PLUS Conference

Three Pain Points

From dealing with multi-million dollar claims by private equity funds to assessing the risk profiles of telehealth providers, professional liability (PL) underwriters and practitioners across a broad spectrum of sectors have plenty to ponder.

Ahead of this year’s Professional Liability Underwriting Society’s (PLUS) annual conference in Dallas, we asked a selection of PL experts to outline the key issues in their respective fields.

Cyber Cover: To Buy or Not

to Buy?

Sarah Stephens, partner and head of cyber, technology, and media E&O at broker JLT, is on a panel discussion entitled “When David Fells Goliath — Small Companies’ Role in Large Breaches,” which explores the threat that inferior IT networks of vendors, service providers and other counterparties can pose to larger, seemingly more secure organizations.

According to Stephens, PL practitioners need to be aware of the resource pressure on small vendors, while navigating a “web of interconnectedness” in both the liability and insurance arrangements of the various companies in the technology supply chain.

While large companies’ cyber insurance policies tend to cover them for expenses and third-party liability resulting from another vendor’s error or omission, small tech vendors are often required to buy tech PL liability insurance under their contract with larger vendors.

Stephens said it is important that practitioners help these vendors establish exactly what is and isn’t covered under their own policies, and whether procuring additional cover is necessary — particularly as in some cases, a small vendor may require tech PL cover with limits that far exceed the size of their own business.

“A vendor whose revenues are $5 million may, for example, provide niche services to a larger vendor and be handling the personal data of millions of retail customers,” Stephens said.

“It can be a real challenge for a broker to go to the market on behalf of a company whose revenues are $5 million and requests $20 million professional liability cover, but the exposure is real. This is the cost and reality of doing business if you are a small tech vendor.

“If I were a large company drafting the insurance requirements for my vendors, do I want PL coverage or do I want cyber coverage, or do I need both? And is it acceptable to request PL that includes cyber coverage?” Stephens asked.

“I think more education is needed as you don’t want to be requiring companies to buy cyber policies when they already have that coverage under a tech PL policy. A better understanding of the coverage and how people buy it will drive efficiencies for both large and small vendors.”

A broader industry challenge, Stephens said, is the overlap where third-party cyber liability coverage meets PL. With some doubting underwriters’ pricing sustainability, modelling and claims-paying ability, Stephens noted there has been a flight to quality cyber carriers with enough capital to pay large limit claims without being scared away from the risk or making knee-jerk price hikes.

“From a practitioner’s point of view, my focus is to help insureds choose a market that will be there in five or 10 years and will be relatively consistent rather than reacting unreasonably to inevitable claims in the market,” she said.

According to Stephens, the nature of a company’s business should probably determine whether they choose stand-alone cyber insurance. It makes little sense, she said, for tech/IT companies to buy stand-alone cyber coverage as cyber risk runs through all of their professional risks, while other sectors with long-established PL histories may be advised to buy separate cyber policies — not least for the valuable crisis response services that usually come as standard with this coverage.

Stephens also raised the question of whether simply not having a cyber exclusion in a PL policy (as opposed to affirmative language outlining specific cyber risk triggers) offers assurance of coverage.

“Some companies choose to rely on the breadth of silence in the PL contract; others aren’t comfortable with that uncertainty as they don’t want to have to litigate a claim, so they opt for a separate cyber policy,” she said.

Financial E&O: A Volatile Subprime Legacy

According to lawyer James Skarzynski, principal of Skarzynski Black and president of PLUS, there is also an overlap at the intersection between cyber policies and D&O coverage. Skarzynski focuses primarily on D&O and E&O in the financial sector — a segment experiencing some of the most volatile and expensive PL claims.

“There are still some fairly significant subprime credit losses being litigated and it is taking time for practitioners to sort through all the issues,” he said.

“One issue is the inter-relatedness of multiple claims within large towers of insurance. There could be multiple unrelated claims in several years of the tower, and when you have tower limits of quite easily $100 million, $200 million or more, this becomes a very substantial issue,” Skarzynski said.

These situations are being dealt with on a case-by-case basis, often with the help of mediators.

“The worst outcome is to fail to reach a resolution. It serves no one’s interest to have a dispute linger on, so that factor helps drive the parties to reach resolutions on how to allocate loss.”

But even if all parties agree and it is in their collective best interests to avoid litigation and reach a commercial resolution, negotiation challenges remain.

“Not surprisingly, the carriers at the top of the insurance towers think there should be full exhaustion of the claim from the ground up, while the insurers at the bottom of the tower may argue that if the claim would fully expose the limits of the entire tower, payment of the loss should be made pro rata so the tower shares equally in the loss.”

Even if the carriers at the top of the tower are willing to compromise and agree not to enforce full exhaustion from the ground up, they may insist that carriers in the lower portion pay a much higher proportion of their limits, Skarzynski said.

“These disputes can be very complex to resolve, and I and others in the D&O space have spent many hours in mediations, negotiating over how claims will be allocated as a prelude to mediating the underlying claims themselves, as you can’t resolve the underlying claim until you have agreed how funding will occur,” Skarzynski said.

Another post-crisis issue, he added, is the significant increase in regulatory investigations, with E&O insurers seeing the fees incurred reaching levels comparable to or above those in major 10B-5 securities litigations.

“Many years ago, no one would ever have guessed we would be routinely seeing seven- or eight-figure fees from regulator investigations and proceedings,” Skarzynski said, adding that variances in policy wordings mean that these governmental fees are not always covered under an E&O claim.

Meanwhile, increasing private equity in the corporate landscape has led to insurance around private equity “taking on a life of its own” — often involving large, volatile dollar sums.

“Private equity plaintiffs are often very serious about getting a large dollar recovery and the values can at times be proportionately higher than the recovery on losses to shareholders in a 10B-5 securities case,” Skarzynski said.

Health Care: An Evolving Risk Landscape

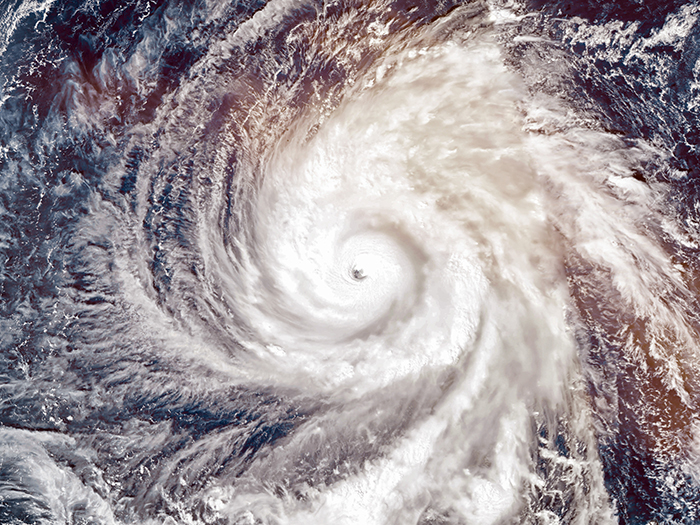

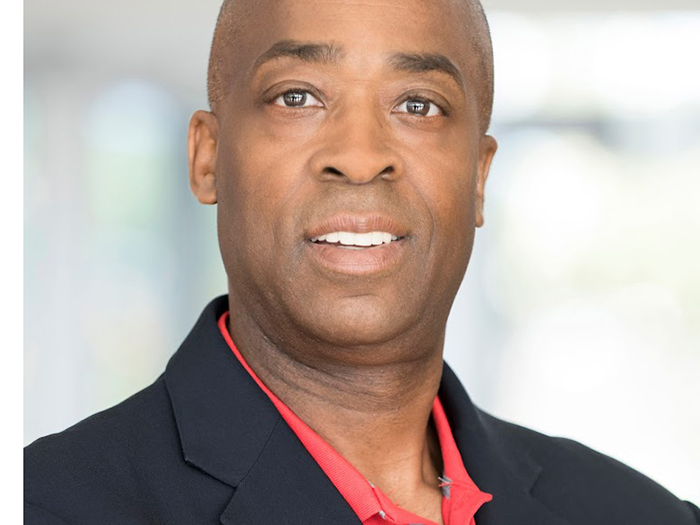

“Increasing settlement verdicts, hardening of the market, and a changing model of how health care is delivered through telehealth or retail clinic settings make a busy, swirling bucket for PL underwriters to get their heads around and put the right premium/price on the table,” said Bill McDonough, managing principal and broker for Integro’s national health care practice, who will be on a panel discussing whether the PL industry can keep up with “The Brave New World of Medicine.”

“The delivery of medicine is moving much quicker than how we analyze, underwrite and understand these risks.” — Bill McDonough, managing principal and broker for Integro’s national health care practice

“Whether it’s individual insureds or the lead layer for a large system, there’s a lot of moving parts. Underwriters have to be smarter and rethink how they have been underwriting for past seven or 10 years.”

The primary shift in the U.S. medical landscape is in the delivery of care, which is evolving from “brick and mortar” bedside care to “retail care” available in shopping centers other walk-up venues, and more recently “telehealth” platforms — through which the diagnosis and prescription of treatment is administered by practitioners via phone, computer or other smart technology.

“Now people are receiving care without ever being in front of a provider,” said McDonough.

“It’s a huge issue for PL underwriters. The concerns revolve around whether there are appropriate controls around the delivery of telemedicine care, whether underwriters can accurately measure the risk and understand how the risk differs to the risk they’ve been writing for the last 30 years.”

McDonough said the PL insurance market including brokers, underwriters and consultants needs to let go of its “antiquated mind-set” in order to redefine health care risk profiles, taking into account the new setting in which health practitioners — who in the case of retail and telehealth are primarily nurses rather than physicians — are operating and delivering services.

“The delivery of medicine is moving much quicker than how we analyze, underwrite and understand these risks,” he said.

“In the next three, five or 10 years, there will be a different way not only of delivering care but also in how we define that risk and insure it. As patients increasingly seek quicker, cheaper and more readily accessible health care, I believe a locus of control is being lost.

“Practitioners can operate very independently, and my sense is that offering cheaper and quicker care is going to lead to more risk.”

Yet, McDonough said, telemedicine nurses continue to be covered under the same PL policies that brick-and-mortar practitioners have been insured under for years — either from the PL market or through captives owned by health systems and providers.

“We have to think about the adequacy of coverage with the new risk profile we’re dealing with,” McDonough said.

He added, however, that practitioners are also concerned about the adequacy of coverage — primarily regarding the size of limits they can obtain.