Retailers Are Grappling with COVID’s Aftermath; Here Are the Successes the Industry Achieved in Mitigating This Risk

The retail marketplace is in a state of flux. Open any newspaper or click on any financial newsfeed, and you are likely to find information pertaining to mergers, acquisitions and bankruptcies aplenty in the brick-and-mortar retail landscape.

And in today’s recovering economy where prudence prevails, retailers of all sizes are evaluating how to use better risk management and claims resolution because in today’s retail market — as the recent pandemic has illustrated — anything can happen.

One thing’s for sure — 2020 will go down in the history books as one of the most impactful experiences for businesses — especially retailers.

“It is difficult to imagine a retail operation that did not feel some impact, and oftentimes that affected the claims landscape,” said Matt Zender, senior vice president, workers’ compensation strategy at AmTrust.

“Many retailers were forced to rethink their business model and how they might work in a contactless environment. Anytime there are fundamental changes to an operation, whether by design or through a forced hand, you can see an altered claims landscape.”

Brian Sebold, senior vice president, Aon

Brian Sebold, senior vice president at Aon, said in general, retailers saw fewer claims in 2020. This is due in large part to the closure of stores and restaurants during the early months of the pandemic. With retail stores closed, customer traffic was reduced or eliminated, and slips and falls as well as other traditional hazards that didn’t occur.

“Additionally, we saw less activity on open claims, as many continued with reserves posted,” Sebold said.

During the latter part of 2020, department stores, malls and restaurants began to reopen across the country. This did increase claims activity but not to pre-pandemic levels.

“Customers are coming back to the stores, but many retailers are limiting the number of patrons in the store at the same time, and they are requiring masks and offering hand sanitizer,” Sebold said.

“So there is a very big focus on health and safety which will help improve the claims landscape.”

Steps Taken

Retailers reacted quickly to the pandemic out of necessity. They modified stores with Plexiglas windows, COVID-related instructional signage and new rules for engaging with customers.

“They also had to communicate more with executive teams due to urgent needs focusing on safety and loss control,” said Mary McGurn, head of the retail practice group at Gallagher Bassett.

“Crisis management plans were dusted off and tested for the sustainability of their business.”

Although retailers saw claim frequency decrease, severity has shifted upward due to a higher concentration of older, non-COVID complex claims. As McGurn explained, claim closure became more challenging as courts closed and claimants were fearful of seeking medical treatment. This shift also caused higher average claim cost in the COVID period.

“However, this period allowed time for claim handlers with fewer new arisings to focus in on inventory closures,” McGurn said.

New risks also emerged or expanded in retail as businesses shifted to delivery, e-commerce or curbside pickup. McGurn specifically points to:

- Questions around the applicability of lease and indemnification language to new exposures. For example, are parking lots no longer considered “common areas” due to use by retailers for curbside pickup?

- Third-party shoppers flooding the floors of retail establishments. This poses a whole new set of claim challenges relative to duty owed and proximate cause in investigations.

“Retailers have also had to deal with a new exposure of third-party claims relative to COVID,” McGurn said.

Let’s say a customer contracts COVID after being in a store where adequate social distancing was not enforced — too many people in an aisle or they were in areas that were not properly disinfected. Or a customer contracts COVID after a worker coughs or sneezes near the customer. These types of claims increased due to the modified retail environment.

Impact on Retail Industry Segments

All segments of retail have been impacted by the pandemic, albeit in different ways. Grocery and other essential retailers have been hit harder by workers’ compensation claims, whereas non-essential retailers, such as luxury goods, home appliances and apparel, have been impacted by store closures or the shift from brick-and-mortar to e-commerce.

“These non-essential retailers have experienced economic downturn with store closures,” McGurn said.

“This has resulted in workers’ compensation and return-to-work challenges. Staffing has been a challenge in general for essential workers as many chose not to work in retail anymore or they call out due to sickness. Workers’ compensation claims have emerged claiming emotional distress as essential workers are required to police compliance to mask wearing and social distancing measures.”

Of course, retailers are mostly concerned about the health and safety of their employees and customers. For restaurants and grocers, food safety is also a top priority as concerns over communicable disease has been a big focus.

“Cleanliness and sanitization of stores has increased with some retailers still limiting their hours of operation in order to reduce foot traffic and to do nightly deep cleans,” Sebold said.

And while claims arising from the impact of the pandemic rightly gained the most attention, we should not forget the historic number of named storms that struck the U.S. in 2020, the extensive wildfire damage and the damage in many cities from civil unrest.

“These events drew increased focus on business resilience planning and the speed and efficiency of the claims process as retailers needed resources even more quickly to recover given the increased overall financial stress,” said Eric Sanders, head of claims at QBE North America.

“We have pushed even faster to take advantage of straight-through-processing opportunities for covered claims to benefit our customers. Furthermore, when the country undergoes financial stress, we often see fraudulent claims targeting businesses rise.”

To stay ahead of fraudulent activity, QBE recently deployed a new platform that uses AI to detect and flag potentially fraudulent images and documents used to verify various aspects of a claim.

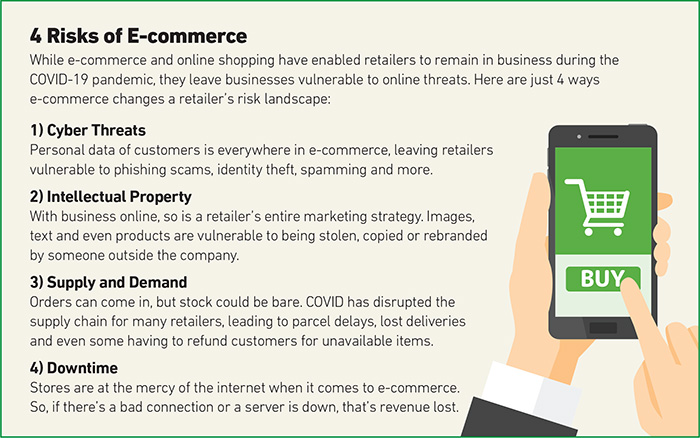

A Shift to E-Commerce

The shift to e-commerce from traditional brick-and-mortar locations has led retailers to invest heavily in distribution centers, by either opening additional centers or improving the technology in existing centers.

“The increase in warehouse workload is also changing the nature and mix of workers’ compensation injuries, impacting cost and lost time,” McGurn said.

“E-commerce creates a different level of liability exposure in shipping, product safety and commercial auto.”

Distribution center workers experience more severe injuries from forklift accidents, overexertion, repetitive stress and loading dock injuries than brick-and-mortar store employees.

In addition, an inevitable result of the shift to e-commerce is the closing of brick-and-mortar stores. Store closures require a strategic and concise claims management plan in order to preserve evidence and prevent an uptick in claims.

According to McGurn, closing stores requires preparation for both workers’ compensation and liability claims, as claims should be triaged to determine which claims can be finalized prior to the closing.

“Claims filed during this time may be more subjective in nature and involve attorney representation, so it’s important to coordinate witnesses, communicate to workers and gather evidence,” McGurn said.

“The bottom line is to prevent and close as many claims as possible during this time of transition to control cost.”

Looking Ahead

Retail operations likely spent more time in the past year rethinking their business models than ever before.

“This is a great opportunity to think about all aspects of risk management, insurance and claims,” Zender said.

“Retailers should challenge themselves to ask whether the changes that they’ve embarked upon are helping or hurting other long-term goals. They should also look for opportunities. Perhaps the changes have created a safer environment. They should make sure that their agent is aware of how and why so they can share that story at their insurance renewal.”

McGurn said retail will continue to innovate with touchless options, self-service, curbside pickup, e-commerce and delivery options for their customers. Once states open up and vaccines become further distributed, other non-essential retailers will benefit from a pent up demand as customers return in greater numbers to their stores.

In the long term, when we put the pandemic behind us, Sanders expects to see the growing power of data and analytics, AI and digitization to anticipate and respond to retail loss much more effectively.

“The cost of deploying monitoring systems to mitigate property damage and theft will continue to fall, while the ability to process and analyze data from multiple sources will continue to rise. When a loss occurs, this data will feed directly into the claims processing where AI can help triage claims to streamline resolution of simple claims and get a quick jump on the complex claims to potentially avoid protracted litigation,” Sanders said.

And while insurance experts predict that many of the changes we have had thrust upon us over the last year are here to stay, some changes within the retail environment could be for the best.

“Those risks that can identify the opportunities, find a differentiated, unique manner of customer engagement will thrive into the future,” Zender said.

“Retail business is here to stay; it just will be different. Those businesses that figure out how to do so, and also how to do so safely, will be here for the long haul.” &