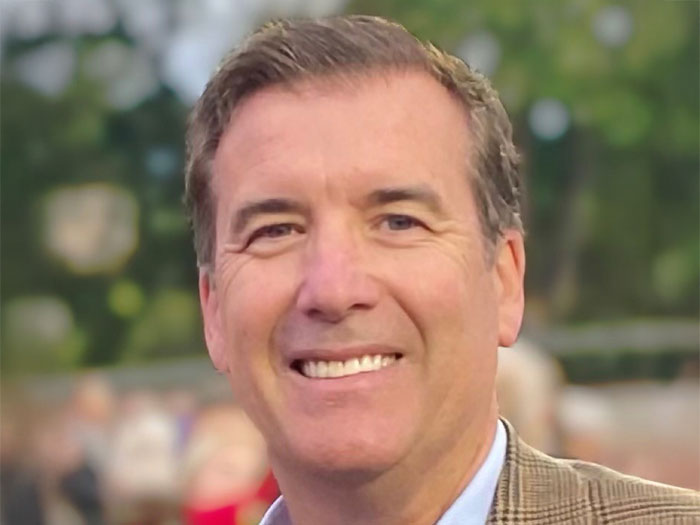

The 2021 Executives to Watch: Chubb Bermuda’s Judy Gonsalves

When companies need hundreds of millions in property and casualty coverage, they turn to Judy Gonsalves. High-limit risks mean high stakes, increased complexity and innovative solutions.

Gonsalves, division president of Chubb Bermuda, encourages clients to meet her face-to-face on the island for a thorough brainstorming session. Those clients see Gonsalves working out complexities on her whiteboard, expertly laying out the what-if scenarios, analyzing risk mitigation efforts and determining potential underwriting options.

“This is a people industry. It’s based on relationships and partnerships. My philosophy is to focus on the customer — the person behind each transaction. What do they need from us and how can we be flexible, creative and innovative in bringing them a solution they need?” said Gonsalves.

Clad in a pink-patterned shirt that fits perfectly in her native Bermuda, Gonsalves explained that the island is hardly just a tourist attraction.

“A lot of people think it’s just this rock out in the middle of the Atlantic,” said Gonsalves. “But Bermuda is known as the world’s risk capital. It doesn’t hurt that it’s stunningly beautiful here with blue oceans, pink sand and palm trees.”

Her career in insurance began 30 years ago when she returned home to Bermuda from Emory University. Although she had aspirations of becoming a psychologist or novelist, she got hired at an insurance firm and never looked back.

In the early days, she was frequently the only woman in the room.

“The client base was generally white, gray-haired males. As a young female starting in the industry, trying to figure out how to bring my authentic self to those conversations was a unique challenge,” she said.

“I had a lot of incredible people throughout my career who gave me opportunities for stretch assignments and encouraged me to raise my hand.”

Today, Gonsalves is helping clients navigate a hard property and casualty insurance market driven by natural catastrophes, large liability verdicts and low interest rates that are putting pressure on bottom line results. Those trends are only heightened in Gonsalves’ world, because she deals with high-limit coverages — and the big risks that come from underwriting them.

“Some people think of large losses being $100 million,” she said. “We see losses beginning with Bs.”

Gonsalves is pleased that companies can still obtain coverage even if it’s a bit more expensive. In the next year or so, she says to expect “reinsurance tightening up, which will impact capacity availability by insurance carriers and put pressure on rates as carriers try to move towards rate adequacy.”

She’s particularly proud of helping a large company in California obtain coverage for wildfires.

“That was not a risk we wanted to run away from. It’s something we wanted to understand by getting in the weeds, hearing how the company manages the risk internally and learning how we could come to the table with a solution,” she said. “We looked at coinsurance ideas and reinsurance capacity to put out a large line of coverage. In the end, we got the client the protection they needed.” &

For the full list of Insurance Executives to Watch in 2021, view here.

For the full list of Insurance Executives to Watch in 2021, view here.