Insuring the Climate Transition: How Can the Construction Industry Confront Escalating Storm Damage?

Like every industry, construction isn’t immune to the effects of global climate change.

Adverse weather affects 45% of construction projects globally, a 2021 report from the Air Force Institute of Technology found, and results in billions of dollars of additional expenses and lost revenue.

Project delays, damaged materials and supply chain shortages are just some of the ways climate change has recently affected the industry. These additional costs come at a time when the industry is already struggling with high materials costs driven by inflation.

As increasingly frequent and strong storms drive up project costs for contractors and developers, the construction sector is searching for new insurance solutions, including parametrics, to protect its bottom line.

Industry leaders are also looking for ways to reduce their own emissions in an effort to make the sector more sustainable.

Project Damage, Worker Safety, Supply Chain Delays: How Climate Change Is Affecting Construction

From worker safety concerns to project delays and supply chain shortages, global climate change poses a number of challenges to the construction industry.

On a day-to-day basis, changing weather patterns and increasingly frequent and strong storms can increase worker safety risks. Record high temperatures can increase the risk of heat sickness among construction workers, who often work outside and may not drink enough water or seek shade during the work day.

Younger and inexperienced workers could be more prone to suffering from these kinds of injuries. Workers are more likely to be injured during their first year on the job, often because they aren’t yet familiar with the necessary safety protocols and best practices. Construction, which saw 56.9% of its workforce exit the field in 2021, may be struggling to help new, younger workers acclimate.

Increased employee safety training and awareness of how to safely work during high temperatures can help.

“There’s a labor shortage and that means that there’s a great opportunity for new training programs to bring people into the industry,” said Jeffrey Segall, AU, ARM, CIC, CRM, CRIS, CPCU, executive director construction and infrastructure at Aon.

Severe weather events, including hurricanes, tornadoes and wildfires, can damage buildings under construction or result in project delays.

“Weather-related events … can disrupt scheduling and increase costs,” Brian Turmail, vice president of public affairs and strategic initiatives for Associated General Contractors of America (AGC), said in an email.

Even if severe weather doesn’t affect a project site, it could cause delays. Natural catastrophes have contributed to the supply chain delays that plagued 2021 and 2022. If a supplier experiences damages due to a storm, builders may have to wait months for necessary materials or find a new vendor.

“[The] industry is still facing supply chain challenges that are residual from the pandemic disruptions,” Turmail said.

“Some members are expressing concern about future disruptions caused not only by climate but also well-intentioned climate policies that introduce uncertainties, impact availability of materials and energy, and lead to cost escalations and uncertainties within the marketplace,” he added.

Contractors might employ resilience officers to create action plans in case of severe weather events. These employees are responsible for creating safety and environmental risk plans to put into action in case a project is affected by weather.

“In the future, there may be more interest in having resilience officers at construction firms, but it is not currently common,” Turmail said. “Jobsite resilience to weather is often tied to worker safety or environmental compliance.”

Financial Impacts

Even with resilience officers to make contingency plans, both project delays and supply chain shortages have the potential to increase costs for contractors and developers. In an industry already being battered by inflation, additional costs can be deadly for projects and smaller businesses.

Between January 2021 and January 2022, the cost of building materials rose 20%, per an Associated General Contractors of America analysis. To help manage inflation, the Federal Reserve has raised interest rates, a decision that has ripple effects for contractors and developers.

“With higher interest rates, some projects are beginning to fall off. That’s impacting cash flow for the smaller medium-sized contractors, which creates its own challenges to be able to complete projects,” Segall said.

To manage costs, contractors are entering into joint ventures, but those come with contractual risks: “These projects are being led with much bigger price tags. Some of those larger price tags are requiring many contractors to have to form joint ventures to be able to qualify to do these projects,” Segall explains.

“Joint venture carries with it some risk — not only the construction risk, but the contractual risk between the parties.”

Can Parametric Insurance Solutions Save the Day?

To manage the risks of increasing costs related to climate change, developers are turning to parametric insurance solutions. Parametric insurance claims are triggered when a certain threshold is met, say wind speeds or a hail storm, and they pay out based on a preset amount.

That way, insureds don’t have to go through a claims adjustment process. They can get the money they need and use it for whatever costs — be they project delays, construction damage or supply chain shortage — that result from the storm.

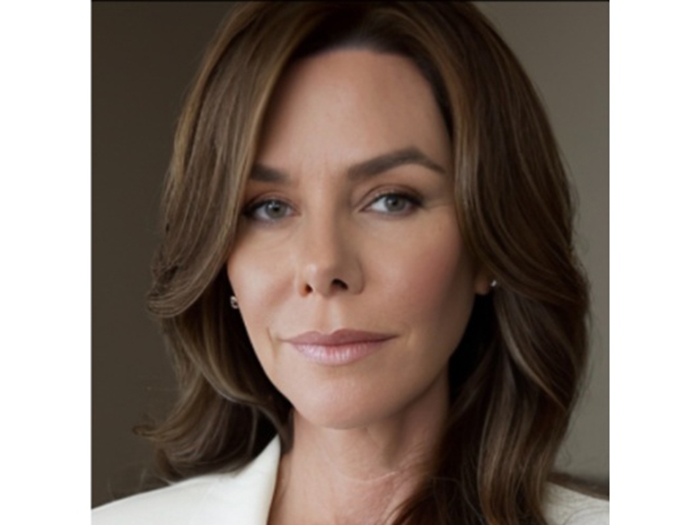

“We have seen an increased number of inquiries from developers who are looking to protect a specific construction project against natural catastrophe risk,” said Megan Linkin, senior parametric Nat CAT structurer, Swiss Re Corporate Solutions.

“The value proposition of buying parametric insurance in general that resonates with some of those developers is the flexibility to use the proceeds to cover any direct or indirect cost due to the event versus one single asset.”

Linkin says that she’s seen increased interest in parametric solutions from developers and contractors over the past year or so — requests for between $1 million to in excess of $100 million for parametric covers.

Once the policy is triggered, parametric policies can pay out in under 30 days. “We can settle the claims extraordinarily quickly,” Linkin said. “You don’t necessarily want to be waiting for a claims adjuster to make their determination.”

These products can also be used to assist builders with contingent business interruption costs. If they have a critical supplier in an area vulnerable to natural catastrophes, insureds can request a parametric product that pays out based on weather events in that geographic region. “One benefit of parametric products is to assist buyers with contingent business interruption,” Linkin said.

Looking Forward: How the Construction Industry Is Reducing Emissions

Given the risks posed to construction sites by increasingly frequent and strong storms, contractors and developers are considering how their industry is contributing to carbon emissions.

The built environment is responsible for 40% of global energy-related carbon emissions, The Economist reported. About 10% of those emissions are “embodied” carbon, which comes from constructing, maintaining and demolishing buildings.

Contractors might employ a number of different strategies to reduce their emissions. Builders might promote recycling, either through material reuse or sustainable purchasing. A 2022 survey from Associated General Contractors of America found that 78% are implementing some form of recycling, while 48% opt for material reuse and 26% engage in environmentally friendly purchasing practices.

“Recycling policies are widespread within the industry,” Turmail said.

Other efforts focus on construction vehicles. Over a third of contractors surveyed by AGC have policies in place to reduce equipment idling. Electric vehicles are also promising but, Turmail says, “many of these solutions are years away.” &