Absence Management

In Search of New Absence Management Strategies

Corporate silos separating workers’ compensation departments from the non-occupational disability management side of the house prevail at most companies, although some sophisticated employers are finding efficiencies by coordinating aspects of the two.

Those employers are integrating employee lost-time data, coordinating claims tracking, and transferring best practices from one side of the house to the other.

They are doing so to reduce overall costs, understand employee leave and absence drivers, and to increase productivity, several large employers told the recently held Disability Management Employer Coalition’s annual conference.

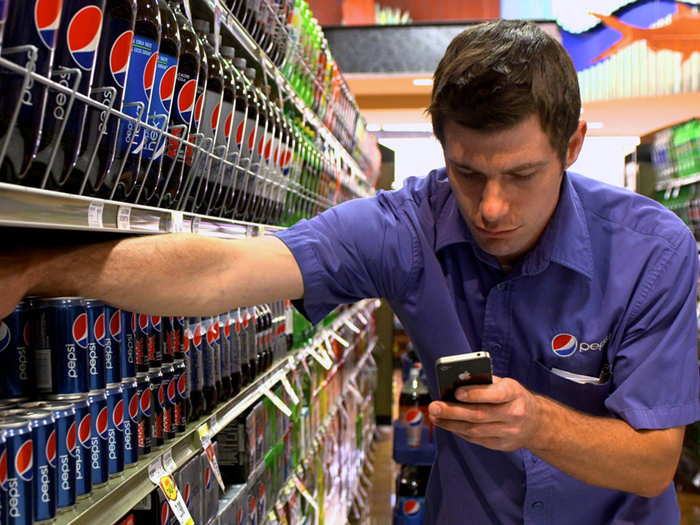

PepsiCo, for example, is three years into a program overhaul to eliminate unaccounted for absences, eliminate overpayment of benefits or salaries, and mine its data to learn whether its benefits drive workers to choose between pursuing either workers’ comp or non-occupational disability benefits.

The company traditionally maintained a strong workers’ comp program for managing claims and a solid disability leave management program, said Barbara LaRocque, benefits director at PepsiCo unit Frito-Lay.

“The problem was we had no overlap,” LaRocque said. “One never had anything to do with the other. Instead there was a lot following through the cracks.”

Consequently, the employer was not efficiently returning workers to their jobs even after leave times expired. It required duplicate medical forms to satisfy workers’ comp, disability and Family Medical Leave Act needs, and the company’s human resources department and managers struggled to track employees on leave.

But extensive changes began in 2011.

Among other measures, PepsiCo — with 250,000 workers worldwide and about half of those in the United States — centralized employee reporting through a leave and claim center providing a single point of contact for cases leading to time away from work, whether a workers’ comp claim, disability or leave of absence.

“Our mantra at this point was one phone number to call, one place to go, and one person to talk to who can talk about all aspects of your leave, your pay, your benefits, your employment rights, your status with work comp or disability,” LaRocque said.

The centralized intake helps tightly control the determination of benefits eligibility and the notification of managers and human resources of an employee’s leave status, among other advantages.

Other PepsiCo changes have included clearly defining the responsibilities of employees, managers, and human resources. For example, human resources must now stop an employee’s pay if they do not call to report a leave.

The company has also outsourced and leveraged its use of technology. Third party administrator Sedgwick Claims Management Services Inc.’s claim system, for instance, serves as PepsiCo’s “system of record for all leave activity,” helping the employer track employee time away from work.

The progress has also allowed PepsiCo to collect an abundance of data it plans to use to learn more about how its leave changes are impacting cost savings and productivity, LaRocque said. It will also use the data to help determine whether its benefit offerings and other factors drive employees with injuries to select between filing workers comp claims or disability claims.

Several other large employers told DMEC’s conference, held July 27-30 in Las Vegas, of their efforts to integrate aspects of various programs including wellness and employee assistance offerings and programs for managing short term disabilities, long term disability, workers’ comp and FMLA administration.

TPA Broadspire announced at the conference that it will help further such efforts by adding STD, LTD, and FMLA leave management to its portfolio of products.

Broadspire’s employer clients have increasingly asked for her company expand into providing disability and absence management services to compliments its workers’ comp offerings, said CEO DanielleLisenbey.

There are several factors driving demand for outsourced disability management programs, Broadspire said. Those include an aging workforce expected to increase absences and disability leaves and growing employer responsibility for following state and federal regulatory mandates.