Professional Liability

Private Label Coverage

In an increasingly interconnected business environment, it is no wonder many companies are taking a closer look at the changing nature of their liabilities — and seeking tailored coverages to ensure none of their unique exposures slip through the cracks.

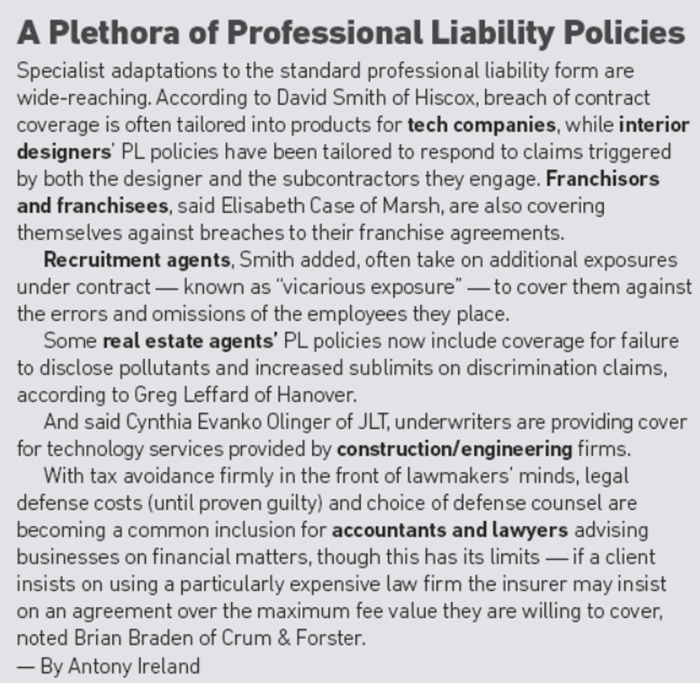

Growing demand from clients and brokers in a tough environment is forcing underwriters to innovate in order to win business and squeeze extra margin from their books. The result is a proliferation of specialist professional liability policies that runs the full gamut of industry sectors, from health care to construction.

The move towards specialization has developed to the extent that now it is possible for various stakeholders within the supply chain of the same industry to each enjoy their own tailored coverages. There are no doubt more niche products to come.

“The trend is being driven by both a willingness from underwriters to look for margin where they can, and also demand from insureds,” said James McPartland, class underwriter, professional indemnity, at ArgoGlobal.

“We now live in a much faster-paced world than even 10 to 15 years ago. The way businesses interact and bring products to market is very different now, and companies can significantly change from month to month.”

Uniquely positioned with their fingers on the pulse of their clients’ evolving risk profiles, brokers play a huge role in identifying coverage needs and driving the development of bespoke wordings.

James McPartland, class underwriter, professional indemnity, ArgoGlobal

“Agent feedback is crucial; they are the catalysts of change,” said Greg Leffard, president of professional liability at the Hanover Insurance Group.

“As businesses change, exposures change, and so should our coverage.”

He added that brokers see the development of new products as a way to differentiate themselves from their competitors just as carriers do.

“It is easy to compete on price, but agents want more than that. They want private label coverages, available only to them.”

“It starts as one client with a specific need, then before long three have asked the same question in a different way and we know there is a trend and we have to find a solution,” said Elisabeth Case, commercial E&O product leader for Marsh, who added that newcomers to the PL space are often the underwriters willing to concede the most ground in the design of new products.

“We have carriers we know are willing to go the extra mile, both in the U.S. and London. It really does come down to individuals at certain organizations trying to keep their companies at the forefront, or trying to build a book. There are new entrants in the PL and cyber liability space coming into the marketplace all the time, so they often have to offer something unique to get their foot in the door.”

According to Cynthia Evanko Olinger, senior vice president of construction at JLT Specialty USA, modifications to standard PL coverage can often be obtained from underwriters “for little or no premium.”

Whereas a decade ago a $2.5 million PL line for accounts “meant you were a player,” now it is common for insurers to put down $5 million or $10 million. — Brian Braden, vice president, professional risk, Crum & Forster

“We argue, for example, that the technology services are part of the core business that the underwriter is insuring, and our request to affirm coverages for these services should have no premium impact,” she said.

Brian Braden, vice president, professional risk, at mid-market underwriter Crum & Forster, noted, however, that the most flexibility is often likely to be given on larger risks due to the negotiating power of big brokers who control a lot of premium dollars.

“Those changes are usually advantageous to the client and a little adverse to the carrier. Sometimes we follow those changes on an excess basis, but if we’re writing primary we won’t,” he said.

He added that underwriters are offering bigger lines. Whereas a decade ago a $2.5 million PL line for accounts “meant you were a player,” now it is common for insurers to put down $5 million or $10 million, he said.

“Plus there are many more players, which drives the price down.”

Hanover’s miscellaneous PL group writes over 100 different classes of business, each with its own unique exposure.

“This creates challenges to ensure we provide appropriate protection for all the various sectors, as well as competitive coverage in the marketplace at a reasonable price,” said Leffard, while McPartland noted that the cost of doing business is increasing and pricing new bespoke coverages can be “haphazard” due to the lack of historical data.

As McPartland pointed out, not all clients are interested in a new bespoke PL product, as such products are often purchased out of regulatory or contractual obligation.

“When you strip a PL policy back, 99 percent of all claims would be covered under the negligence clause. Add-ons enhance the product to make it more attractive, but the fundamental driver of purchase is price, and people are prepared to move business around a lot quicker nowadays,” he said.

McPartland added that while brokers could until recently rely on existing clients to remain loyal at renewal, clients are now more interested in what the broker can do for them going forward than what they’ve done for them in the past.

“We are having to work harder to retain our business. The book churns quicker and as a result our modeling becomes more volatile and pricing gets more difficult.”

Niche Demand

Nevertheless, said Leffard, many professionals are becoming more knowledgeable on the benefits of insurance and the true cost of a claim.

“Mature businesses are willing to pay more for a solid form compared to a basic form that just meets contractual business requirements,” he said.

Faye Chapman, medical malpractice underwriter, ArgoGlobal

“Established marketing firms, advertising and public relations agencies, technology firms and home inspectors are also good examples of sophisticated, educated insureds. They are more likely to understand their professional liability exposures and ask for the right coverages.”

The health care sector is ripe for specialist PL covers. According to Faye Chapman, medical malpractice underwriter at ArgoGlobal, quasi-medical practitioners including beauticians and masseurs are seeking PL cover due to the increasingly invasive nature of treatments (such as injectables and laser treatments), which goes beyond the scope of some general liability underwriters’ appetites.

Practitioners offering one-on-one patient treatment may also require abuse of patient cover, she said, though there is some debate within the insurance industry over whether abuse would fall in a liability or medical malpractice policy.

Meanwhile, medical devices including implants present another potential liability exposure as practitioners could find themselves facing a claim if they recommend the use of a substandard or dangerous product.

Chapman noted that insurers are offering extended reporting periods, effectively transforming covers from claims-made to occurrence basis policies, across a number of specialist health sector products.

More broadly, fundamental business themes demand that old coverages be revisited across almost every sector — most notably concerning the proliferation of cyber risk and the evolving use of technology.

“Professionals such as lawyers, accountants and even engineers and architects who are holding personally identifiable information are beginning to realize that negligence could be deemed to be the main trigger for a breach of privacy,” said McPartland, noting that cyber liabilities are increasingly being written into PL, professional indemnity (PI) and errors & omissions (E&O) policies.

Braden said cyber liability risk has “changed the landscape” on a number of products. “Our tech product, for example, used to just be E&O coverage for tech professionals, but over the last four or five years if you don’t offer full first-party coverages including credit monitoring, notification costs, extortion and business interruption, you are dead in the water.”

“It’s an exciting market,” said David Smith, professional indemnity underwriting manager (UK & Ireland) for Lloyd’s underwriter Hiscox, which writes 20 profession-specific PI products.

“In the past it was traditionally professions such as surveyors and architects that bought PI cover, but in recent years we’ve seen the evolution of people being asked to buy PI for their contracts with third parties and interest from a host of new professions — and we see that trend continuing.”

Smith noted that many of Hiscox’s PI products now cover insureds against claims arising from their own websites, such as the unlicensed use of images, in addition to third-party damage.

Elisabeth Case, commercial E&O product leader, Marsh

“Ultimately, what clients will start to want more is an all-in-one E&O and cyber liability policy with potentially some physical loss/damage related to a cyber event if the systems they rely heavily on to deliver their products or services are interconnected to others,” said Case.

Similarly, advances in electronic technology are changing the way many professions operate, and are creating new exposures that need to be written into specialist PL products.

Car parts, for example, increasingly include tech components, which is making auto suppliers seek cover against component malfunctions that could lead to manufacturer recalls, noted Case.

“We are getting lots of requests from various types of manufacturers who have both a manufacturing and design element, who are sometimes confused about what type of cover they should buy.

“People mistakenly think they need an architects and engineers policy if their engineers are designing products, but in fact they need manufacturers’ E&O,” she said.

The tech industry itself is a complex area when it comes to PL. “Tech clients are very specialized and there are sub-sectors of the tech world that need even further differentiating,” said Case, noting that FinTech companies are often unable to find E&O solutions that cover their entire exposures, so Marsh is creating bespoke coverages by aggregating multiple policies in order to obtain adequate coverage.

McPartland predicted the next area for specialist PL cover could be 3D printing.

“This printing will speed up repair processes but it is also an opportunity for people to make mistakes,” he said. “If someone prints the wrong valve for an oil rig, for example, it could result in a significant oil spill. It’s an area to watch over the next 18-24 months.” &