Here’s How Cities Can Reduce Climate Change Risk

Tropical rains flooding Miami Beach.

Climate change is increasing the frequency and severity of extreme and costly weather events such as storms, hurricanes, extreme rains and heat waves. These are increasing costs and risks to cities, in turn threatening their credit rating and their cost of borrowing money.

The U.S. government’s 2018 National Climate Assessment Report recognizes that “Climate change creates new risks and exacerbates existing vulnerabilities in communities across the United States, presenting growing challenges to human health and safety, quality of life, and the rate of economic growth.”

Moody’s Investors Service warns that climate change “will be a growing negative credit factor for issuers without sufficient adaptation and mitigation strategies.”

These mitigation strategies include what we call smart surfaces — including highly reflective roofs, porous and reflective pavements, roads and parking lots, green roofs and trees. These strategies can reshape how cities manage rain and sun, greatly reducing costs and risks of excess heat, smog and flooding, and making cities more livable, comfortable and safe.

To date, the potential impact of adopting these strategies on city credit rating has been largely overlooked. Our analysis demonstrates that cities that choose to not adopt smart surfaces will experience significantly increased climate related losses, increased risk of credit rating reductions and associated increases in city borrowing costs.

Over time, these combined threats will increase risk of insolvency for cites that do not adopt resilience strategies such as smart surfaces.

Part One of the authors’ analysis, which is detailed below, explores the background of smart surfaces and their impact on a city’s credit risk and risk management strategies. In Part Two, the authors dive deeper into the impact increased severe weather events have on a city, looking at heat waves and flooding as prime examples. Part Three concludes the authors’ research, highlighting several benefits to having a smart surface strategy in place to increase climate change resiliency and decrease costs for a city.

This three-part series provides rigorous description and quantification of the costs and benefits of city climate change mitigation strategies on their credit risk. This work is part of the Smart Surfaces Coalition, comprised of 30 partners, including the National League of Cities and the American Institute of Architects.

This analysis is intended to help cities better understand and more effectively manage and reduce climate risk, and thus help cities remain livable, healthy and financially viable.

Smart Surfaces, Credit and Risk: Background and Need

Climate change is increasing the frequency and severity of extreme and costly weather events such as storms, hurricanes, extreme rains and heat waves.

These events increase costs and risks to cities, threatening their credit rating and their ability to borrow money and finance city operations.

Smart surfaces — such as reflective and porous pavements and roads, solar PV on cool or green roofs, and trees — provide very cost-effective ways for cities to manage sun and rain to reduce temperature, flooding and risks associated with climate change.

The Smart Surfaces Coalition is made up of 30 partners, including the National League of Cities and the American Institute of Architects. The Coalition is building on a half-decade of rigorous cost benefit analysis with cities researching and documenting the cost-effectiveness of smart surfaces.

These cost benefit studies are available on the Smart Surfaces Coalition website and reflect the Coalition’s mission: “The Coalition is committed to the rapid, cost-effective adoption of smart surfaces to enable cities to thrive despite climate threats, save cities billions of dollars, decrease heat, reduce flood risk, slow global warming, and increase city livability, health, equity and jobs.”

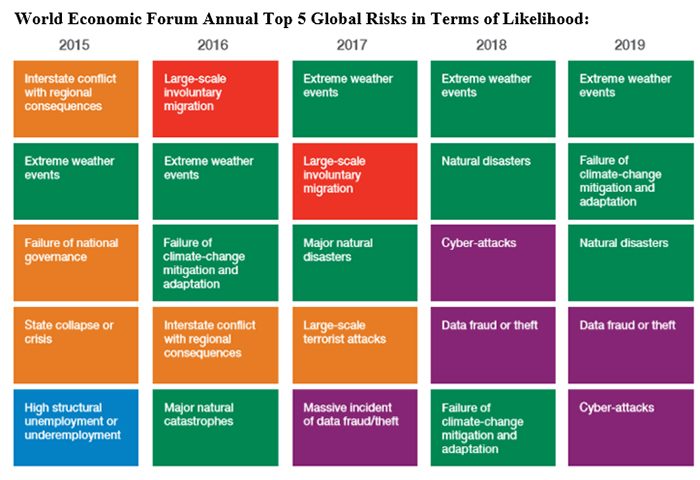

The World Economic Forum (WEF) every year issues its assessment of the top five global risks in terms of likelihood.

In 2016, according to the WEF, failure of climate change mitigation and adaptation appeared for the first time (as the 3rd largest global risk).

In 2019, the three largest global risks directly relate the climate change.

These include extreme weather events, major natural disasters and failure of climate-change mitigation and adaptation. All these risks are being driven by accelerating climate change and together they create enormous risks and costs for cities.

Increasing frequency and severity of severe weather events, increasing heat and rising oceans in turn are driving expanding property losses, making insurance increasingly expensive, and leading some insurance firms to withdraw from high risk areas.

Similarly, the United States government released the Fourth National Climate Assessment Report in November 2018. The report’s summary states that “Climate change creates new risks and exacerbates existing vulnerabilities in communities across the United States, presenting growing challenges to human health and safety, quality of life, and the rate of economic growth.”

It further reports, “The impacts of climate change are already being felt in communities across the country. More frequent and intense extreme weather and climate-related events, as well as changes in average climate conditions, are expected to continue to damage infrastructure, ecosystems, and social systems that provide essential benefits to communities.

“Future climate change is expected to further disrupt many areas of life, exacerbating existing challenges to prosperity posed by aging and deteriorating infrastructure, stressed ecosystems, and economic inequality.”

The American Meteorological Society’s (AMS) 2018 report Explaining Extreme Events in 2017 from a Climate Perspective identifies several extreme weather events that they said were “virtually impossible” without climate change.

The AMS press release states that these extreme weather events “could not have happened without warming of the climate through human-induced climate change.”

The editor-in-chief of the Bulletin of the American Meteorological Society stated that “these attribution studies are telling us that a warming Earth is continuing to send us new and more extreme weather events every year,” and “the message of this science is that our civilization is increasingly out of sync with our changing climate.”

Moody’s Investors Service, which rates the creditworthiness of government bonds, tells governments to adopt approaches to increase city resilience in order to reduce the risk and severity of future losses projected to occur as a result of accelerating climate change, saying that climate change “will be a growing negative credit factor for issuers without sufficient adaptation and mitigation strategies.”

Moody’s cites the rise in loss of business operations resulting from loss of power and slow recovery times.

“The interplay between an issuer’s exposure to climate shocks and its resilience to this vulnerability is an increasingly important part of our credit analysis, and one that will take on even greater significance as climate change continues.”

This report further analyzes the costs and benefits of city adoption of smart surface measures that would enhance the resilience of cities.

The risks/costs that these smart surface measures help mitigate include excess summer heat, flooding, smog, loss of tourism and business downtime and recovery time.

Insurance’s Role in Climate Risk Management

The insurance industry has likewise recognized the impact of climate risk and has taken steps to minimize adverse effects on its underwriting results.

The American Academy of Actuaries, the Canadian Institute of Actuaries, the Casualty Actuarial Society, and the Society of Actuaries have developed the “Actuaries Climate Index,” a five-year moving average of climate extremes across the U.S. and Canada.

The Index reached a new high in the fall of 2017 reflecting continued deviation of climate and sea level extremes from historically expected patterns.

Losses from insured climate-related risks continue to increase despite increasingly restrictive underwriting and pricing programs.

Flooding risks of all kinds (including rising bodies or water, back up of sewers, basement flooding, and mold related costs and illness) are typically excluded from U.S. property insurance policies.

Policies issued in wind-prone geographies generally have high deductibles for wind damage, even higher deductibles for named storms (sometimes excluding damage from a named storm) and lower limits — placing a greater risk burden on the policy holder.

Data reported by the Insurance Information Institute and Munich Re reveal that the insured losses due to natural disasters in the United States in 2017 totaled $78 billion, more than triple the $23.8 billion total for 2016.

Tropical cyclones with $49.1 billion in losses accounted for 63% of U.S. insured losses in 2017.

Severe thunderstorms losses, at $18.2 billion, accounted for about 23% of the 2017 insured losses.

Wildfires, heat waves, and drought produced $9.5 billion in insured losses in 2017, or about 12% of the total.

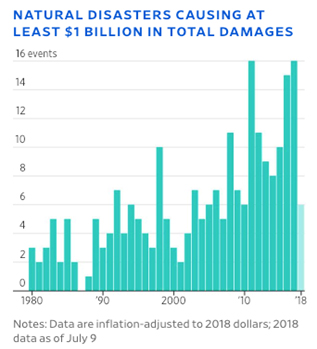

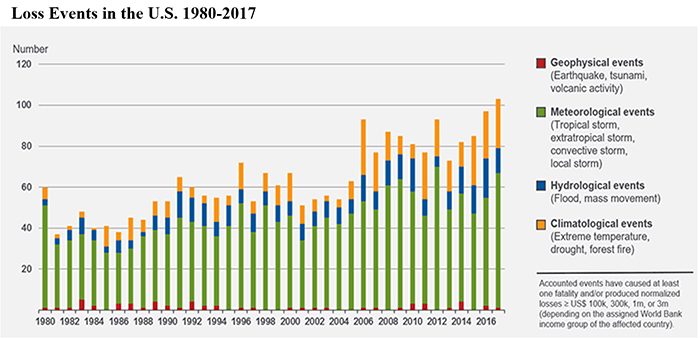

Overall, losses per event have grown while number of loss events have more than doubled since the 1980s.

Climate Change Accelerating

The threat and costs of climate change is large and expanding rapidly.

Moody’s finds that “of the 86 global sectors that Moody’s has qualitatively scored for exposure to environmental issues that may have a credit implication, a total of 11 — with approximately $2 trillion of rated debt — are experiencing material credit impacts or are likely to start doing so over the next three to five years. For these 11 sectors, the consequence of regulatory or policy initiatives for carbon reduction and other air emissions is the most frequently cited issue impacting creditworthiness.

“A further 18 sectors — with approximately $7 trillion of rated debt — face the potential of changes in their credit profiles that could be material due to environmental considerations, but over a longer period of 5 years or more.”

An increasingly large part of the economy is at risk from accelerating climate change, making the work of quantifying risk to cities and understanding how to limit these risks increasingly urgent and necessary.

How Climate Risk Affects Credit Risk

Climate change drives increasingly severe weather events in ways that are not precisely attributable on an event by event basis.

This makes it difficult to assign direct impacts of climate change for a single event since climate change may just increase severity of a weather event rather than cause it directly.

In addition, climate change at this scale is a relatively new phenomenon. While there is scientific consensus that severe climate change driven losses are large and growing, assigning specific losses, and resulting city credit downgrades, to climate change events is a new and challenging area that will be increasingly important if cities are to make informed and smart design and policy decisions.

Will Wynn, former mayor of Austin, TX

As former two-term mayor of Austin (and a co-author of this report) Will Wynn stated: “Increasingly, the success of mayors and their cities will depend on whether cities adopt smart proactive policies like smart surfaces to make their cities less vulnerable to climate change. Those that do not heed the scientific reality of climate change will suffer while those who move quickly by adopting smart surfaces such as green and cool roofs and porous, reflective pavement will protect and enhance their city livability.”

Because cities rely on borrowing to finance operations, their ability to borrow money at a low interest rate is of great importance.

Cities generally issue bonds to raise money for a range of purposes, including financing important urban infrastructure, such as new wastewater treatment plants.

Credit rating agencies assign each city a credit rating that determines the interest rate at which cities can borrow money — or if they can borrow money at all. Therefore, a credit rating is fundamentally important to the financial viability of cities.

Credit ratings, especially by the big three — Moody’s Investors Service Inc. (Moody’s), Standard & Poor’s (S&P), and Fitch Group (Fitch), determine cities’ financial health through regular (usually annual) review of cities’ credit rating. Each agency has their own rating system; however, they all function similarly.

Credit Rating Agencies Worry Over Climate Risk

There are tens of thousands of issuers of municipal bonds, all of which rely on credit ratings.

A worsened or downgraded credit rating translates into a higher cost of borrowing. As Stoyan Bojinov wrote, “When a bond issuer gets downgraded, the yield on the bonds from that issuer will usually go up; this is to compensate prospective buyers of the bonds for a perceived increase in risk reflective of the lowered rating.”

When a city issues a bond, it is in effect pledging to pay lenders back from city revenue, largely from property and sales tax. The property tax is a function of overall property values. If property values decline due to severe weather events or the prospect of increasing risk due to weather catastrophes, it reduces property value and therefore the amount of taxes that the city can raise.

Since much of cities’ budgets go to fixed obligations, changes in tax base or taxes can have a large impact on repayment ability and therefore on credit risk and rating.

Greg H. Kats, CEO, Smart Surfaces Coalition

Mayor Wynn noted during a discussion, “Fundamentally, mayors have to convince the credit rating agencies that they are either (1) taking active steps to mitigate future risks, or (2) are prepared to and able to raise tax rates immediately following a disastrous event. My experience is that the agencies are becoming more skeptical of the latter.”

Climate change poses a broad, profound, and fundamental risk to cities not only because of increasing storms, excess heat and other direct costs, but also because it directly impacts the credit rating process.

Major credit rating agencies are increasingly concerned about climate change impact on risk because of their exposure to increasing losses resulting from rising temperatures and more severe and costly weather events.

According to Lloyds, for example, following Hurricane Andrew in 1992, the Property Claims Service reported an industry loss of $15.5 billion and the insolvency of 11 insurers.

Increases in actual and projected severe weather events resulting from climate change has led credit rating agencies to issue warnings about credit risk.

For example, Moody’s warns cities that their credit rating is at risk because of climate change unless they plan for and invest in reducing risk exposure and improving resilience.

As a New York Times editorial summarized: “Moody’s is making it clear that there is a potential climate risk bubble in which an extreme weather event causes damages so catastrophic that taxpayers, insurers, lenders, states and municipalities suffer damages or losses of hundreds of billions of dollars and local and state government face downgrades in their credit worthiness, affecting their ability to borrow money.”

Moody’s warns municipalities and states that failure to respond to climate change driven severe storm, flooding and related events will result in increased risk of credit downgrade.

Moody’s notes that “analysts for municipal issuers with higher exposure to climate risks will also focus on current and future mitigation steps and how these steps will impact the issuer’s overall profile when assigning ratings” and concludes that climate risk “will be a growing negative.”

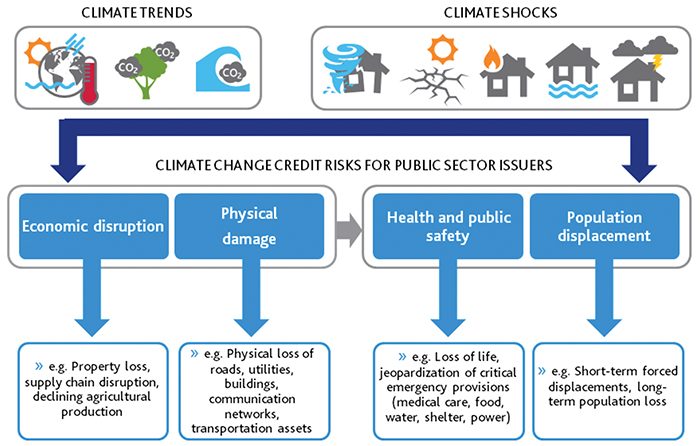

Moody’s also includes key credit risks associated with climate change:

- Economic disruption (e.g., property loss/damage; lower revenues; increased debt; and higher insurance costs);

- Physical damage (e.g., property loss/damage; loss of utilities, transportation and communication networks);

- Health and public safety (e.g., loss of life; jeopardized critical emergency service provisions);

- Population displacement (e.g., short term displacements and longer-term population migration).

The smart surface strategies analyzed in this three-part series help to reduce all four of these risks.

Climate Change Trends and Losses

This framework from Moody’s provides a valuable basis on which to build a more specific model of how climate change driven losses translates into cost increases, reduced property value and lower revenue at the city level.

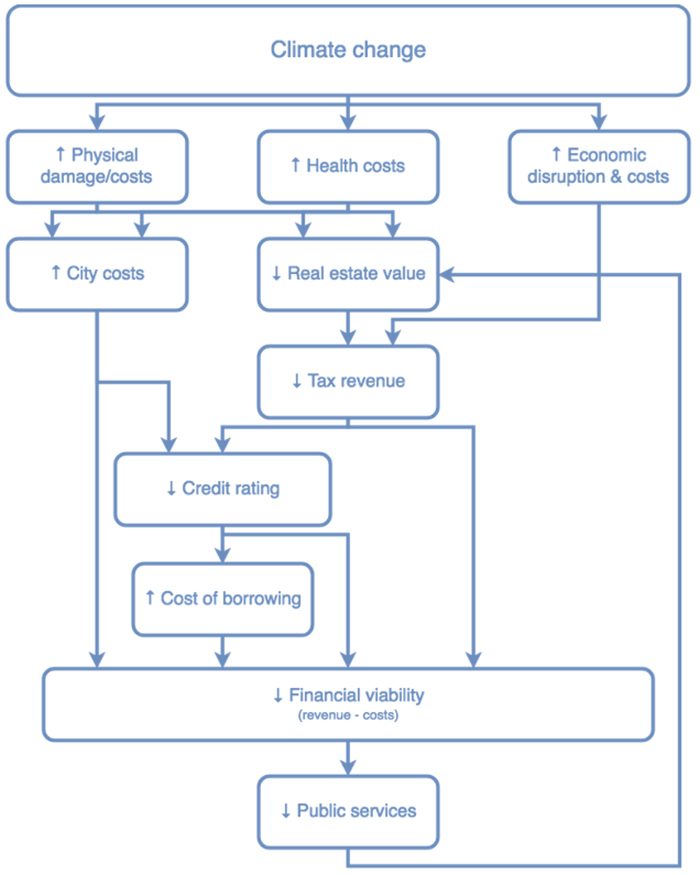

Below we have mapped how climate change related severe weather events result in physical damages, increased health costs, increased city costs (including from property damage and greater need for city services), reduced real estate value and then reduced credit rating and higher cost of borrowing.

This chart maps out many of the main pathways by which climate change imposes costs and risks on cities, including loss of value to real estate and resulting decline in tax basis and city revenue.

Rob Jarrell, analyst, Capital E

With increased climate change driven losses, city costs and need for expanded public services also increases, creating financial and budgetary challenges for cities that can hurt credit rating, in turn increasing the cost of borrowing and worsening city budgetary challenges.

Rating agencies, such as Moody’s, issue a credit rating that constitutes a professional, highly considered judgment of the likelihood that a city will be able to pay back lenders, or bondholders.

If the credit rating drops, cities have to increase the amount of interest paid to bondholders in order to compensate for the excess risk the bondholder takes on.

Cost of borrowing is determined by the city credit rating — and an improved credit rating reduces the cost of borrowing. For example:

- In 2014 when Baltimore’s credit rating improved, the Baltimore Sun noted, “The new credit rating is expected to allow the city to borrow money at lower interest rates for projects such as infrastructure upgrades, new schools and improved recreation centers. That in turn would save taxpayers cash on interest payments.”

- In July 2015, Detroit, in a remarkable turnaround after struggling out of insolvency, received an investment-grade bond rating from Standards & Poor’s on $245 million in bonds tied to the city’s bankruptcy exit financing. The city reported that the favorable rating should allow it to save $2.5 million annually and $20 million in interest costs over the life of just that small portion of the city debt.

- In May 2016, Seattle received high credit ratings, leading Mayor Ed Murray to note that “High ratings allow the city to borrow money for projects at a lower cost to taxpayers. Every dollar that we save through lower borrowing costs helps us to stretch limited public dollars and reinvest those savings in providing better service to residents.” &

Here’s How Cities Can Reduce Climate Change Risk

Climate change is increasing the frequency and severity of extreme and costly weather events, but cities have an opportunity to mitigate the risks.

A deeper dive into the impact increased severe weather events have on a city’s credit risk, looking at heat waves and flooding as prime examples.

How Smart Surface Strategies Are Increasing Resiliency for Cities Faced With Climate Change Risk

A smart surface strategy can increase climate change resiliency and decrease credit risk and its costs.