This Supreme Court Case Shows Exactly Why Every Employer Needs to Understand ERISA Requirements

The U.S. Supreme Court recently ruled unanimously against the arguments of Intel Corp. in a significant lawsuit (Intel Corporation Investment Policy Committee v. Sulyma) surrounding the Employee Retirement Income Security Act (ERISA) provisions and guidelines.

In 2015, a former Intel Corp. employee brought a lawsuit against Intel Corp. for a breach of fiduciary duties. The former employee alleged that the plan fiduciaries violated their obligation to act as a responsible fiduciary by making high-risk investment allocations that caused substantial plan losses.

According to The Wall Street Journal, the lawsuit was brought to court more than three years after Intel Corp. disclosed the investment allocation arrangements through its plan participant website.

Derrick Wong, account executive, Risk Cooperative

Intel Corp. argued that the lawsuit was filed outside the Employment Retirement Income Security Act of 1974 (ERISA) statute of limitations guideline that requires the plaintiff to sue within three years of obtaining “actual knowledge” of a breach.

The district court ruled in favor of Intel and dismissed the case due to the statute of limitations, but the U.S. Supreme Court reversed the decision in February 2020. The U.S. Supreme Court held that “actual knowledge” could not be established merely by making disclosures available online to the plaintiff.

Since the U.S. Supreme Court deemed that the plaintiff did not have “actual knowledge” of the potential fiduciary breach, the six-year statute of limitations period was applied to the case.

The Importance of ERISA Compliance

The decision will likely impact how plan sponsors, like Intel, communicate with participants moving forward, putting the onus on employers to ensure that plan beneficiaries acknowledge receipt of these disclosures.

This decision will also impact how plan sponsors make and communicate investment allocations to employees, further ensuring that plan sponsors are responsible fiduciaries.

As an employer, it is important to understand ERISA and the penalties involved for non-compliance.

What Is ERISA?

The U.S. Department of Labor (DOL) passed the ERISA as a federal law that sets minimum standards for retirement and welfare benefit plans, including 401(k), pension, profit-sharing and group health plans.

Under ERISA, employers are required to provide notice to participants about the benefit plan terms, including funding, coverage and costs.

This type of transparency and accountability ensures employers are acting in the best interest of the plan participants and their beneficiaries.

Common Retirement Accounts Subject to ERISA

- 401(k) plans

- Simplified Employee Pension (SEP) plans

- Savings Incentive Match Plan for Employees (SIMPLE) plans

Common Welfare Benefit Plans Subject to ERISA

- Medical, dental, and vision plans

- Prescription drug plans

- Group life insurance plans

- Accidental death and dismemberment (AD&D) plans

- Short-term and long-term disability plans

- Health reimbursement arrangements (HRAs)

- Flexible spending accounts (FSAs)

Exemptions from ERISA

- Government entities

- Church organizations

- Compliance plans offered for the specific purpose of complying with a state or federal statute

- Foreign plans maintained outside the United States that benefit non-citizens or non-resident aliens

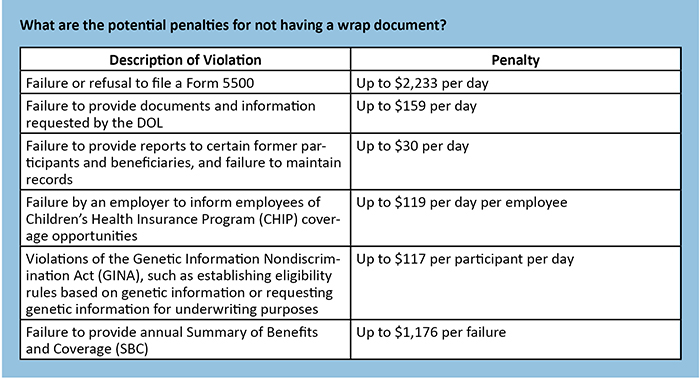

Potential Penalties

ERISA is administered by the Employee Benefits Security Administration (EBSA), a division of the DOL. Violations of ERISA can be met with investigations, enforcement actions, and penalties from the DOL. These breaches in compliance can also open the door to private lawsuits from employees.

Les Williams, partner and chief revenue officer, Risk Cooperative

The EBSA regularly conducts audits of benefit plans to ensure compliance and maintain the integrity of the employee benefit plan system in the United States. According to the FY 2019 DOL Fact Sheet, EBSA’s administrative authority covers approximately 690,000 retirement plans and 2.2 million health plans.

The EBSA closed 1,146 civil investigations in FY 2019, with 67% of those cases resulting in monetary results for plans or remedial action.

Over $2.5 billion was recovered in direct payment to plans, participants, and beneficiaries. There were 275 criminal investigations that closed in FY 2019, which led to the indictment of 76 individuals (including plan officials, corporate officers and service providers) for offenses related to employee benefit plans.

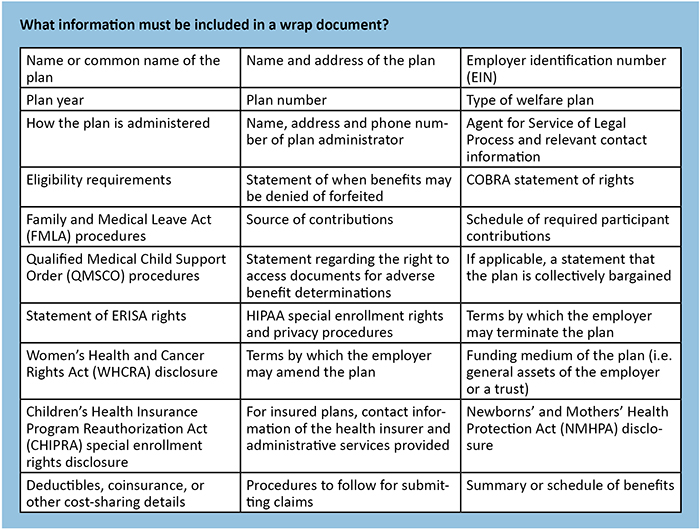

Minimize the Chance for Potential Penalties: The Wrap Document

What is a wrap document?

A wrap document incorporates all required language to meet ERISA guidelines and “wraps around” existing insurance policy language to create a fully compliant plan document.

How does a wrap document impact Form 5500 filing?

ERISA requires that all benefit plans subject to ERISA have a governing plan document and a summary plan description (SPD).

Wrap documents allow an employer to file a single Form 5500 for multiple benefits coverage, which saves an exponential amount of time and money.

Without a wrap document, a separate Form 5500 must be filed for each welfare benefit plan offered by the employer.

Partnership: A Wise Investment

Experts recommend that employers partner with professional retirement plan consulting practices to help alleviate the burden of fiduciary liabilities.

These certified consulting practices provide fiduciary oversight by implementing a proactive approach to plan governance, ensuring employers adhere to the fiduciary standards under ERISA. Some professional consulting practices can even serve as the fiduciary.

History has made clear that ERISA class action lawsuits are not limited to the largest companies. Employers and plans of all sizes are vulnerable to these potential penalties and litigation.

It is important for employers to educate themselves on the complex and continually changing ERISA guidelines and make informed decisions to help minimize potential violations that can lead to substantial fines or, in the most severe cases, criminal punishments.

It is an investment that all employers should make. &