2017 RIMS

Reviewing Medical Marijuana Claims

Liberty Mutual established a formalized claims-review process to determine whether circumstances warrant paying for medical marijuana requested by a workers’ compensation claimant.

It appears that the Boston-based carrier is the first to take this approach.

Craig J. Ross, doctor of osteopathic medicine and regional medical director, Liberty Mutual

Developing the workflow process for evaluating medical marijuana expense reimbursement requests became necessary for several reasons, including the legalization of marijuana for medical use in 29 states, said Craig J. Ross, a doctor of osteopathic medicine and a Liberty Mutual regional medical director.

The internal claims-review guidelines direct adjusters to involve the insurer’s legal and medical experts when injured workers request reimbursement for medical marijuana.

The additional expert review is necessary because the doctors prescribing cannabis typically are not the same physicians treating injured workers for the medical cause of their workers’ comp claim, Ross said during an interview at the Risk and Insurance Management Society’s annual conference held April 23-26 in Philadelphia.

“You need a workflow to determine whether marijuana might be medically appropriate for that patient, how they came to it, whether the indication is really for the work-comp injury or some other condition, and whether there are jurisdictional drivers that will make us more likely to say yes,” Ross said.

So far, while Liberty Mutual has received very few claims requesting payment for cannabis, a spokesman could not say how many requests for medical marijuana reimbursements it paid or rejected.

The claims it has seen, though, typically involve cases where doctors and their patients are searching for alternatives to ongoing opioid use.

Out of workplace safety concerns, insurers and employers overwhelmingly have taken measures to discourage employee marijuana use, said Kevin Glennon, a registered nurse and VP of clinical programs at One Call Care Management.

Glennon said has not heard of other insurers establishing claims-handling processes specifically for addressing whether medical marijuana reimbursement requests should be paid.

Glennon is scheduled to speak on medical marijuana in workers’ comp during the RIMS conference. He provides workers’ comp services for several injured workers who use medical marijuana, but they have not requested that their insurers pay for the drug, which remains illegal under federal law.

“The [insurance] carriers that I am working with, they know that these individuals are utilizing medical marijuana, but the injured worker has never broached the subject of reimbursing for it,” Glennon said.

“The [insurance] carriers that I am working with, they know that these individuals are utilizing medical marijuana, but the injured worker has never broached the subject of reimbursing for it,” Glennon said.

Some states that have legalized medical marijuana require insurers to reimburse claimants for their spend on the drug while other jurisdictions prohibit doing so, said Glennon added.

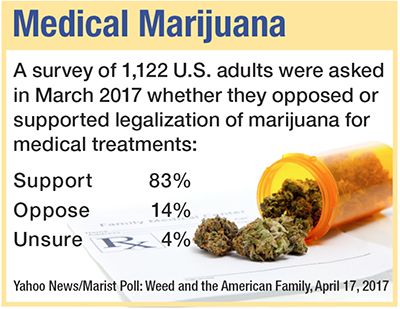

Meanwhile, public support for legalizing marijuana, especially for medical use, continues to grow. More than 60 percent of Americans believe the drug should be legalized, according to a CBS News poll released earlier this month. That is up 5 points from a year earlier.

More than 70 percent of Americans oppose any federal government attempt to stop cannabis sales in states where it has been legalized for recreational use, the poll found. A Marist poll, also released earlier this month, found that 80 percent of Americans support marijuana use for medical purposes.

While Liberty Mutual has received few requests to pay for marijuana, the insurer is attempting to stay ahead of the trend, the spokesman said.

Additional stories from RIMS 2017:

If barriers to implementation are brought down, blockchain offers potential for financial institutions.

Embrace the Internet of Things

Risk managers can use IoT for data analytics and other risk mitigation needs, but connected devices also offer a multitude of exposures.

Feeling Unprepared to Deal With Risks

Damage to brand and reputation ranked as the top risk concern of risk managers throughout the world.

Cyber Threat Will Get More Difficult

Companies should focus on response, resiliency and recovery when it comes to cyber risks.

RIMS Conference Held in Birthplace of Insurance in US

Carriers continue their vital role of helping insureds mitigate risks and promote safety.

New cyber model platforms will help insurers better manage aggregation risk within their books of business.