The Real Estate Sector Got Slugged by COVID. How Managing Vacant Building Risk Is Now a High Priority

From shortages of personal protective equipment to checking employees’ temperatures, to sending staff to work at home for an unspecified time frame, the COVID-19 pandemic has presented challenges for businesses that once seemed unimaginable.

One challenge expected to continue in 2021 and beyond is a rising tide of businesses that will vacate buildings because they are struggling to survive or are facing bankruptcy due to the pandemic.

What the Studies Have to Say

Statistics show that the pandemic is already impacting vacancies.

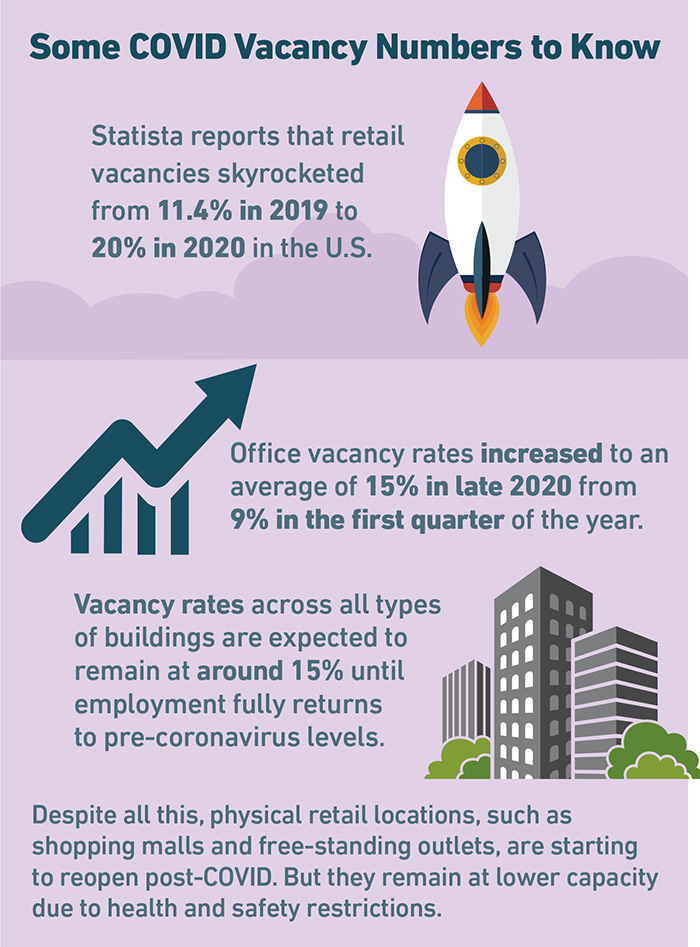

In the retail arena, for instance, vacancies skyrocketed in the U.S., according to Statista, which reports that retail vacancy rates grew to 20% in the second quarter of 2020 compared to about 11.4% in the second quarter of 2019.

Vacancy rates in the office sector increased to an average of 15% in the second quarter of 2020, a jump from 9% in the first quarter of the year.

“I think the tale of this has yet to be told,” said Charles Greer, vice president of large property underwriting for QBE North America. “I think as the economic impact of the pandemic continues, we’ll see more impact from vacancies.”

A Look at Risk and Insurance

The perils of vacating a building are numerous and range from threats that might be easily predicted, such as a burst water pipe, fire or vandalism, to others that might be a bit harder to foresee.

Take as an example a vacated building in London’s formerly bustling financial district. In January 2021, it was discovered that an illegal cannabis factory with 826 cannabis plants, wired lighting and ventilation tubes had been established in the basement of a vacant commercial structure not far from the Bank of England.

While an illegal cannabis operation taking root in a vacant building may seem like a far-fetched threat, an empty or largely vacant building presents myriad risks and liabilities.

Unfortunately, business owners who are strapped for cash may put maintaining and monitoring a vacant structure at the bottom of their to-do list.

“Businesses may cut costs when an asset isn’t performing. If there isn’t a lot of excess cash, they may reduce or delay capital expenditures, which could lead to a serious situation,” said Alexandra Glickman, global practice leader for real estate and hospitality at Gallagher.

Key to understanding the risks associated with a vacant building is to know what defines a vacant building, and that varies by insurance carrier.

It may hinge on how long a building has been empty, and the time frame–be it 60 days, 90 days or some other number—also will differ by carrier. It also may depend on what percentage of the building remains occupied or on what equipment it contains.

“Our definition is based on a facility being vacant when it doesn’t contain enough property or equipment to conduct business,” said Mark McGhiey, associate vice president of loss control services for Nationwide Insurance.

“Standard coverages need to be purchased whether a building is occupied or unoccupied,” added Marcel Ricciardelli, senior vice president at Allied World North America Environmental and Design Professional Divisions.

If the property is idled, vacant or repositioned for a different use during renewal, the carrier should be notified.

Underwriters base the premium in risk associated with uses presented at the time of underwriting. Changes in the use could affect the coverage available under a policy, Ricciardelli further explained.

Look to Insurance Experts for Advice

Insurance companies frequently provide advice on how to best maintain a vacant building, whether it is installing sensors to warn of a water leak or having someone check on the building regularly.

“An insurance company can provide guidance on best practices to avert a loss during the interim period with no tenants in the building,” Greer said.

Business owners also should expect the insurer to want to know what a company is doing to protect the asset.

“They need to understand what plans are in place to protect it and what the risks are,” McGhiey said.

Insurance carriers rely on vacancy clauses in their policies to avoid coverage for unintended risks due to damage or other liability when a property is vacant or becomes vacant after the policy is issued.

“Ninety-five percent of insurance companies have vacancy restrictions. But there is a lot [of] inconsistency about what a vacancy clause means, and a lot of people don’t understand that,” said Richard Lonneman, Executive Vice President of Sales at AssuredPartners, a partnership of independent brokers.

A broker can try to lessen the impact of a vacancy clause.

“We negotiate vacancy clauses so they are very liberal or removed with certain caveats,” Lonneman said.

Besides seeking a lenient vacancy clause or none at all, Glickman and others advise customers to be open with their broker about a vacant asset.

“They need to be honest and frank about how long the vacancy period is expected to last and the percentage of vacancy in the building,” she said.

“They need to commit to an active property management program and understand that there may be a higher deductible because of a vacancy.”

Maintenance Is Imperative

Without maintenance and monitoring, it is likely that problems will only mount, said Jeff Corder, vice president of loss control for AmTrust Financial Services, Inc. He expects to see more problems associated with vacant buildings in coming months.

“We’re only now really getting into winter, and there could be pipes bursting or sprinkler systems malfunctioning,” he said.

Keeping all of a building’s systems functioning, including the electrical, water, heat, sprinkler and security systems, is key.

“I tend to be pretty cautious,” Corder said.

“I don’t want a building to go below 55 degrees so the pipes don’t burst.”

Neglecting maintenance puts business owners at risk of acquiring even higher costs.

“If you’re not maintaining a vacant asset you could be stuck with a high deductible or, in the case of a wind or hail claim, a percentage deductible of the damaged asset’s replacement cost that could’ve been avoided if you’d made the capital expenditure,” Glickman said.

In addition to the potential of a higher deductible, an extended vacancy can lead to an insurer dropping a customer, who will then need to seek coverage at possibly a higher cost from a specialty insurer.

Lonneman cites an example of a large corporate campus that received a notice from its insurer after a year of vacancy that it would need to move its policy to a specialty insurer even though the campus had been maintained.

When It’s Time to Reopen

Certainly, being able to reopen a vacant building will be happy news for a business owner. But Ricciardelli warns that it also may also bring a need for additional pandemic-related investments.

Items that might be needed include enhanced workflow and office design, improved ventilation, introduction of high-efficiency particulate air (HEPA) fan/filtration systems and ultraviolet germicidal irradiation (UVGI) as a supplemental technique to inactivate potential airborne virus.

While a vacant building may seem like it only portends problems, there are things a business owner can do to maintain the building and avoid unexpected costs.

“There are a lot of things that can be dealt with on a proactive basis, but if they [are] ignored, there can be a lot of issues,” Lonneman said.

Businesses that seek to make a claim should discuss it with their brokers.

“Covid-related claims are working their way through the courts and thus far, the majority of claims have been denied due to the lack of ‘direct physical damage’ to the property,” Glickman said. “Owners should discuss their particular issues with their brokers.” &