Ominous San Andreas Fault Study: Risk of a Big Quake 5X Higher Than Previously Thought

On July 4, 2019, Californians were preparing for a typical festivity — fireworks, barbeques, pool parties — when their homes started to shake. Stress on fault lines near Ridgecrest, Calif. had become too much, and the fault slipped.

Ruptures along three separate lines caused a 6.4 magnitude quake, one of the strongest California has felt in recent years.

Soon, aftershocks with magnitudes hitting between 3.5 and 4.6 followed. California Governor Gavin Newsom declared a state of emergency for the town of Ridgecrest in the Mojave Desert.

Then on Friday, July 5, four separate faults ruptured in the same area, creating a 7.1 magnitude quake — the biggest to hit California in two decades.

Structure fires caused by the quakes engulfed one home in flames, and 15 people were taken to emergency rooms for their injuries. Shaking from the quake was felt everywhere from Sacramento to Tijuana.

But for insurers, the 2019 Fourth of July quakes were a non-event.

Ridgecrest — one of the most affected populated areas — is small, with fewer than 29,000 people. Large cities emerged relatively unscathed. In fact, the desert bore the brunt of the damage, where the quakes shattered the desert floor, creating jagged splits in dry streams and roadways.

Dr. Ross S. Stein, CEO, co-founder, Temblor, Inc

“Although it was a large quake, a M 7.1, it occurred in such a remote, high desert area where so few people live that the insurance consequences were essentially nil,” Dr. Ross S. Stein said. Stein is the CEO and co-founder of Temblor, Inc, a tech company that models seismic hazards and provides risk assessments for insurers, reinsurers and mortgage lenders, among others.

While these large quakes may have felt like jitters to the insurance world, their activity bring up the odds that a major quake will strike along the San Andreas fault within the next year to about a 1 in 87 probability, recent research from Stein and seismologist Dr. Shinji Toda, Ph.D, IRIDeS, of Tohoku University, has found.

If a major fault does occur along the San Andreas, the damages won’t be “nil” for insurers.

Hundreds of thousands of properties would be put at risk, and many uninsured multifamily units might find themselves facing damages without the coverage they need to recover.

Risk Zig-Zags to the San Andreas

The fault lines responsible for the Ridgecrest quakes lie nearly 150 miles northeast of the San Andreas fault.

Given their distance, it’d be easy to assume that any ruptures along the faults near Ridgecrest wouldn’t affect the San Andreas, but the two are connected by the Garlock fault running on a diagonal between the two.

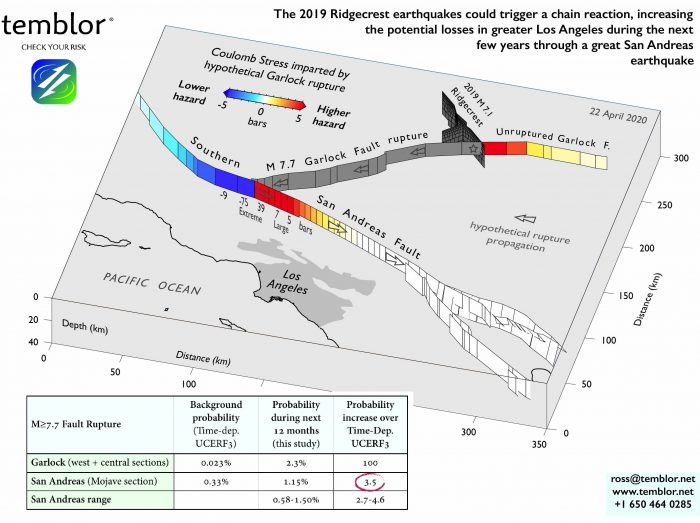

The whole system looks like a large, slightly slanted Z, with the Ridgecrest faults making the top line, the Garlock fault the middle diagonal, and the San Andreas the bottom line.

Photo courtesy of Temblor, Inc.

After the Ridgecrest quakes occurred, a shallow portion of the Garlock started slowly slipping in a process known to seismologists as “creep.” This slippage could have been caused by the stress or the shaking caused by the quakes near Ridgecrest.

Since then, there hasn’t been any other activity along the Garlock, but it appears to be more vulnerable to quakes.

Stein’s research estimates the likelihood of a 7.7 magnitude earthquake along the Garlock is now 100 times higher than the annual chances estimated in the third version of the Uniform California Earthquake Rupture Forecast (UCERF3).

Similar to the way the Ridgecrest quakes stressed the Garlock fault, a high magnitude rupture along the Garlock could trigger activity along the San Andreas.

“If the Garlock fault ruptured in an earthquake of magnitude 7.5 or larger, it would reach all the way, or nearly all the way, to the San Andreas,” Stein said.

“It would put enormous stresses on the San Andreas and profoundly change its conditions for failure.”

As with the Ridgecrest quakes, a high-magnitude rupture along the Garlock fault would be an insurance non-event, Stein said. A large rupture along the San Andreas, however, could cause upwards of 1,800 deaths and would displace somewhere between half a million and a million people.

Stein’s research estimates that there’s a 2.3% chance of a quake along the Garlock within the next year. If it ruptures, there’s a 50/50 chance of a quake along the San Andreas, making the odds of a large quake within the next year 3.5 to 5 times higher than the annual chance in the UCERF3 model.

Implications for Earthquake Insurers

If the San Andreas experiences a high magnitude quake, it will be an event unlike insurers have seen in California before.

The Northridge Earthquake in 1994 only reached a 6.7 magnitude, and the San Francisco Earthquake of 1989 only had a magnitude of 6.9.

A quake along the San Andreas triggered by the Garlock fault could reach a magnitude of 7 to 7.5.

Daniel Wallis, CPCU CLCS, president, Motus Insurance Services

“As devastating as the Loma Prieta and Northridge quakes were, with the exception of those alive in 1908, Californians have only lived through moderate to strong earthquakes,” said Daniel Wallis, CPCU, CLCS, president of Motus Insurance Services.

“When you go from a strong quake 6.7 to a large quake 7.5, it’s roughly 13 times stronger. When you go from 6.7 [Northridge quake] to 8.2, probably the strongest earthquake that could hit the San Andreas, it is a mind-bending 178 times stronger,” Wallis explained.

“As Dr. Lucy Jones who led a team of 300 scientists in a 2008 study claimed, ‘the San Andreas is overdue for a release of energy, a release that could easily conceive a 7.8 magnitude, which would cause damages up to $200 billion to California.’ ”

Most models of earthquake damage only account for the magnitude of the shaking. They don’t account for the duration, Stein said.

In the L.A. basin, where seismic waves tend to get trapped, this added reverberation could cause additional damages to buildings.

Stein likened it to bending a paperclip once vs. bending it repeatedly. As buildings keep shaking, nails inch out of the wood each time, causing additional damage or in the worst case scenario, structural failure.

“The duration of shaking matters,” he said. “The Los Angeles Basin is just a deep bowl of jello. And the Jello — sediments — shake much harder than surrounding bedrock areas and for a much longer duration.”

Making matters worse is the fact that some of the most vulnerable units are underinsured.

During the ’84 and ’94 quakes, 84% of the damages were to multifamily units, even though they only made up 22% of housing products, according to data from Motus Insurance Services.

“Condos or apartments have all the vulnerabilities that make them most susceptible to damage from strike-slip faults,” Wallis said. “This reality, coupled with a lack of insurance, is our fundamental problem with post-earthquake resiliency in California.”

Today, these structures account for 40% of housing in California, and only 5% have purchased earthquake insurance.

Owners of condos and other common interest developments have limited earthquake options when a homeowner association does not purchase a master earthquake policy. Most individuals are ineligible for the limited earthquake options.

This kind of master earthquake policy is best for condo owners in terms of price and coverage, but the product can only be accessed if the HOA agrees to purchase and everyone participates. Lenders and the state of California don’t require master earthquake coverage and the HOA board is not, usually, legally obligated to purchase it.

As a result, less than 10% of HOAs purchase a master earthquake policy. This is why roughly 2.4 million unit owners are left without access with the best rates and coverage.

“We can’t just say, ‘nobody gets access unless everyone buys,’ ” Wallis said. “We need to let everyone have access.”

Opportunities for Growth

Coverage gaps and a looming quake along the San Andreas shouldn’t send insurers and insureds into a panic. While the risk of a quake has increased, the probability of one occurring is still small.

“No insurance company should panic,” Stein said, “because we’re always living with this likelihood. But that likelihood has gotten greater. So, the rational response is to increase your preparedness.”

In the immediate future, insurers should be concerned with making sure premiums are appropriately priced given the increased risk of a quake over the next few years.

“For a homeowner, this would be a great time to buy insurance, because you are buying it at a discount. Even though the price didn’t change, the risk went up,” Stein said.

As for gaps in coverage for multifamily units, Wallis sees opportunities for insurance to step in and reduce the barriers to access. His company, Motus, is working on deregulating policies and creating a direct-to-consumer product.

“The state really is just kind of hoping and praying it doesn’t happen,” Wallis said.

“Put another way, it is mandatory that all housing units that have a 25% chance of experiencing a flood over the life of loan purchase flood insurance ([lood zone A, 1 and 100 year event], yet the scientific community, in the most recent USGS report, claimed that there was a 96-98% chance of another 6.7 or greater earthquake in northern and southern California in the next 25 years, and a 46% chance of a 7.5 quake in the greater LA area. Yet no earthquake insurance is required?”

The lack of coverage is especially concerning, considering the critical role insurance plays in recovering from losses after a catastrophe.

“There was over $12 billion in earthquake insurance that was paid out in ‘94, so the state got back to its feet really quickly. We will not be so lucky next time as insurance has deteriorated, and we now have this growing dependency on multifamily units,” Wallis said.

If insurers continue to leave units uninsured, the state could face a longer road to economic recovery.

The San Andreas is already considered one of the riskiest faults. Because of its fast-moving nature, it accumulates strain faster than other faults. If it ruptures, it could cause $300 billion in losses.

Insurance is the logical place for these losses to find coverage. The industry is based on housing risks and helping insureds find security if disaster strikes. If people have the option to protect their homes and properties through insurance, Wallis is betting they’ll opt in. &