Commercial Insurance Market Shifts to Buyer-Friendly Conditions in Q3 Despite Rising Nat Cat Losses

The global commercial insurance market delivered double-digit rate reductions for preferred property risks in Q3 2025 as competitive dynamics intensified, even as insured losses from natural disasters approached $100 billion in the first half of the year—the second-highest on record, according to Aon’s latest market insights report.

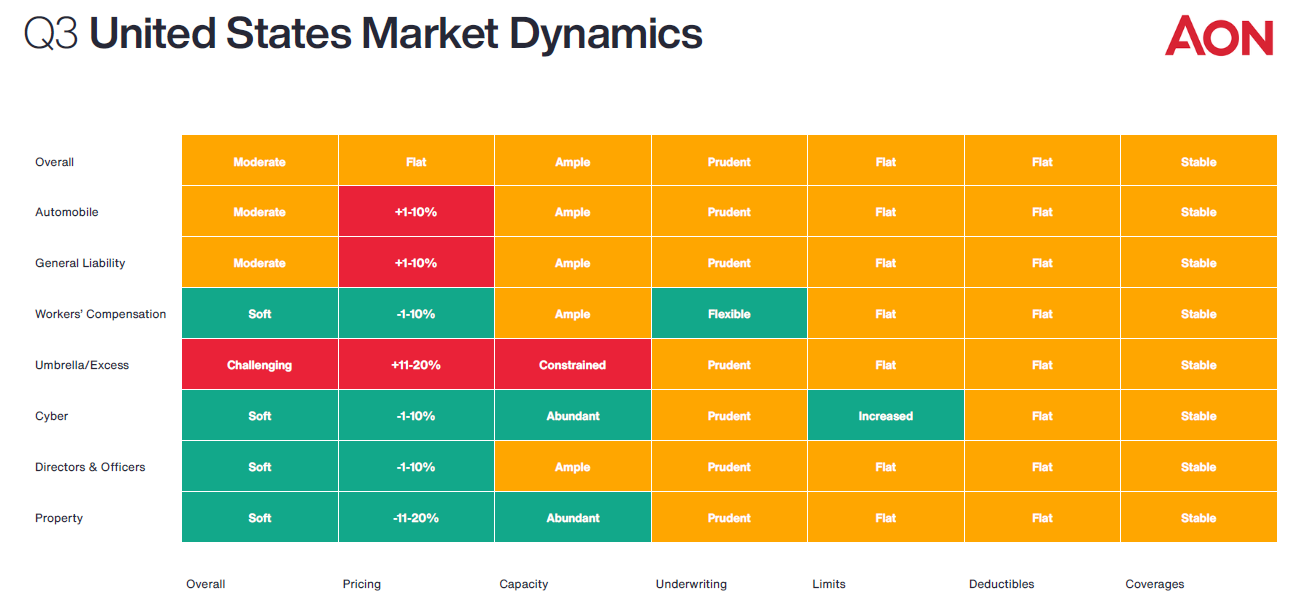

U.S. commercial insurance buyers experienced significant pricing relief across most product lines as insurers pursued growth ambitions amid ample capacity and easing reinsurance conditions, according to Aon’s report. Property insurance led the downward trend with double-digit percentage decreases for preferred risks in several markets, while cyber rates continued declining though at a more moderate pace. Directors and officers liability insurance maintained its soft market trajectory despite signs of price flattening in lead layers.

The competitive commercial lines environment extended beyond pricing as underwriters showed increased flexibility, often reconsidering risks they previously declined. Local markets attracted new entrants while international insurers and reinsurers expanded their presence, creating oversubscription scenarios for preferred risks. Workers’ compensation sustained its long-term downward pricing trend, contrasting sharply with automobile and excess liability lines where rates continued climbing due to persistent loss severity.

Underlying Challenges Persist Despite Surface Improvements

While current conditions favor U.S. buyers, fundamental market challenges remain unchanged. Loss severity and frequency continue their systemic increase across property, cyber and U.S. casualty lines, driven by factors including adverse litigation trends that plague the American market. The global insurance marketplace has evolved into a collection of micro-markets segmented by product line, industry and geography, each responding to specific supply and demand dynamics, Aon said.

“We believe the property reinsurance and insurance markets over-reacted in Q4 2022 to loss activity at the time,” said Joe Peiser, CEO of Commercial Risk Solutions at Aon. The current property market softening represents a “pricing correction” rather than a fundamental shift, as no significant new capital has entered traditional insurance and reinsurance markets despite improved profitability over the past two years.

Strategic Opportunities in a Transitional Market

The favorable conditions observed in the third quarter create opportunities for risk managers to strengthen their programs beyond capturing premium savings, according to Aon. Organizations should review coverage limits, sublimits and consistency while evaluating the quality of their insurance partners—particularly their claims-handling capabilities during major events. Reinvesting premium savings into long-term resilience measures offers protection against the market’s eventual hardening.

Four megatrends—trade disruptions, technological advancement, extreme weather patterns and workforce evolution—continue reshaping the risk landscape, the report said. These forces demand integrated risk management strategies that leverage data analytics, scenario modeling and alternative risk transfer solutions including parametric triggers, captives and facultative reinsurance.

Hurricane Melissa’s recent devastation in the Caribbean, ranking among the strongest Atlantic storms recorded, underscores the importance of comprehensive risk planning even during favorable market cycles, the report noted.

View the full report here. &