Autonomous Vehicles Are Coming to a Street Near You. How Will We Insure Them?

The promise of cars that drive themselves has been just over the horizon for years now — one of those breakthroughs that’s always coming yet seemingly never arrives. That’s changing, though, and rapidly.

Fully autonomous taxis are already on the streets of Phoenix and San Francisco, and they’re coming to Los Angeles next. And over a quarter of a million Teslas currently on the road are equipped with the company’s Full Self-Driving add-on (which, despite the name, is a driver-assistance feature, not full autonomy). Self-driving cars are already here — they’re just not very evenly distributed.

The question of what will happen when these vehicles mature from a niche concern into a ubiquitous fixture of everyday life is on many people’s minds, as evidenced by the number of seminars exploring the topic at RISKWORLD 2023.

Not If but When

“As it exists today, there are no U.S. laws that change the notion that the negligent ‘operator’ of the vehicle is liable for an auto accident,” said Joe Mclean, vice president, senior technical underwriting manager at Zurich North America, who led the RISKWORD 2023 session “Autonomous Technologies: Benefits and Risks of the Coming Age of Self-Directed Machines.”

“In other words, the person sitting in the driver’s seat is still legally liable when their vehicle collides with another,” Mclean added. “There have been a few auto manufacturers that have promised to accept liability if the vehicle is operating under specific driving conditions and causes an accident. But likely, the person in the driver’s seat will still require insurance to cover in the event of an accident, absent any changes in the law.”

As autonomous vehicles (AVs) become more commonplace, however, we can expect those changes in the law to occur — it’s just a question of when.

“We have been edging toward autonomous vehicles for a long time — ever since cruise control became available to the public in 1958,” said David Klein, a partner at Pillsbury Winthrop Shaw Pittman, and the presenter of a RISKWORLD session entitled New Roads: How Autonomous Vehicles Will Change Law and Insurance.

“Vehicles have gradually become more autonomous over time, with the emergence of features like lane departure warning, adaptive cruise control and self-parking (among others) over the past 30 years,” Klein explained.

“With Tesla’s Autopilot, we have reached what the Society of Automotive Engineers classifies as Level 2 autonomy: vehicles that combine some autonomous features but still require driver oversight and assistance. But some autonomous taxis and trucks are already on the road. So it isn’t a question of when, but how much, how soon.”

While nobody knows the precise answers to these questions, a recent McKinsey report pegs the probable revenue from autonomous driving at up to $400 billion by 2035.

Level 2 autonomous vehicles require a driver who can assume control at any time, and that driver is still held liable in the event of an avoidable accident, said Pranav Patel, president, ResiliAnt, who led a RISKWORLD session entitled Autonomous System Cyber Security Management.

“The legal and regulatory framework for current L2 vehicles doesn’t need a change,” said Patel. “But the widespread adoption of [fully autonomous] Level 3 vehicles and beyond requires a significant transformation: a shift from an ‘owner/driver-reliant’ model to a ‘technology-reliant’ model.”

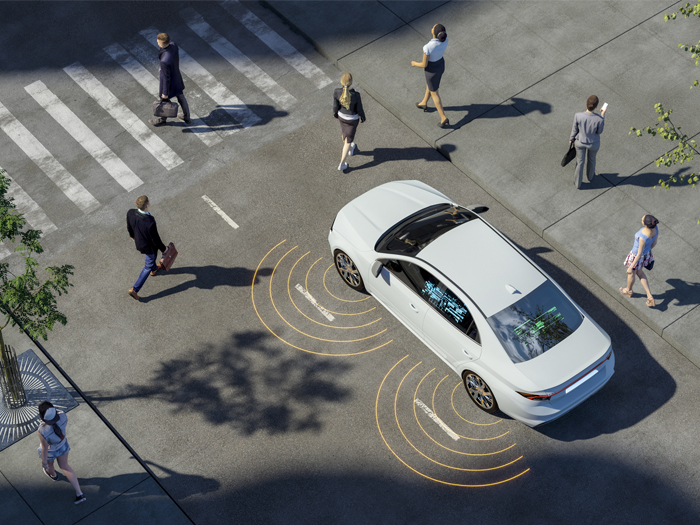

At this stage, ensuring the safety of that technology is a multifaceted challenge, Patel explained, one that comprises the vehicle’s mechanical components (its lidar, radar, ultrasound, cameras and so on), its autonomous system components (the processing architecture and smart software algorithms — which comprise more than 100 million lines of code) and the ecosystem in which it operates (including GPS, V2X traffic control systems and any other forms of communication with the rest of the world, from transmissions to nearby vehicles to the streaming video backseat passengers watch).

In fact, the third item on that list — the need for an ecosystem that fully ensures AVs’ cybersecurity and interoperability — is the biggest obstacle inhibiting adoption across the internet-of-things spectrum, according to a 2022 McKinsey report.

“What if a GPS signal isn’t available?” Patel asked. “What if cellular connectivity is somehow lost; what if a cyberattack with lateral movement changed critical vehicle safety-system parameters or caused some components or systems to malfunction; what if critical information didn’t transmit as intended?

“Some of these could cause mass catastrophe because these infrastructure and enterprises do not only serve (or connect with) one vehicle but also serve a fleet of many vehicles. We need assurance of safe performance and operations under all these scenarios,” he said.

Pointing the Finger

When driver and automobile share the task of driving, who’s liable when an adverse event occurs?

As Klein explained, it comes down to the level of automation. “In vehicles that require driver oversight (which is nearly all nowadays), the driver will be liable if an accident is traceable to his or her inattention.

“We’ve seen instances where drivers using Tesla Autopilot blamed their cars for accidents, but courts rejected these claims because the facts showed they failed to intercede when required. But there will be instances when accidents are attributable, on a review of the facts, to the vehicle itself. As higher levels of autonomy come into use, the likelihood that this will be converted to a product liability issue will increase.”

And while there’s plenty of case history when it comes to automotive product liability, not very much of has to do with how vehicles behave under their own authority.

“Most of the decisions around this issue have yet to be made,” Klein said. “Manufacturers’ existing product liability policies may need to be modified or endorsed to adapt to this change. Measuring the risk will likely be an evolving process. And adapting to new liability rules that the courts may adopt will also be a source of continual change.

“Finally,” Klein added, “insurers will have to think about how to deal with novel issues — like the role of cyber insurance in dealing with the risk of interference or hijacking of a vehicle, or whether to address as ‘accidents’ deliberate programming choices that, for example, prioritize the safety of pedestrians over that of vehicle occupants.”

“Insurance models may have to shift from covering individuals to covering technical failures,” Patel concurred. “The importance of product liability and E&O increases considerably for entities in the ecosystem, including the vehicle manufacturers; such policy should cover novel perils like cybersecurity breaches compromising autonomous systems …

“Because the industry is in such a nascent stage, there are many ‘unknowns’ — people don’t know what they don’t know — that could lead to incidents,” Patel continued. “Hence it’s difficult to estimate cost/impact exposure for coverage. A considerable level of technical knowledge is also needed to establish initial cost/impact levels.”

And even once the question of liability is (more) settled, insurers will still face the practical problem of how claims are filed.

“In the future, product liability exposure will need to be factored in when assessing liability in a loss,” said Joey Daryanani, vice president, CSAA Specialized Services, CSAA Insurance Group, a AAA Insurer.

“Ideally, this will need to be considered at the time the first notice of loss is reported. Given that, in most cases, less experienced personnel handle the initial claim intake, we will need to enhance training programs to include product liability, preservation of evidence and when to consider hiring an expert early in the liability investigation.”

Furthermore, said Mclean, “Aside from shifting liabilities, understanding how autonomous use changes the vehicle’s value will be challenging when it comes to pricing coverage. This is relevant regardless of whether the vehicle is equipped with the instrumentalities (like sensors) to enable autonomous use post-manufacture or if the vehicle is manufactured with autonomous capabilities …

“The most important thing is to know how much coverage is needed to cover the vehicles in question,” Mclean added. “At least one state is requiring higher auto liability limits for autonomous vehicle operation.”

Making the Leap

While the prospect of charging into uncharted technological and legal territory may be risky, it’s not without promise.

In the short term, as the courts determine how liability will shift from drivers to manufacturers, we can expect some uncertainty (and volatility) to persist. “At this point, historical data is very thin,” Daryanani said. “Carriers will need to keep an eye on loss trends and be prepared to respond quickly.”

“In the absence of [established legal frameworks], an owner has an opportunity to hold the vehicle manufacturer, ecosystem entities and the aftermarket service entity liable, depending on the cause of each incident,” Patel added. “This could lead to a highly litigious environment.”

But as precedent is gradually established and data accumulates, the benefits of autonomous vehicles will become more clear. Human error is a more or less intractable problem, but the failure of AVs is a technological one, which means that it can be ameliorated over time — so we should expect to see the rates of accidents involving AVs to steadily decline.

As AVs are proven safer than your typical human driver, we will likely reach a tipping point at which the adoption of AVs accelerates rapidly — and insurers could be a big part of that push.

Consumers feeling the pinch from sharply climbing auto insurance and fleet insurance premiums are more likely to embrace any technology that offers relief — although risk managers should make sure they’re familiar with the technology and their insurance options before making any decisions.

“If they are OEMs or suppliers, they should first be cognizant of the new risk they are assuming, and should give careful consideration to measuring that risk in terms of market penetration, expected accident rates and the allocation of liability between vehicles at different levels of automation and non-automation,” Klein advised.

“The actuarial picture will not be the same from one year to the next, and it will likely take decades to sort out.”

For AV manufacturers, “finding a trusted and nimble insurance partner is key,” Daryanani said.

“In my experience, we have had to keep the lines of communication open and better understand the autonomous vehicle company’s growth and risk mitigation strategy … I recommend brokers look for insurers (like Mobilitas Insurance) that are specifically set up and targeting the new forms of mobility. In addition, look for insurers that are already insuring autonomous vehicles today.” &