Claims Trends

Treating the Whole Person

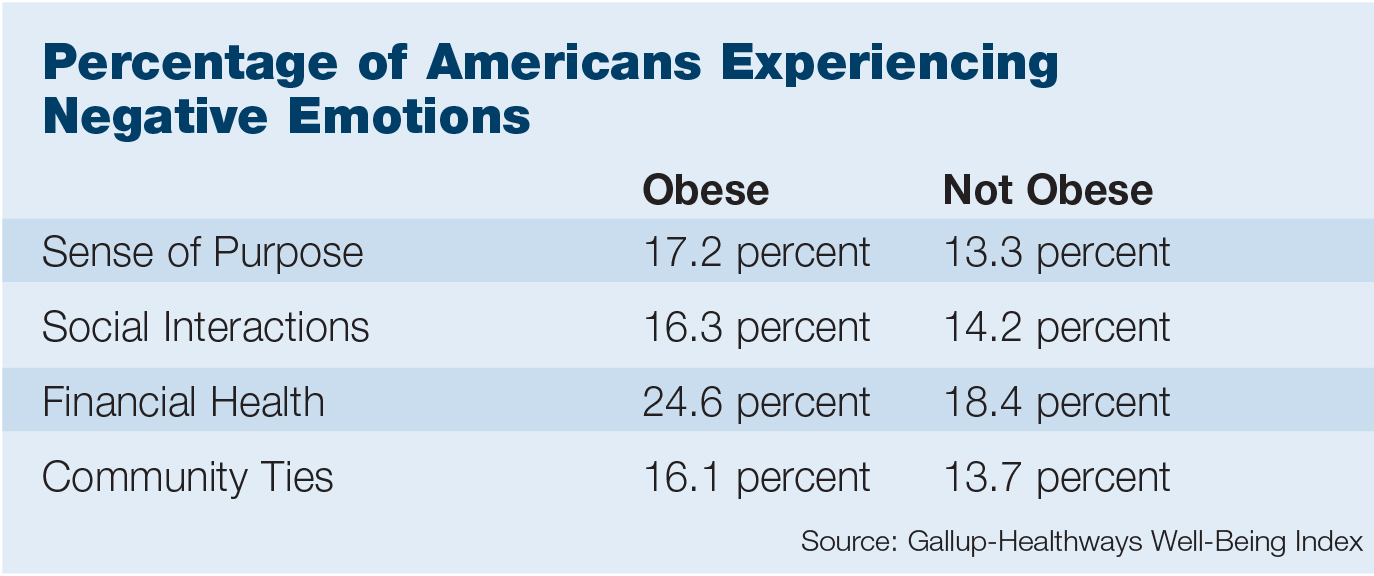

Recent research from Gallup and Healthways Inc. shows what claims payers already know: The percentage of obese Americans continues to increase. In their May 2015 report, Gallup and Healthways stated that the nation’s obesity rate rose again in 2014, reaching 27.7 percent, up from 27.1 percent in 2013.

Even more unsettling — and perhaps surprising to some — is that research indicates changes in diet and exercise are not enough to reverse the trend.

What’s needed, according to the studies, is a more holistic engagement that boosts a person’s sense of purpose and strengthens their community and social relationships; even their financial health.

Professionals that help injured workers address biopsychosocial issues say they agree with that assessment. They also say it is increasingly a factor in their work with employers and other workers’ compensation and disability claims payers.

Biopsychosocial issues refer to psychosocial factors impacting a person’s medical problems, said Michael Coupland, CEO and network medical director at Integrated Medical Case Solutions Group, which provides biopsychosocial assessments and interventions.

Most biopsychosocial approaches take into account that factors such as emotions, behaviors, social environments and culture all impact human medical conditions and performance.

Services addressing biopsychosocial problems are being applied more often when medical treatment alone fails to mend injured workers. They can help with depression, pain medication misuse and obesity, which can delay or even thwart successful return to work.

About 75 percent of the workers’ comp and disability claimants referred to his group are obese or morbidly obese, IMCS’s Coupland said. They are referred by claims payers, treating physicians, self-insured employers and others.

“They are the people that tend to have psychosocial factors that are delaying their recovery,” Coupland said.

IMCS Group specialists offer their patients cognitive-behavioral techniques for taking control of their health and wellness, Coupland said. The techniques include meditation, mindfulness and biofeedback.

Those practices can help, for example, with decreasing muscle discomfort so recovering workers are able to go for walks and reap the benefits of exercise.

Darrell Bruga, founder and CEO, LifeTEAM Health, agrees with the Gallup and Healthways findings that factors such as social interactions, financial well-being and a sense of purpose must be addressed.

Bruga said many of the injured and disabled workers his company sees are obese, although his organization does not directly treat obesity. LifeTEAM professionals provide services for reducing psychosocial and return-to-work obstacles.

Interventions that help people develop a sense of purpose, achieve financial well-being and develop community interactions “are exactly the sort of things we are focused on in helping people re-engage,” Bruga said.

“It makes sense that if you are having challenges from a psychosocial standpoint in life as a whole, that is certainly going to impact your well-being and potentially your body composition,” he said.

“No question.”

But it’s important to recognize that returning to work is part of the solution — it can help meet the needs the researchers outline because work is social and it also improves peoples’ financial position, Bruga added.

“It makes sense that if you are having challenges from a psychosocial standpoint in life as a whole, that is certainly going to impact your well-being and potentially your body composition.” — Darrell Bruga, founder and CEO, LifeTEAM Health

Bruga will speak on mitigating psychosocial risk factors with biopsychosocial measures during the National Workers’ Compensation and Disability Conference® & Expo to be held at Mandalay Bay in Las Vegas November 11-13.

Dr. John T. Harbaugh, occupational medicine physician director at Southern California Permanente, will join Bruga and share results from helping his organization’s injured employees overcome psychosocial risks with a biopsychosocial strategy.

Recovery Obstacles

What’s important to keep in mind in managing the biopsychosocial aspect of work injury and return-to-work is that any injury creates stress for both the employer and the employee. The mere fact that a once-productive employee is leaving work creates a host of issues.

“There is a stigma to going out of work. Nobody wants to go out on leave,” said Rebecca Moya, a behavioral health manager with Sun Life Financial.

“So if we can battle that, have employers manage that piece in a more empathetic, supportive and understanding way, that’s one less hurdle that insurers or benefit analysts or vocational rehabilitation consultants have to jump over to get there,” Moya said.

There is also psychological trauma that lives within a worker who associates pain and injury with their workplace.

“It’s hard to revisit and go back to that place,” Moya said.

“We’ve worked with employers to ask, ‘Are there other sites? Is it possible to have this person work at a different site?’ Because they’re ready to come back — it’s just that the emotional and psychological aspect of returning to the site of their injury is very challenging,” she said.

There are also the injuries to self-esteem and the sense of self-worth that a physical injury can bring about.

Even without obesity or some other comorbidity dogging them, a worker who faithfully performed a task for decades can suffer a loss of confidence or suffer depression when a work injury means they will never be as strong or able again.

“That’s hard for people. They don’t always want to go back and do something different. Even with accommodations, it’s hard for people to accept that’s going to be the way things are going to be going forward,” Moya said.

Overcoming those fears and that damage to self-esteem means focusing on the positive, Moya said.

“If an analyst starts off a relationship with an injured worker with a positive, ‘We’re going to work on your abilities, not your disabilities, and we are going to get you back to work,’ then people are really receptive to that.

“It’s all about the foundation you lay at the start of a claim,” Moya said.

IMCS Group’s Coupland agrees that helping people return to work and reclaim their sense of purpose is a key piece of the well-being issue that the Gallup and Healthways researchers raise.

“We get so much of our purpose from work,” Coupland said.

Data Drives Down Skepticism

Growing acceptance of paying for biopsychosocial approaches to wellness is being helped along by a significant shift that occurred in 2009, Coupland added.

Health providers in psychology gained the ability to provide health and behavior treatments under Current Procedural Terminology codes for physical medicine rather than having to provide them as treatments under psychiatric codes, he said.

Now, workers’ comp payers are much more accepting of the treatments, Coupland said.

Debra Levy, senior VP, workers’ comp product management and national workers’ comp practice leader, York Risk Services Group

Even so, some workers’ comp claims payers are skeptical about a concept calling for treating the “whole person” and are still reluctant to pay for providing injured workers with biopsychosocial treatment approaches.

But increasingly, sophisticated claims payers are funding such programs and their numbers will continue to rise, said Debra Levy, senior VP of workers’ comp product management and national workers’ comp practice leader for York Risk Services Group.

Payers funding those programs are doing so because their data shows a positive return on investment, Levy said.

“The earlier you can recognize those are factors and offer solutions or guided care … you see a positive impact as opposed to throwing away money,” she said.