescue tug boat to Manhattan and stood on the West Side Highway.

Across the wide road, atop the towers’ smoldering rubble, three dusty firefighters were affixing an American flag to a pole jutting skyward.

Franklin pointed his telephoto lens and snapped a picture that would appear not only on the front page of his paper, “The Record” of Bergen County, N.J., but in newspapers around the world.

The breathtaking image aptly captured a moment of unimaginable loss, resilience and hope, and echoed the famous photo of the flag being raised on Iwo Jima in World War II.

The flag at Ground Zero, which had been purchased at a boat show 10 months earlier for $50, was the centerpiece of one of the most memorable photos from one of the worst days in American history. In a snap, it became an invaluable national treasure.

But hours later, the flag disappeared. And no one seemed to know who removed it or where it went.

After a few twists and turns, and 15 years, the iconic 4-by-6-foot American flag finally returned to New York City, courtesy of an insurance company.

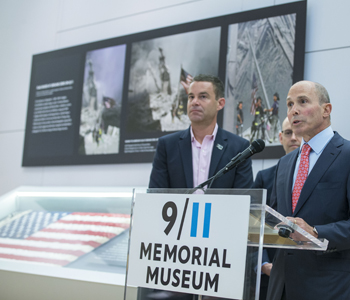

“The raising of this American flag was a powerful symbol of hope, strength and resilience at one of the most trying moments in our nation’s history,” said Evan Greenberg, chairman and CEO of Chubb, at a ceremony on Sept. 8.

Chubb got involved when a claim was filed after the flag was initially lost.

“As we prepare again to pay tribute to those who were lost, this flag is a timely reminder of the spirit of our heroes and the resolve of a great city and great nation.

“Chubb is honored to donate the flag to its new, permanent and proper home in the 9/11 Memorial Museum,” Greenberg added.

Flag on Yacht Caked in Debris

When the World Trade Center’s twin towers came under attack, the flag was flying on the Star of America, a charter yacht docked nearby. The 130-foot-long, three-level boat with ivory-colored suede ceilings was owned by Shirley Dreifus and her late husband Spiros E. Kopelakis. It was insured by Chubb.

Evan Greenberg, right, chairman and CEO, Chubb, and Brad Meltzer, author and History channel host. Photo credit: Jin Lee, 9/11 Memorial

New York firefighter Dan McWilliams spotted the flag flying on the debris-caked yacht about 5 p.m. the day of the attacks, according to news stories published at the time. McWilliams removed the flag along with its pole from the deck, carried it toward West Street and with help from firefighters Billy Eisengrein and George Johnson, hoisted it.

While they have never met in person, the key players in the photo were linked again six month later when Dreifus and Kopelakis tracked down the three firefighters through a lawyer and asked them to sign affidavits stating that yes, they did remove their flag from their yacht.

The “New York Times” reported in March 2002 that Dreifus made the request as a legal formality that would allow her and her husband to donate the flag officially to the city, and perhaps claim a charitable deduction on their taxes.

The now-historic flag was invaluable. Chubb paid the full limit of the owners’ rental insurance to cover the claim.

But, what no one knew at the time was that the wrong flag was recovered.

When Dreifus prepared to formally donate the flag, a size discrepancy was discovered: While the yacht’s flag measured 4-by-6 feet, this flag was 5-by-8 feet. Dreifus started a website in an effort to get the historic flag back.

After the mystery was featured in an October 2014 episode of “Brad Meltzer’s Lost History” on the History channel, a man who wished to remain anonymous turned over the true original flag to police in Everett, Wash.

Police contacted representatives involved in the documentary and together they began a forensic investigation that overwhelmingly determined that the flag was the Ground Zero Flag.

The story of the flag’s recovery and journey back to New York was retold in a television movie, “Ground Zero Flag Found,” which aired Sept. 11 on the History channel.

“We had always hoped this special flag and its story would be shared with our millions of annual visitors coming from around the world, and for that, we are thankful to Shirley Dreifus, the City of Everett, History, A&E Networks, and Chubb,” 9/11 Memorial President Joe Daniels said in a statement.

“In the darkest hours of 9/11 when our country was at risk of losing all hope, the raising of this American flag by our first responders helped reaffirm that the nation would endure, would recover and rebuild, that we would always remember and honor all of those who lost their lives and risked their own to save others”

Shirley Dreifus, left, Howard Bergstein, president, Erich Courant & Co.; and Marlene Cuadrado, personal lines manager, Courant

On Sept. 8, Chubb joined with the flag’s original owner, Shirley Dreifus, and donated it to the National Sept. 11 Memorial & Museum in honor of Dreifus’s late husband.

Representatives from Erich Courant & Co., the insurance brokerage which handled the renters insurance claim on behalf of the owners, were also at the ceremony with their client.

“Never in my life have I handled a claim of this cultural magnitude,” said Howard Bergstein, Erich Courant’s owner and president.

“The photograph of this flag being hoisted by firefighters caused this flag to become an iconic symbol of American patriotism and unity. We are at once thrilled to be a part of it and also hope never to be part of something so devastatingly tragic ever again.”

It was “a once in a lifetime claim in terms of its cultural significance,” he said.

“Have I ever had another claim where the client was paid the full amount of their coverage because the lost product was deemed to be invaluable?

“No, I never have been in that situation,” he said, noting that “the notoriety, the excitement of the flag’s recovery, the history, the sentiment,everything that has accompanied this claim has been extraordinary and I am hoping we never have to deal with something arising out of a tragedy again.”

The museum where the flag is now on display honors the 2,983 people killed in the horrific attacks of Sept. 11, 2001 as well as the car bombing at the WTC on Feb. 26, 1993.

It displays more than 10,000 personal and monumental objects linked to the events of 9/11, while presenting intimate stories of loss, compassion, reckoning and recovery that are central to telling the story of the attacks and aftermath.

Chubb has played an ongoing role in the museum since conception. ACE, which merged with Chubb to form the current company, was a founding member of the 9/11 Museum & Memorial. Additionally, Chubb North America’s general counsel, Kevin M. Rampe, sits on the 9/11 Memorial’s board of directors.