‘If You’re Not Changing, You’re Not Getting Better’: What One CEO Says About Insurance’s Biggest Challenges

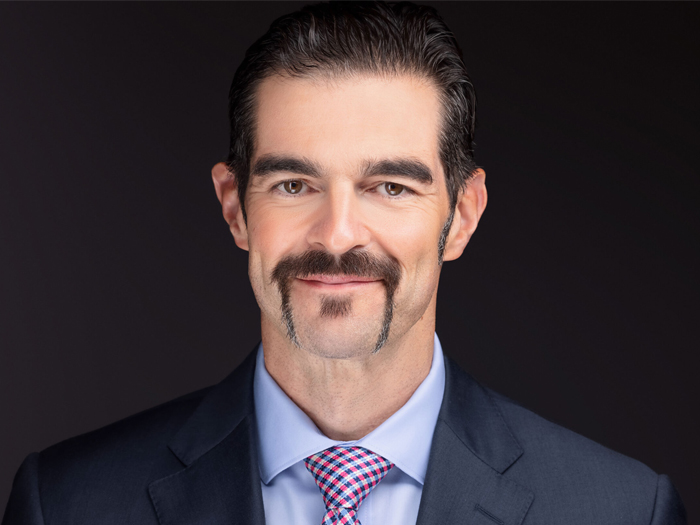

Tom Warsop, CEO of York Risk Services Group, comes from a background heavy in financial services technology and business process transformation. That’s partly why we chose him as an Executive to Watch in 2019.

Technological change is progressing more rapidly than ever. Keeping up is a challenge for every sector, but the insurance industry faces unique barriers due to the age of its legacy systems — and increasingly, the age of its workforce.

We sat down with Warsop for his insight on just what opportunities and challenges are created by the rapid pace of change, and how he thinks insurers should tackle the onslaught of new tech.

R&I: When it comes to the pace of change, how well do you think the insurance industry is adapting?

Tom Warsop: There is so much change happening not just within the insurance industry, but in the world in general. Some people thrive on change, and others see it as daunting. I think change is not only necessary, but exciting. You have to change to stay competitive — if you’re not changing, you’re not getting better.

In our industry, there’s constant pressure to become more efficient, so we have to be on the lookout for ways to take advantage of developing trends and stay ahead of the curve. Specifically, the top challenges for our industry are technology implementation and talent recruitment.

R&I: How does technological change put pressure on traditional insurance operations?

TW: As technology makes so many tasks easier and faster, it has created an expectation among consumers that everything should be just as fast and easy.

Look at smartphones. Companies like Samsung and Apple release new products every year, and people have not only become accustomed to that, but in fact demand it. The Amazon effect is another example. We order a product with the click of a button and it a day or two it’s on your doorstep. We’ve come to expect everything to happen immediately.

That increasingly applies to the claims process as well. When people have a claim, they want an answer almost instantaneously. Sometimes the industry can meet that expectation; sometimes it can’t.

Take a workers’ comp claim, for example. There are too many variables and other parties involved to have a case closed in one day. It’s challenging to meet the demand for speed when you’re dealing with complex claims.

R&I: What opportunities and challenges does technology present from an implementation standpoint?

TW: One of the most talked-about applications of technology in insurance is the automation of manual processes. Automation offers opportunity to become more efficient, more productive and more cost-effective, but it presents a challenge when people try to implement automation without a clear idea of the end goal.

If we identify the objectives first, I’m pretty confident we’ll get to a good place. If we do it in the reverse order, I don’t have any idea what we’re going to get to. It’s going to be expensive, and you’re probably not going to be happy with the results.

Early in my career, I met with the Chief Information Officer of a large government agency in Europe, and he wanted to completely automate a specific process. I sat there for a minute and said, “Okay, I understand what you want, but that’s not what we’re going to do.”

I explained that we need to understand the outcomes we’re trying to achieve before we build anything.

If we identify the objectives first, I’m pretty confident we’ll get to a good place. If we do it in the reverse order, I don’t have any idea what we’re going to get to. It’s going to be expensive, and you’re probably not going to be happy with the results. Automating a process with no plan will produce the same bad outcome you’ve been experiencing, only faster.

R&I: How have you brought that mentality and approach to York? How has York implemented technology to improve a particular process?

TW: Soon after I joined as chairman about 18 months ago, we put in place a whole program using Lean Sigma techniques. We had to dissect our business processes and ask ourselves, which pieces of those processes add value, and which do not? Automating the non-value add steps frees up your human expertise to focus on the steps that do create value for your organization.

Using that program, we are re-engineering our claims handling process and have seen a substantial improvement in productivity. That translates to better outcomes for claimants and for our own teams.

R&I: What changes does the industry have to make in order to attract workers earlier in their careers?

TW: Thankfully, Millennials are possibly the most studied generation in the history of generations, so we have some clues as to what they are looking for in an employer and a work environment.

There’s data to suggest that Millennials see our industry as old school, slow to change and generally not all that attractive. I think the exact opposite is true. The insurance industry is all about trying to improve processes and creating solutions that allow businesses the room to create and innovate. It’s far more than just selling products and services.

We also know that Millennials want to work for an employer that does good in the world and is a socially responsible citizen of the community. Well, the insurance business is critical to a functioning economy and society.

The problem we have is one of education. We have to be better at communicating all the opportunity there is in insurance to drive change.

We also know that Millennials want to work for an employer that does good in the world and is a socially responsible citizen of the community. Well, the insurance business is critical to a functioning economy and society. York’s mission statement is, “We reduce risk and get people and organizations back to health, work and productivity.” At the end of the day, we are here to help people get back on track. By understanding and managing risk, we can help to make society and life better.

Many of us in the industry know that, but we have to be committed to reaching young people early in their careers, helping them to see that mission and get excited about what we’re doing.

R&I: Are there any specific ways you’re communicating that message to Millennials?

TW: Yes. We’re trying to identify different ways that Millennials like to communicate and learn, and that has driven an effort to become more adept at social media.

We’re also trying to make our work environment more interesting and modern. One of the things that I noticed when I came to York was that all of the offices looked similar.

They had very high cubicle walls. They were generally pretty dark colors. You’d have private offices on the outside of a building taking all the windows, and then you’d have cubicles inside, and that made the cubicles very dark. It didn’t necessarily inspire collaboration.

So, over the next couple of years, we’ll work on making these office environments much more open, inviting, bright and inspiring of collaboration. That means very few private offices, more huddle rooms, open floor plans, and no blocking the windows.

We’ll also incorporate new tools like “smartboards” that make it easier to work together on documents and presentations. No more emailing attachments and losing things in the shuffle. People coming out of college today are used to these new tools, and that’s what they expect to use at work. &