A D&O Hard Market? A 2020 Analysis from Gallagher’s Phil Norton: Part One

As we entered 2020, the D&O market had been hardening since the spring of 2019, with some acceleration of price increases, many cuts in capacity on the more difficult risks, and underwriters pushing for higher retentions across several classes of businesses.

Attitudes from the D&O carriers certainly mirrored hard market events of late 2001.

D&O carriers were trying to adjust to the “new normal” of more than 400 federal Securities Class Actions (SCAs) per year — as such 2019 claims frequency match those larger numbers from 2017 and 2018.

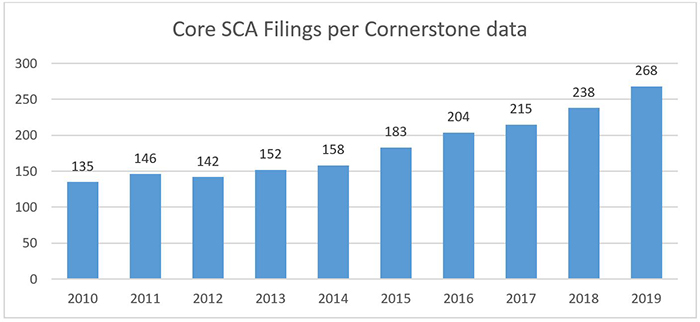

But as Cornerstone presented its 2019 Year in Review, the steady rise in “Core SCAs” was likely more disturbing than the overall numbers — numbers that have included a lot of the less costly M&A claims since the Trulia decision in 2016 caused plaintiffs to shift litigation from state courts to federal courts.

But in the Core SCA Filings graph below, we see a doubling of claim counts over the last 10 years.

The federal Merger-Objection claims are then on top of these claims. Such Merger-Objection claims are typically much less severe, though their sheer volume has also exacerbated carrier losses, as even small settlements plus plaintiff attorney fees and defense costs add up to total claim costs often in excess of the insurance deductibles.

What is driving such dramatic changes in the historically stable claims patterns?

Two key factors are at work.

The first factor is simply the emergence of a new breed of plaintiff attorney firms — literally referred to in research articles as “emerging plaintiff firms.” Their approach contrasts sharply with established firms that have been suing our clients regularly since the early 1990s.

The established firms were more likely to carefully aim for a consistent number of annual cases and also brought them against larger companies for larger presumed case values.

These emerging law firms have grown their market share of the “top D&O cases (by value),” from approximately 5% about 15 years ago to a majority position today.

The second key factor driving up this Core SCA frequency is the type of cases pushed by these emerging firms.

They regularly bring “event-based” cases, often claiming that the directors and officers failed to sufficiently supervise, or more specifically did not accurately or adequately disclose their deficiencies prior to a company setback due to an event related to such things as:

- Cyber/privacy breaches

- #MeToo

- Environmental

- Opioids

- Accidents/safety/fire

- Business practices

- Products

- M&A

- Construction/operational

- COVID-19

Other newer D&O claim trends identified include:

- Suing medium sized companies more often, seemingly triggered simply by a negative press release and an accompanying stock price drop.

- Asking for outsized settlements in proportion to the initial damages sought.

- Erratic timing as to settlement discussions; often quite late in the process after failed mediations, but sometimes pushing settlement at the onset.

- On the defense side, record defense expenses have surprised most industry observers.

As a result of these adverse developments, the D&O market firmed in early 2019 and was very challenging by the end of 2019.

As noted previously, this market shift paralleled the last hard market for D&O in 2001. However, the average increases in D&O premiums in the range of 40% back in January and February of 2020 are no longer relevant to most commercial companies.

Instead, the D&O market now resembles the hard market that incepted in 1985 and created a crisis in terms of the shortage of D&O capacity for many large corporations. We shall elaborate further in Part 2 of this series. &