Specialty Insurance

Event Cancellation Insurance is Pricey: But Oh-So Necessary

It should have been idyllic. A private Bahamian island playground for the young and posh, for celebrity influencers, supermodels and thought leaders. Two fantasy weekends filled with music, art installations, five-star cuisine, chartered yachts and luxe tents as well-appointed as any upscale hotel room. Oh, and $1 million in treasure and jewels hidden throughout the island.

The marketing push for the Fyre Festival promised an experience like no other. To be fair, that part turned out to be true.

Festival attendees, some of whom had paid up to $125K for VIP ticket and accommodation packages, arrived at the island of Great Exuma to behold utter chaos. Trash-filled grounds, feral dogs, FEMA disaster-relief tents, bloodstained mattresses, no electricity, processed cheese sandwiches— and not a stage or a musical act in sight.

The festival actually collapsed weeks before it ever began. But not until the day of the event did organizers admit defeat — taking to Twitter to announce the cancellation, while frantic teens and 20-somethings tweeted frantically for hours, begging authorities to rescue them from the island.

The first class-action lawsuit was inked before all the festival-goers made it back home. Five more followed, as well as suits from an investor, a financing company and an event management company that was hired to provide medical services. Ticket vendor Tablelist filed suit for the $3.5 million it says it needs to refund ticketholders. Lawsuit demands to date are far in excess of $100 million.

Festival organizer Billy McFarland was arrested on a charge of wire fraud. Prosecutors say he used false documents to secure $1.2 million in funding for the event. Some say the entire thing was a scam from the start. Some say it was just an ambitious idea without the level of knowledge or experience to support it. The FBI will weigh in eventually.

The demise of Fyre Festival could be dismissed as a fluke. But only three weeks later, it was announced suddenly that Canada’s Pemberton Music Festival would be cancelled and organizers were declaring bankruptcy. Most were appalled that in lieu of refunds, ticket-holders would have to file a proof of claim form as unsecured creditors.

Experience Matters

These very public festival implosions serve as a reminder that music festivals are intensely complicated to orchestrate. There are countless ways that a misfire could put an entire event at risk. Which is why the insurers that write coverage for festivals dig deep into the details before taking them on.

There’s evidence that Fyre Festival’s organizers shopped around for insurance, but found no takers. That’s no surprise, because first-time festivals have no proven track record, and an untested promoter would do little to instill confidence.

“From an insurance perspective, you want a reputable promoter who has done festivals successfully in the past,” said Susan McGuirl, Head of North America Entertainment, Entertainment Division, with Allianz Global Corporate & Specialty.

Even so, an untested promoter could likely still find appropriate coverage if they chose to partner with reputable and experienced entities.

“What I look for when I get involved in a festival is who the actual people are with what I call the feet on the ground,” said Peter Tempkins, managing director of entertainment for HUB International.

“I’m not quite as concerned [with] who owns it; it’s who’s running it — who’s the site manager? Who’s the production manager? Who’s the security director? Who’s the medical director? Because that’s where the important stuff really comes from.”

Underwriters typically know all of the players and their reputations, said Tempkins.

“The festival world, as big as it is, is a very small world, and a lot of the same people or the same companies work on a majority of the festivals.”

That’s why it was worth noting, he said, that of the companies involved with the Fyre Festival, he recognized only one name. Having unknowns on board would prompt a deeper level of research.

“If they say, ‘Oh, John Doe is going to be our security director,’ then I’ll ask people who do festivals what do you know about John Doe? And what do you think about John Doe being a security director for a festival? These are people who I trust, who will be honest with me,” he said.

“If they say they’re going to use Doe Staging, I’m going to research Doe Staging. And if it turns out that it’s something John’s building in his backyard out of old plywood, then I’ll probably walk away at that point,” he explained.

Organizers typically work with insurers well in advance. Major festivals require numerous types of coverage in addition to cancellation insurance, including general liability, workers’ compensation, commercial auto, umbrella policies, and typically terrorism coverage as well. Some event organizers will also opt for E&O and D&O coverage, and possibly crime coverage.

The costs involved are quite high. Cancellation insurance alone will typically cost 1 percent to 1.5 percent of the overall cost of an event. General liability is priced per head, and will vary depending upon a variety of factors including whether it’s an overnight event. The total bill for insurance can be quite steep.

Some, however, say it still isn’t pricey enough. In a blog post written six weeks before the Fyre debacle, David Boyle, contingency class underwriter for Argo Insurance, explained that Argo as well as a number of its peers decided to stop providing coverage for festivals “at least until something gives.”

“Failure of festival organizers to better implement proven risk mitigation procedures and of insurers to charge a genuinely risk-reflective price will lead to further losses and more insurers with loss-making books of festival insurance business will decide that enough is enough,” he said.

Boyle cites numerous reasons why festivals are so risky to insure, but experts say drugs and alcohol are at the top of the list, and, of course, all of the shenanigans you might expect when those substances are free-flowing.

A December 2016 Canadian study found that alcohol and drugs were a factor in 13 percent of all reported music festival deaths between 1999 and 2014, and the majority of all non-traumatic deaths.

California’s Hard Summer festival, produced by a division of concert giant Live Nation, had four fatalities between 2013 and 2015. The earliest was ruled to be death by natural causes, although MDMA (Ecstasy) was involved. The other three were directly related to MDMA overdose.

“You get past the underwriting, you get past the insurance, you get past everything else … to me, it’s all about safety. ” — Peter Tempkins, Managing Director of Entertainment, HUB International

In May 2016, two people died of MDMA toxicity and 57 more were hospitalized after attending the Sunset Music Festival in Tampa.

Two months later, tragedy struck the Hard Summer festival yet again, claiming the lives of three more young people, despite the copious warnings and a white “amnesty” box set out for people to place illegal drugs in before going inside the venue.

Drugs are the problem that organizers and insurers can’t get ahead of, despite warning flyers, safety messages, bag searches and drug-sniffing dogs. That’s one reason that staffing levels and on-site personnel are scrutinized by insurers, as well as every other issue that could put people at risk.

Allianz utilizes risk services professionals with a keen eye for potential problems, said McGuirl.

“Our crew is pretty seasoned, they literally walk around and look at all the components of the festival, with the utmost focus on safety,” she said.

That means looking closely at weather planning, evacuation planning, medical facilities, parking structures, campsites, communication systems and more.

The focus, she said, “is always on the safety of the patrons — those people who are buying tickets and going to the event to have a good time … making sure that they are treated well, that they’re safe and then they can go home.”

“You get past the underwriting, you get past the insurance, you get past everything else … to me, it’s all about safety,” agreed Tempkins.

“My daughter’s 25. She’s going to shows, and I want her coming home at night.”

The Price of Mistakes

Even established, respected organizers struggle with the risks. The Fyre Festival is far from the most shocking example of under-prepared promoters.

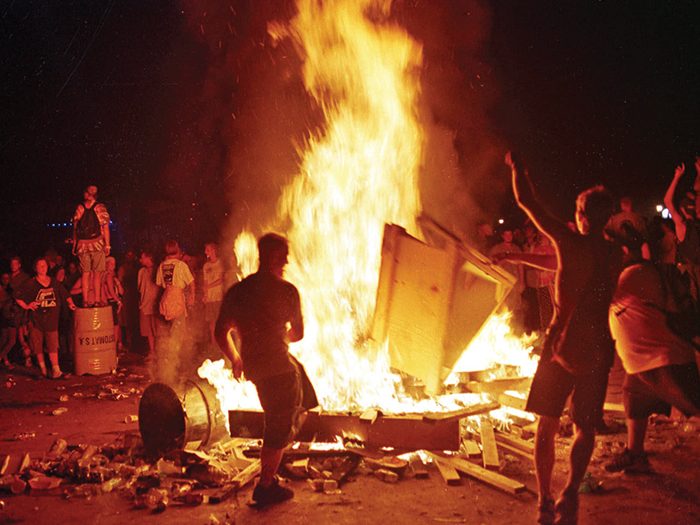

Woodstock ’99 – the second reboot – was an organizer’s worst nightmare, which had a lot to do with judgement missteps of the organizers themselves, one of whom happened to be legendary promoter John Scher.

Mistakes were made. Toilets overflowed. Garbage collection ceased. Overwhelmed security staff gave up and walked away. Add drugs and alcohol, 100-degree temperatures, grossly overpriced concessions and the rage-filled music of hardcore rock bands. It was a powder keg. Aggression and violence were rampant. Assaults and rapes in the mosh pit were reported.

And then a sponsor made the baffling decision to hand out 100,000 candles near the close of the event.

The powder keg was lit, quite literally.

The festival culminated in a riot. People used the candles to set ablaze the overflowing garbage, then began destroying structures to add fuel to the fires. Everything burned, including tents and merch stands. A 50-foot speaker tower was toppled. Trucks exploded.

“From an insurance perspective, you want a reputable promoter who has done festivals successfully in the past.” — Susan McGuirl, Head of North America Entertainment, Entertainment Division, Allianz Global Corporate & Specialty

The final tally exceeded $2 million in damages (counting both structure damage and the cost of stolen or destroyed merchandise.) Forty four rioters were arrested.

All things considered, it’s actually a bit mystifying that insurers didn’t turn their backs on the festival industry altogether right then and there.

But the bands play on.

As for the Fyre Festival, its earlier promise to come back and get it right in 2018 is highly questionable, particularly now that a group of investors have filed a petition to force the company into bankruptcy.

“The music industry is a very small industry,” said Tempkins. “If you make a mistake, depending on the mistake, sometimes you can recuperate from it and sometimes you can’t.

“When they come back — or try to come back — people remember.” &