A D&O Hard Market? A 2020 Analysis from Gallagher’s Phil Norton: Part Two

In my previous column, I discussed the claim trends that contributed to the hard market, including increasing claims frequency that has not actually peaked yet; event-based D&O claims that often suggest corporate executives are responsible for all business reversals, even bad luck; the emerging plaintiff attorneys promoting such claims; and the dramatically increasing cost of defense.

But what specifics can we give about the current hard market for D&O insurance?

What makes a market truly hard, versus firm, is the struggle for capacity?

When underwriters are firm about their 35% increase and refuse to budge on pricing, we at least know we have a renewal. When incumbent carriers cut capacity, however, and new carriers are reluctant to step up, that makes for an extremely difficult situation — a hard market.

Indeed, the triage process at most D&O underwriting shops goes something like this:

1) What capacity, if any, should I deploy? Perhaps made relevant by thoughts such as:

- I don’t wish to make any big mistakes right now.

- I have enough premium on the books already.

- I don’t have any premium in the bank for this particular client.

2) What retention is appropriate — or how much more retention in some cases?

- I don’t wish to insure any systemic losses, including M&A-driven defense costs.

- I don’t want to trade dollars on cases without merit, which cost more these days.

- Your own D&O claims history is irrelevant, but peer claims and peer retentions matter.

3) What premium should I charge?

- What rate do I need to repair the loss ratios on my book and return to profitability?

- What is going on in the client’s market segment?

- Are there any unusual financial stresses, including as a result of the COVID pandemic?

4) What terms and conditions may need to change at renewal?

The good news about point 4 is that only minor changes are being made at most renewals and coverage quality for D&O insurance remains very high.

Most clients have seen retention increases pushed within the last two years, sometimes by pricing the higher retention more favorably. In some market segments, there is no choice given if “minimum retentions” need to be enforced and the client has held on to a retention significantly below its peer averages.

The real excitement for most of us is in the price increases. While underwriters have always differentiated risks (and thus premium costs) by industries or market segments, the amount of differentiation has been magnified by the hard market.

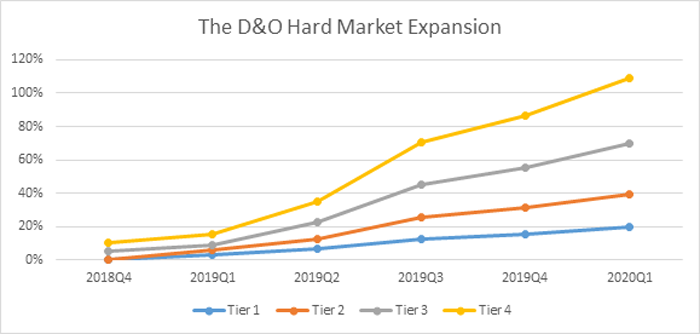

Consider the graph of price increases by underwriting “Tier,” whereby most risks ranged from good to mildly concerning and saw premium changes on renewal of about 0% to 10% just 18 months ago.

Now, the 4 Tiers that we have identified span from 10% to 100+%, including big numbers for clients with no D&O claims in their history. Here is our very rough explanation of the 4 Tiers:

- Tier 1 — mostly financial institutions; insurance companies and banks (perhaps excluding some of the largest ones) have done well with typical increases in the 10% to 25% range

- Tier 2 — these are the most attractive industries and for the most part the financially strong and claims-free members of such industry groups. Their typical increases are 25% to 50%

- Tier 3 — the greatest mix is here, as there may be some high-performing companies from less favorable industries as well as weaker performers from more attractive industries. Most established, higher quality technology and life sciences companies are likely in this tier. The range for price increases is typically 50% to 85%

- Tier 4 — the challenged industries, including those undergoing financial stress due to the pandemic, are seeing 85% to 130% increases if everything goes well at renewal; however, average increases are 300%+. The industries generally viewed as Tier 4 are airlines, automotive, energy, many higher education, hospitality, some retail and retail REITs, and young life sciences companies (often just past IPO)

Similar to the last hard market, our advice focuses on positioning your risk to the best Tier allowed, focusing on well-built carrier relationships and ensuring in advance that you have sufficient capacity to build your program — or if not, to manage client expectations and discuss alternatives.

Parts of this D&O marketplace are clearly lacking rationality, so clients and brokers must anticipate trouble and act accordingly. &