It’s High Time We Address the Cyber Insurance Talent Gap. What Will It Take to Secure the Future?

It’s no secret that the insurance industry is struggling to attract and retain talent, and cyber lines aren’t immune.

In 2021, there were 465,000 cybersecurity job vacancies, according to the Cyber Insurance Academy, an educational group dedicated to training cyber professionals.

“The cybersecurity industry in general is suffering from a severe shortage of skilled workers,” said Syvanne Aloni, director of marketing and product development for the Cyber Insurance Academy. “Cyber risk is increasing but we don’t have enough people to deal with that.”

A lack of qualified talent pinches every industry where cyber professionals are in demand. But insurance may be feeling the pain more acutely because of the preexisting talent shortage. Here’s a look at the scale of the problem the industry is facing and what we can do to improve it.

By the Numbers

The cybersecurity talent shortage is so bad that “there is not one single person who told me that he’s not looking to recruit or that he’s good with the talent he has,” Guy Simkin, co-founder and CEO of Cyber Insurance Academy, told Risk & Insurance®.

Though the cyber talent gap is pervasive across nearly all cyber insurance professions, insurance research from Cyber Insurance Academy has found:

- Insurance expects to soon be facing over 400,000 open positions across different lines of coverage.

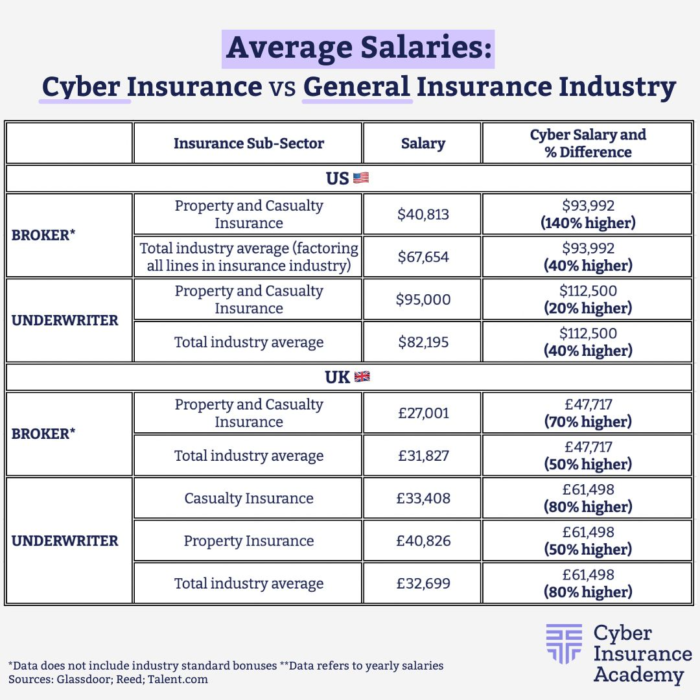

- Cyber insurance salaries are higher than those for a typical property casualty broker by 140%. For underwriters, cyber insurance professionals make 20% more.

- Cyber insurance brokers make an average of $93,922.

- Despite these higher pay rates, cyber insurance talent shortages still exist.

- Insurance, in particular, struggles with bringing young people into the field. Eighty percent of insurance companies report needing younger talent, but 52% say they have difficulty recruiting employees younger than 31.

Why We Need to Address the Cyber Insurance Talent Gap

This talent shortage comes at a time when society needs more cybersecurity and insurance professionals than ever before.

Cyber risks have become prolific in recent years. Ransomware and other threats have been menacing businesses, and insurance markets are hardening in response.

“We haven’t grown our talent pool at the same rate as the demand for cyber/E&O insurance from clients,” said Stephanie Dingman, managing director with Aon.

To add fuel to the fire, the world is only becoming more digital. With cryptocurrencies and NFTs making assets that were once tangible wholly virtual.

“We believe that the risk landscape is going to change completely in the next few years,” Simkin said.

“Risks are becoming much more digital than they were a couple of years ago. Assets are becoming much more intangible with all of these new technologies coming up, cryptocurrency, blockchain technologies, metaverse digital assets.”

How to Combat the Cyber Insurance Talent Gap

Part of the reason the cyber talent gap is an issue is that there are a very limited number of people with the necessary knowledge of cybersecurity to properly broker and underwrite policies.

“Considering cyber insurance professionals make up a very small margin of all insurance professionals, there are a very limited number of individuals specializing in this class of business,” said Joey Sylvester, area senior vice president and director for the Cyber Risk Solutions team at Gallagher.

“Cyber insurance is highly specialized. Cyber insurance professionals are required to not only keep up with the insurance market but also the cybersecurity industry,” he said.

Increased education can help brokers and underwriters from other lines of insurance transition to other roles.

“There has been a lot of movement between insurers, Insuretechs and brokers, and we expect this to continue for the foreseeable future,” Dingman said.

“Our focus has been on building a culture that provides feedback and opportunities to our colleagues, as well as aligning talent to the right role within our team.”

But since the industry is facing a massive talent shortage across all lines, it may not be enough to fix the problem. Insurance will need to proactively recruit graduating college students into the field in order to help close the cyber insurance talent gap.

One way to help bring young people into the field is through showing how fulfilling working in insurance — especially an exciting line like cyber — can be.

“Insurance isn’t sexy; it’s not attractive and appealing to younger people,” Aloni said.

“There is a lack of awareness about this rewarding and exciting field within the insurance industry. Recruitment strategies should go beyond undergraduate business, finance or risk management programs and into other programs, such as cybersecurity programs,” Sylvester added.

Internship programs are one way carriers and brokerages have tried to attract young talent in recent years. Exposing young people to the industry can help break down some of the stigma around a career in insurance. They’ll learn that the job isn’t as boring as they may have thought before going into the field.

Providing technical education will be another crucial step in improving cyber talent pools. Some people may be interested in cyber insurance but unsure of whether they have the technical qualifications necessary for success.

“Insurance brokers and companies can broaden recruiting efforts to other industries and other non-traditional degree programs. Going a step further, they can develop internal recruitment strategies for insurance professionals who may be interested in cyber but are unsure of how to get started given the technical aspect of this career,” Sylvester said. &