For Zurich’s Sabrina Hart: The Brand’s the Thing

As a central zone executive for Zurich, Sabrina Hart oversees local marketing, distribution and regional management staff. It’s no surprise then that when she thinks about the challenges and opportunities in commercial insurance, she focuses on brand.

“We do not hear about the great things that the insurance industry does, helping businesses and communities recover and remain in business after an event and helping individuals in time of need,” she said.

“I think we would benefit greatly with further humanizing the brand.”

And there’s plenty to humanize, in her opinion: “I get most excited about the people,” she said.

“In the insurance industry, we work with awesome people, including colleagues, customers, brokers and those in the communities we serve.”

She can also look back and express appreciation for all the opportunities this business provided her with.

“I’ve served in a variety of roles and have had the opportunity to live and work internationally and in various parts of the United States,” she said.

“But my proudest career accomplishments involve people. The achievements, development and career advancement of individuals who I have hired, worked with and/or mentored/sponsored are my proudest moments.

“All the business accomplishments are the result of great people and a great team,” she said. “Also, I am very proud to have been a co-founder of WIN (The Womens’ Innovation Network) for Zurich North America in 2008.”

Hart added, “Being a part of the process in driving diversity and inclusion in our industry has been rewarding, but there is still much to do.”

You’ll hear it time and again, and you’re going to keep on hearing it: The insurance talent gap is real and growing.

As stated above, humanizing the brand is one way for commercial insurance to bridge that gap. Another way is doing a better job of telling the story of what insurance actually does; functioning, as it does function, Hart says, as the bedrock of the economy.

“Without insurance, we can’t drive cars, own homes, start businesses,” she said. “The insurance industry is all about helping companies, people and communities in their time of need.

“All you need to do is read about the major natural disasters we’ve experience recently in the United States to see what role insurance plays in helping communities bounce back,” she said.

That recovery piece is part of the reason Hart knew she had found the right business early in her career.

A math major, Hart found her first job out of college as a risk management assistant with a professional liability insurance company. Within six months, she was asked to consider an actuarial or underwriting role.

She chose underwriting and discovered, to her delight, that she enjoyed spending time with customers just as much as she liked working with numbers.

“I remember thinking, ‘This is kind of cool.’ I can utilize my technical skills (I love analysis and underwriting a great deal) as well as my interpersonal skills (I love connecting with customers and brokers) so it provided the variety and balance that suited me,” she said.

Hart also benefited from mentoring and having sponsors.

Read More: 10 Reasons Why Insurance and Risk Management Is a Great Career

“The belief and confidence that others had in me and the investment they made in me is what helps drive me,” she said. “I also have an unwavering belief in ‘pass it on’. To demonstrate my appreciation to those mentors and sponsors, I am dedicated to serving as a mentor and sponsor to others.”

Her first and most important sponsor was her mother.

“She instilled in me to always give your best — whatever you choose to do, do your very best. She encouraged independence and she expected excellence and commitment to a greater good,” Hart said.

Hart concedes that insurance faces many challenges.

“But honestly, I see the challenges as opportunities,” she said gamely.

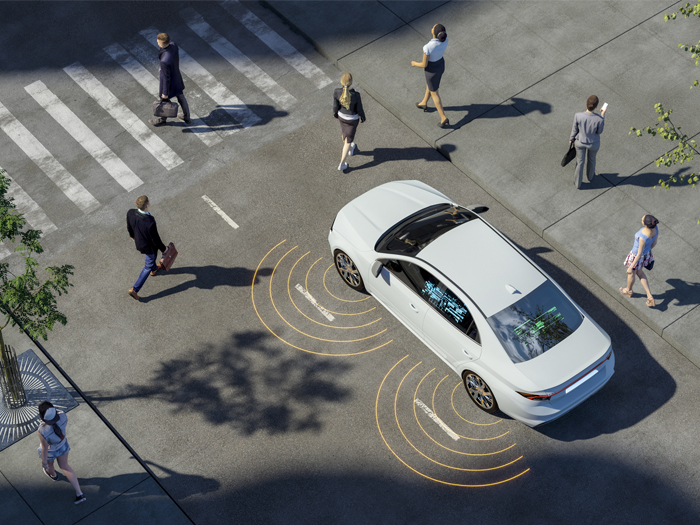

The customer and broker experience are being transformed by the use of technology.

“Driving timely innovation that makes it easier for customers and brokers to do business with us is among the opportunities before us,” Hart said. But to take advantage of those opportunities, insurance must attract the talent it needs to drive technological change. And that in turn depends on how well insurance can tell its story.

“The insurance industry needs to build a better brand, first by dispelling negative myths about insurance, then by attracting more and diverse talent,” she added.

Even an advocate such as Hart knows that’s easier said than done. &