Telehealth Isn’t Just a Pandemic Stop Gap. It Improves Self Care and Lowers Claims Costs

At the height of the COVID-19 pandemic, people were working at home, teaching their children at their kitchen tables, and avoiding various activities including in-person visits with their doctors.

As a result, for a few months at the start of the pandemic, the use of telehealth and telemedicine exploded.

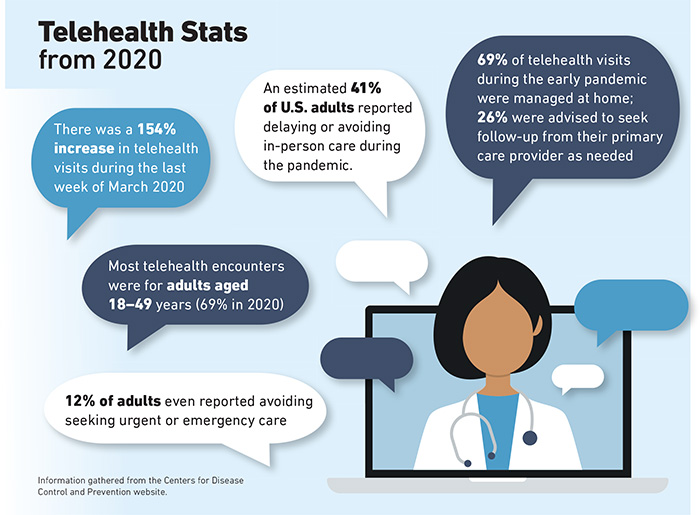

The Centers for Disease Control and Prevention reported that telehealth visits were up 154% in the last week of March 2020, compared to the same period in 2019.

Today, as more people in the U.S. become vaccinated, it appears that spike in telemedicine use has flattened, but some questions linger: Is interest in telehealth here to stay and will it play a major role in cost containment and service delivery in workers’ compensation?

Statistics support the notion that there is increased acceptance of telehealth. According to McKinsey, 46% of patients say they now use telehealth for some visits, compared to 11% in 2019.

An increase in telehealth caused by the pandemic was witnessed by David Lupinsky, vice president of digital health and innovation at CorVel.

He said his company reported more telehealth visits in the last two weeks of March 2020 than they had in the previous two years combined.

“It had been going up [in the previous two years], but we saw a huge spike of nearly 500% in March 2020,” he said.

That number has dropped, though it hasn’t gone down to pre-pandemic levels, he said.

His company receives about 100,000 calls a year to its nurse triage hotline, which is staffed by nurses who refer patients to self-care, telehealth or an in-person visit at a medical office or clinic.

About 70% of claims filed at CorVel start with a call to the nurse triage hotline. About 50% of calls are resolved with the nurse recommending self-care for patients, which results in no claim. Of the other half, about 45% are referred to telehealth and 55% end up going into a physical office for a doctor’s visit.

Well-Defined Benefits

In addition to helping to mitigate the spread of disease during a pandemic, Lupinsky said telehealth has a myriad of other advantages for injured workers and employers.

“There are so many other benefits of telehealth,” he said. “There is obviously a return on investment there. It helps reduce the medical spend and improve the speed to get [a patient] to a provider.”

He noted that nurses answer the company’s triage phones within 30 seconds, and a physician will respond to a referral for a virtual telemedicine visit within 10 minutes. A movement in some states to allow doctors to be licensed across state borders also has been a boost for telehealth.

Jennifer Cogbill, vice president of the GBCare Advisor Team at claims service provider Gallagher Bassett, also saw a 15% increase in telehealth-related medical bills in the first 90 days of the pandemic.

That number has since dropped to about 2%.

Like Lupinksy, Cogbill said there are areas in workers’ compensation claims where telehealth is particularly useful, such as triaging patients to determine the type of care they need.

She said she hasn’t seen telehealth used much in workers’ compensation beyond that point-of-injury care and attributes that, in part, to a lack of investment in the technology.

“A lot of providers never invested in the ability to provide a secure connection for a telemedicine visit, although [with the pandemic], we saw providers starting to offer it,” she said.

Cogbill believes telehealth is well-suited for use in ongoing care to monitor a person’s recovery from an injury or minor illness.

“I believe there is a lot of opportunity for telemedicine in follow-up care, but that needs to be promoted by the provider community,” she said. “I think there are some who’ve made that investment and who want to continue to offer that.”

An Innovative Tool

Melissa Burke, vice president at AmTrust Financial Services, Inc., said telehealth is just one way to address patients’ needs.

“It’s another tool in our tool belt,” she said. “It’s about looking at the injury and seeing what makes sense for treating that injury.”

Her company has used national guidelines to train staff on what types of injuries are suited to telehealth.

Like Cogbill, she sees follow-up care as one area where telehealth may be especially useful. Another area is behavioral health.

“We’ve seen an increase in acceptance of telehealth and I think that’s going to continue,” Burke said.

Still another area where telehealth may prove beneficial is in physical therapy that would begin with in-person visits but evolve into virtual visits as a person’s condition improves.

Burke said the pandemic has raised awareness of telehealth, including among her company’s employees.

“Our claim and medical professionals are aware that this service is available and how it can improve the claims process,” she said.

“It can allow employees to be treated at work without having to leave the work site or transition back to work when they do things like tele PT or behavioral health.”

Terri Rhodes, chief executive officer at Disability Management Employer Coalition, agreed that the pandemic has accelerated adoption of telehealth: “In 20/20 hindsight, it wasn’t just that patients weren’t using it,” she said. “Doctors weren’t using it either. So, I think we were all forced into it, and very quickly we had to figure it out.”

Other forces boosting telehealth during the pandemic included the federal government, state Medicaid programs and private insurers that expanded coverage for virtual health care services during the crisis.

The U.S. Department of Labor also allowed telemedicine in lieu of in-person treatments under the Family Medical Leave Act.

Looking Ahead

While experts agree that telehealth is useful in some workers’ compensation situations, it still has shortcomings.

Rhodes said a potential disadvantage is that “a medical professional might miss minor signs or symptoms resulting in an inaccurate or incomplete diagnosis, because you really can’t see that person. You can only see what they’re showing you on camera.”

Technology, of course, with its problems of faulty internet connections or dropped calls, can be a deterrent, and some employers are reluctant to adopt the technology.

“We have some clients that really embrace technology and others that are more skeptical,” Cogbill said.

Despite these shortcomings, Rhodes said the need to incorporate telehealth will only grow, because younger workers, who will make up the future workforce, prefer it. “They’re big on self-service portals, online appointment scheduling and accessing mental health through apps,” she said.

“I think there are lessons we can learn from that group in terms of how we shape the future of telehealth and telemedicine.”

Cogbill foresees new technologies like wearables might increase telehealth use as well. A wearable device might be used to monitor an injury or a patient’s recovery remotely, she noted.

Lupinsky also sees a role for telehealth in reducing risk. He said CorVel is taking a proactive approach to reducing risk by identifying potentially costly claims.

For example, in the case of a patient using opioids, the CorVel team’s telehealth tech system might suggest to a provider they direct that patient to other methods of addressing pain.

“What we want to do is direct patients to other healthier alternatives,” he said.

“We can direct patients to a different mode of care such as cognitive behavior therapy or meditation.”

The pandemic shone a spotlight on telehealth, but the degree to which it will be accepted in workers’ compensation remains to be seen.

Lupinksy, for one, believes it will only grow. “The genie is out of the bottle,” he said. “I think it’s going to be tough to put it back in.” &