Risk Insider: John Devereux

Data: The New Player

The insurance industry is on the brink of transformation. The unprecedented amount of capital present (including alternative capital) and the rash of consolidations in brokerage firms and insurance enterprises (U.S. companies, international companies, Lloyd’s syndicates) are among the reasons.

Another transformative trend is that the insurance distribution system has a new participant — data. Data has always been present, lingering behind the scenes, but now data is demanding to be a bigger part of the equation.

Recent reports show that data tools have become more accessible, more efficient and easier to use now than ever before. Data presents itself under a number of different guises — Big Data, Predictive Modeling, and Analytics are just a few.

Regardless of what form data takes, data is and will be the engine that drives market forces now and in the future.

Analytics based on predictive modeling have already transformed personal lines insurance. A number of companies with significant volumes of data and many intelligent resources use data and telematics to develop a custom rate for each individual based on a host of characteristics and actual driving habits.

While the leap from personal lines to commercial lines and then to specialty commercial lines may not be intuitive or even seem likely, it’s happening.

Regardless of what form data takes, data is and will be the engine that drives market forces now and in the future.

Commercial credit scores, advanced mapping techniques, the use of significant internal and external databases, aerial inspections by drones, and other such tools are already in use.

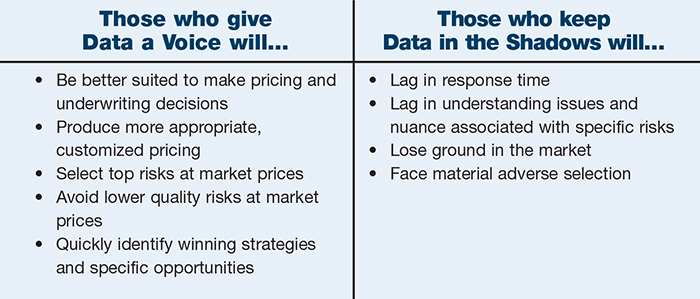

So what does this mean for the insurance marketplace? It means that as these tools and advanced data and analytics continue to make their way into the marketplace, those employing them will be better suited to make pricing and underwriting decisions.

They will be able to produce more appropriate, customized pricing or, perhaps more importantly, to select the best risks and avoid lower quality risks at market prices. They will be able to leverage these tools to quickly identify winning strategies and specific opportunities.

Conversely, it means those who don’t use such tools will lag in response time, delay in understanding issues and nuance, and ultimately lose ground in the market and be adversely selected against.

Innovation is critical to success in the insurance industry. Innovation in products and services, innovation in delivery, etc., innovation in the way we look at and analyze risk the tools we use, the data that we leverage, the processes we employ — will all be critical to success.

All of the above isn’t to say that automated tools and analysis will replace the need for quality underwriting. However, these types of tools and analysis are here to stay and their impact will continue to grow and be felt.

With that in mind, we need to welcome data to the conversation and continually explore novel ways that data can help us make better decisions, identify the right risk, and create a differentiated approach for our clients.