Insured Natural Catastrophe Losses Hit $20 Billion in Q1

Global insured losses from natural catastrophes were an estimated $20 billion in the first quarter of 2024, down from $33 billion in insured losses in last year’s first quarter, according to Gallagher Re’s National Catastrophe and Climate Report.

Insured losses for Q1 2024 were more manageable for the insurance industry, the report stated, as insurance payouts were slightly above the most recent 10-year first-quarter average of $18 billion in insured losses.

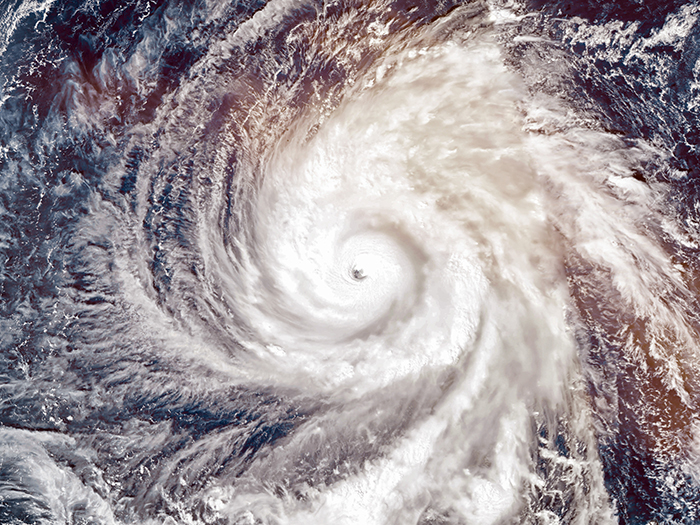

“While 2024 has resulted in a manageable start for natural catastrophe losses, the spring and summer months across the Northern Hemisphere often bring more volatile weather or climate-related activity. There is already heightened awareness for the looming Atlantic hurricane season,” noted Gallagher Re’s Chief Science Officer Steve Bowen.

The economic toll of natural catastrophes in Q1 2024 was $43 billion, significantly lower than $108 billion in the same period of 2023, according to the Gallagher Re report.

The economic cost of weather and climate-related disasters alone — excluding losses associated with earthquakes, volcanoes, or other non-atmospheric driven events — totaled at least $31 billion. That figure is lower than the 10-year quarterly average of $43 billion. Insured losses from climate and weather events alone was an estimated $17 billion in Q1, equal to the 10-year average.

Gallagher Re observed that there is little correlation between catastrophe losses in the first quarter and the rest of the calendar year. As spring and summer months begin across the Northern Hemisphere, a more volatile period for weather-related activity is often observed in Q2 and Q3.

The United States, the most active global market for filed insurance claims, becomes a focal point for severe convective storm activity, drought, and potential landfalling hurricane events during these months. Europe and Asia also enter peak months for possible large-scale weather/climate disasters.

The report also draws attention to an expected transition from El Niño to La Niña conditions in the central and eastern Pacific Ocean, leading to early projections for a potentially hyperactive Atlantic hurricane season.

“Whether this translates to more U.S. landfalls is the critical question. It bears close watching, particularly as primary carriers are already responding to a difficult U.S. market, but ample reinsurance market capital has the industry well positioned to navigate an active hurricane season,” the report stated.

The most expensive individual event of Q1 2024 was a magnitude-7.5 earthquake that struck Japan’s Noto Peninsula on January 1, accounting for $12 billion in direct economic losses, or 28% of the entire global Q1 total.

The U.S. accounted for $21 billion, or 49%, of economic disaster costs in Q1, equal to the 10-year quarterly average. Asia accounted for at least $17 billion, or 40%, of economic disaster costs in Q1, notably higher than the last decade’s quarterly average of $8 billion.

Access the full Gallagher Re report here. &