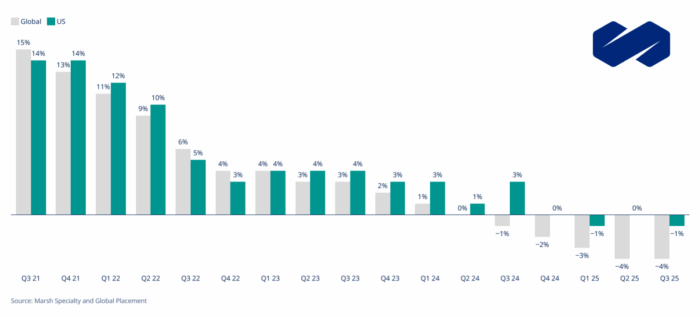

Commercial Insurance Rates Continue Downward Trend Globally in Q3 as Competition Intensifies

Global commercial insurance rates fell 4% in the third quarter of 2025, marking the fifth consecutive quarterly decline as insurers compete aggressively for business amid abundant capacity and favorable reinsurance pricing, according to Marsh’s Q3 Global Insurance Market Index.

The U.S. commercial insurance market experienced a 1% overall rate decrease in the third quarter, fueled by a 9% decline in U.S. property insurance rates. The Pacific region saw the steepest composite rate reduction at 11%, while the U.K. and Latin America each saw composite rates fall 6%. Rates in Asia fell 5%, decreased 4% in Europe, and were down 3% in Canada, according to the Marsh report.

Intensifying competition among commercial insurers, bolstered by improved financial performance and lower reinsurance costs, has created a buyer’s market for many commercial insurance lines, according to Marsh. Commercial property insurers are offering more favorable policy terms to win business, while cyber insurance rates fell 3% globally, marking the 10th-straight quarter of decreases in that sector.

The competitive environment has enabled clients with strong risk profiles to negotiate enhanced coverage terms and explore alternative risk transfer solutions, including self-insurance and captive arrangements, the report noted. Financial and professional liability lines also declined 2% globally, with directors and officers liability dropping 3% as insurers begin resisting the steep reductions of recent years.

U.S. Casualty Insurance Faces Mounting Pressure from Legal Environment

While most U.S. commercial insurance lines enjoyed rate relief, casualty insurance moved in the opposite direction with an 8% increase, driven primarily by the frequency and severity of large jury awards, Marsh reported. Excluding workers’ compensation, U.S. casualty rates jumped 11% in the third quarter.

The U.S. umbrella and excess liability market faced particular strain, with risk-adjusted rates rising 16%, down from an 18% decline the previous quarter, Marsh said. Lead umbrella programs with favorable loss histories typically saw rate increases of 12% to 15%, while those with adverse losses confronted hikes of 30% or more.

Several excess liability insurers capped their single-risk capacity at $10 million due to adverse litigation developments, with high-excess minimum pricing climbing to $10,000 per million of coverage, the report said.

Commercial auto liability continues to suffer from both large verdicts and rising physical damage repair costs, prompting insurers to push for higher retentions and attachment points, particularly for large fleets operating in higher-risk states, Marsh said.

General liability rates increased 2% in the quarter, as GL coverage increasingly excludes emerging risks such as per- and polyfluoroalkyl substances (PFAS), biometric data, and cyber exposures, the report noted.

Market Dynamics Signal Continued Divergence

The current market conditions suggest a tale of two markets will persist in the near term.

“The current period follows what had been several years during which rates generally increased. As insurers continue to vigorously compete for business, we expect the overall trends seen in the third quarter to continue, barring unforeseen changes in conditions,” said John Donnelly, president, global placement for Marsh.

For property, cyber, and financial lines, the combination of ample capacity, strong insurer competition, and minimal catastrophe activity points toward continued rate moderation. The relatively quiet 2025 hurricane season to date has helped maintain downward pressure on commercial property rates, though this dynamic could shift quickly with major storm activity, the report noted.

Conversely, the casualty market shows no signs of relief as third-party litigation funding concerns persist and insurers target renewal pricing at 12% to 15% above loss cost trends. The stark contrast between U.S. casualty trends and those in other regions — where casualty rates increased just 1% in Europe and declined up to 7% elsewhere — underscores the unique challenges posed by the U.S. legal environment.

View the full report here. &