Rising Star Nick Terlecki on His Main Interests in the Public Sector Field and the Biggest Challenges He’s Tackled in His Career

Come see the Stars! As part of our ongoing coverage of the best brokers in the commercial insurance space, Risk & Insurance®, with the sponsorship of Philadelphia Insurance, is expanding its coverage of the Rising Stars — those brokers who represent the next wave of insurance brokering talent.

Look for these expanded profiles on the Risk & Insurance website and in your social media feeds now and continuing into 2023.

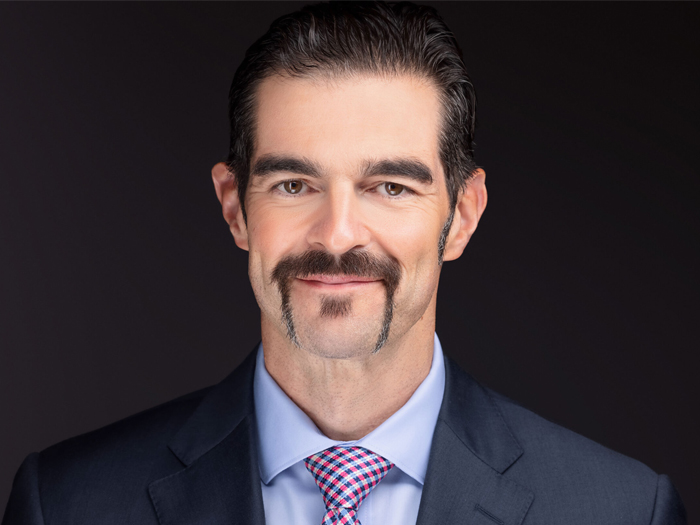

Here’s our conversation with Nick Terlecki, area assistant vice president at Gallagher, and a 2022 Public Sector Power Broker Winner.

Risk & Insurance: Insurance broking has been in your family for a few years now, with your dad Richard also having been in the business. Was that your main motivation for getting into the industry?

Nick Terlecki: Growing up around the insurance industry certainly piqued my interest, but it wasn’t until I attended Florida State University risk management classes and enrolled in the Gallagher Internship Program that I truly realized my passion for the industry.

Understanding the importance of the industry and witnessing the value that insurance brokers provide to their clients, helping them navigate complex risks and protecting their assets, inspired me to pursue a career in insurance brokerage.

While my family background introduced me to the industry, my drive and dedication to helping clients achieve their goals motivates me every day.

R&I: How did you become an expert in the public sector and what is it that most interests you about that field?

NT: I began specializing in the public sector early in my career, drawn to the unique risks and challenges faced by public entities.

Through extensive research and experience, I have gained a deep understanding of the complexities of the public sector, including law enforcement liability, property and cyber coverage.

What interests me most about the field is the opportunity to make a meaningful impact in protecting essential public services and infrastructure, such as airports, counties and cities.

R&I: What have been some of the more challenging accounts you have worked on and how did you ensure a successful outcome?

NT: Some of the most challenging accounts I worked on are large property programs located in CAT-affected areas or regularly affected by claims.

For the large property program we ensure a successful outcome by accessing all forms of capacity in every domicile globally, being creative in structuring the program, and clearly communicating and collaborating with the risk management team.

R&I: As governments and local authorities come under increasing pressure to make cost savings, what can clients do to ensure they are sufficiently covered while continuing to mitigate against risk?

NT: Stop only looking at the premium and look at the total cost of risk including claims paid, retention levels, uninsured risk and potential exposure to continued claims trend.

I would recommend that clients that want to understand their risk tolerance, and what risk they have, to complete an enterprise risk management study. This will help by identifying potential exposures and developing strategies to address them, thus clients can reduce their overall risk and potentially lower their insurance costs.

It’s also important for clients to stay informed about changes in the insurance market and emerging risks so they can adapt their coverage as needed. They need to continue to analyze their risks and create a comprehensive risk management plan.

They also need to partner with their insurance carrier and broker to hold coverage workshops and utilize the resources brokers and carriers have to provide.

R&I: What does the industry need to do as a whole to keep up with these ever-evolving risks and to improve?

NT: The insurance industry needs to continue investing in technology and data analytics to better understand and assess risks. By leveraging these tools, insurance brokers can provide more accurate and tailored coverage to their clients, while also improving their own risk management processes.

Additionally, the industry needs to prioritize transparency and education, helping clients understand the nuances of insurance and risk management so they can make informed decisions about their coverage.

Finally, collaboration and communication between insurers, brokers and clients are key to staying ahead of emerging risks and developing effective solutions. &