What Keeps Brokers Up at Night? Climate Change and Driverless Cars, For Starters

Each year, new risks enter the market, and the insurance industry steps up to figure out how to insure them.

This ever-changing landscape is what many in the industry love about their career, but having a job that’s steeped in risk means that falling behind can be dangerous.

As new technologies are developed and future global risks grow, insurance professionals need to make sure they stay up-to-date. This is especially true for brokers as they compare policies for their clients.

A 2019 survey from Argo entitled “The Future of Insurance” highlighted several risk areas that are top-of-mind for brokers as we head into 2020.

The Top Risk Areas to Watch

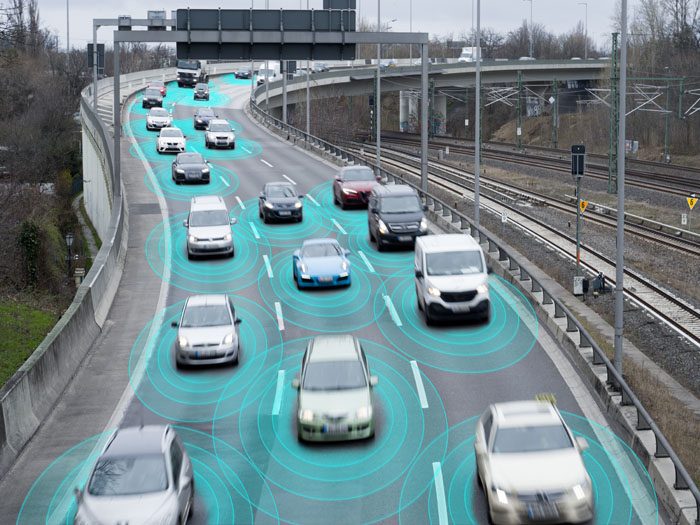

Autonomous Vehicles: As autonomous and semi-autonomous vehicles continue to rapidly develop, brokers are looking at the risks associated with the new technology.

Hacking and software risks are the primary concerns brokers have about self-driving cars, with 37% naming software malfunction the the primary threat the vehicles pose. Twenty-eight percent named cyber threats the predominant risk, and 27% listed the inability to account for other drivers.

While brokers have some concerns about insuring autonomous vehicles, self-driving cars are widely considered to be safer than their human operated counterparts.

Seventy-seven percent of brokers expect self-driving cars to reduce the frequency and severity of accidents, while 59% expect them to result in lower insurance premiums.

Climate Change: Climate change is definitely a major risk, but most brokers are more concerned about it in the long-term than they are in the short-term.

In fact, while 73% of U.S. brokers consider climate change a priority in the long term, fewer brokers think of it as a high risk than in 2018. Fifty-three percent of brokers called climate change a high risk in 2018, while only 51% of respondents named it as a high risk in 2019.

Global Risk: Global risk, including election hacking, political climates and trade wars, is quickly becoming a risk brokers are concerned about.

Fifty-two percent of U.S. brokers considered Russian cyber hacking as major global risk, and 48% considered the U.S. political climate to be a major risk.

The trade war ranked as the third highest global risk survey respondents noted with 37% of U.S. brokers, naming it as a major global risk.

Cyber Security: The survey reports that viruses, spyware, malware and malicious code are the most frequent form of cyber attack, according to 61% of brokers.

Cyber attacks of all kinds are still a top-of-mind risk, but covered incidents are making attacks more affordable. Uncovered cyber security incidents cost an average of $63,500 while covered attacks cost an average of $33,460, according to data from the survey.

Internet of Things: When it comes to risk, IoT is a mixed bag. Fifty-seven percent of brokers believe IoT solutions can reduce the cost of a company’s risk, but 91% see IoT technologies as this year’s dominant tech threat.

Whether as a threat or a strategy for reducing risk, nearly 73% of U.S. brokers expect IoT technologies to disrupt the insurance industry over the next five years.

Artificial Intelligence: Brokers are mostly positive about AI, with 73% agreeing or strongly agreeing that AI is a complement to insurance brokerage services. Additionally, 78% of brokers say that advances in AI will make work more efficient for their companies.

Despite positive attitudes towards AI, the new technology comes with its own risks. Eight percent of small and medium enterprises surveyed either agreed or strongly agreed that automation and AI will expose them to new liabilities.

Cryptocurrency and Blockchain: With Facebook attempting to jump into the cryptocurrency game, this new technology has gotten a lot of media attention recently.

But news articles and social media buzz seem to be the only notice these technologies are getting. Fewer brokers claim that they will be using blockchain in the next five years compared to 2018 (25%), with the 2019 survey results showing that 19% believing they will adopt the technologies.

Only one percent of brokers accept cryptocurrency payments, and 45% of small and medium enterprises say adopting the technology is not a priority.

What’s Changed?

The results of the 2019 survey are largely in line with the 2018 survey responses, but there are several notable changes.

The first concerns global risk. In 2018, brokers and small to medium enterprises cited cyber threats as the most concerning global risk. Now with the U.S.-China trade war and Brexit dragging on, survey respondents placed a high threat on geopolitical risks.

Brokers have also shifted their opinions over the liability of autonomous vehicles over the last year. In 2018, 88% of brokers thought that the risk of self-driving cars would shift to municipalities and manufacturers compared to 79% in 2019.

While many of these risks will certainly remain top priorities, advances in technology, elections and the likely proliferation of self-driving vehicles will certainly change 2020’s risk landscape as we look forward. Even if these issues remain a high priority, the risks associated with them, may be likely to change. &