Inflation, Social and Otherwise, Continues to Demand Sharper Underwriting on the Part of Insurers

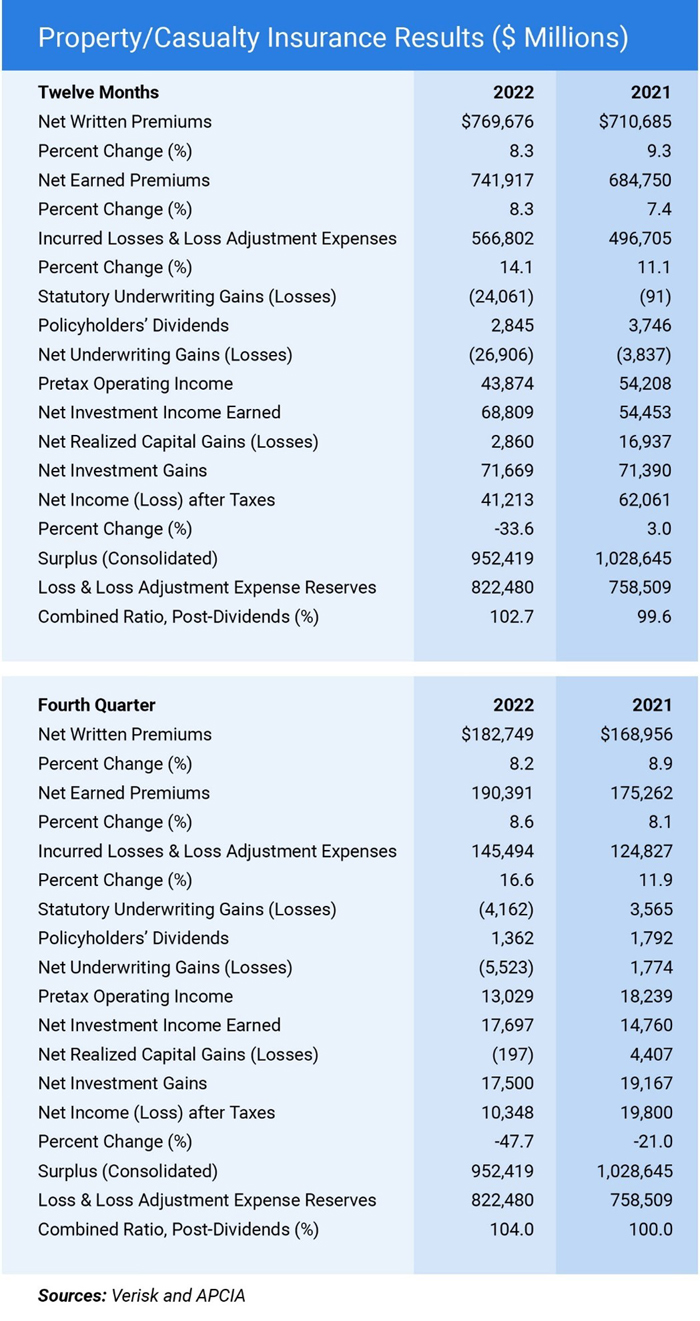

Key financial results for private U.S. property and casualty (P&C) insurers significantly worsened in 2022 from a year earlier, according to preliminary results from data analytics firm Verisk and the American Property Casualty Insurance Association (APCIA).

The industry experienced a $26.9 billion net underwriting loss in 2022 — more than six times the $3.8 billion underwriting loss in 2021.

The underwriting loss was the largest the industry has seen since 2011.

Net income fell to $41.2 billion in 2022, compared to $62.1 billion a year earlier, equaling a 33.6% decline. In 2022, incurred losses and loss adjustment expenses grew 14.1%, while earned premiums grew 8.3%. The combined ratio — a key measure of profitability for insurers — deteriorated as well, from 99.6% in 2021 to 102.7% in 2022.

The Factors at Play

The preliminary results (see table below) were consolidated estimates based on annual statements filed by insurers with insurance regulators. The results are based on about 94% of all business written by U.S. property/casualty insurers.

“The insurance industry is being hammered by increasing input costs, natural catastrophes, legal system abuse and resistance in some states to adequate rates,” said Robert Gordon, senior vice president, policy, research and international for APCIA.

“Insurers suffered a 14.1% increase in incurred losses and loss adjustment expenses, 16.6% in the second quarter, contributing to a more than $76 billion contraction in insurers’ surplus at a time when loss exposures are rapidly growing. In 2023, insurers are faced with a significant challenge to close the rate gap to meet their growing cost of capital.”

Hurricane Ian, which battered the west coast of Florida last autumn, as well as the effects of inflation, resulted in major losses for property insurers last year, noted Neil Spector, president of underwriting solutions at Verisk.

The factors noted by Gordon exacerbate each other. For example, some insurers are reducing their exposure to coastal property coverage or not writing those risks at all because they cannot charge adequate premiums.

“That is causing a shift to state-run programs,” said Spector. “Regulators and politicians want insurance to be available at the same time that insurers are using analytics to price more appropriately. We are in a hard market and the cycle takes 12 to 18 months to flow through.”

A Look at Rates and Pricing

At the policy level, however, Gordon stressed that “there is an enormous moral hazard to society when regulators and politicians do not allow risk-based rates.”

Even when such rates are approved, the process can take years.

The joint analysis also found that insurers’ rate of return on average policyholders’ surplus, a measure of overall profitability, declined to 4.2% in 2022 from 6.4% in 2021. Policyholders’ surplus itself recovered somewhat from $911.7 billion in the third quarter of 2022 to $952.4 billion in the fourth quarter, but it still remains below that of year-end 2021.

That situation was driven primarily by the large amount of unrealized capital losses accrued during 2022.

The industry’s net income fell to $10.3 billion in fourth-quarter 2022 from $19.8 billion in fourth-quarter 2021, and the annualized rate of return on average surplus fell to 4.4% from 7.9% a year prior.

Net written premiums rose $13.8 billion in fourth-quarter 2022, or 8.2%, compared to a year earlier. Net underwriting losses declined to $5.5 billion in fourth-quarter 2022 from $1.8 billion in gains a year earlier, and the combined ratio deteriorated to 104.0% from 100.0% a year prior.

“There is enormous anxiety [on the part of insureds] because [insurance] rates are going up,” said Gordon, “but costs are going up faster than the underlying consumer price index. And the reinsurance market took an even bigger hit than the insurance market reflected in these statistics.”

Spector stated that “in many cases, the premiums on the books don’t match the risks that are incoming.” He added, “While inflation has moderated, it is not stopping. We are recommending more frequent reevaluation of risks as long as the economy is in an inflationary environment.”

Returning to the theme of years-long delays between events and rate changes, Gordon cited the “regulatory paradox”: “During the pandemic, regulators were trying to force a reduction in rates, especially on auto coverage because people were not driving. Now people are driving again, and accident rates are up. Behind all of that, cars are much more complicated and expensive to repair.”

“For example,” Spector added, “it used to be a simple thing to get a cracked windshield repaired or replaced. Now it’s much more complicated. Some windshields include technology,” such as for heads-up displays or blocking glare.

He also mentioned an insight from the data: “Insurers charge drivers based on their record, but violations are down even as accidents are up. With fewer tickets being written, insurers do not have accurate driving records from which to price correctly.”

Still a Positive Outlook for the Future

For all the areas of concern, Gordon spoke of several areas of optimism.

“In terms of legal system abuse, Florida is finally coming to grips with its situation. There are similar initiatives in Louisiana,” he noted. Although it represented less than 7% of homeowners’ claims in 2021, Florida had a 76% share of the country’s homeowners’ lawsuits, he explained, citing figures from the Florida Office of Insurance Regulation’s Property Insurance Stability Report, from January 2023.

There is also progress in building codes in high-risk areas, notably coastal zones prone to flooding and hurricanes, as well as wilderness terrain subject to wildfire. The Institute for Business & Home Safety, a nonprofit research organization supported by insurers and reinsurers, has developed new programs: Hurricane Ready and Wildfire Prepared.

“We see a tremendous increase in people wanting to build in risky places,” said Spector. “We don’t see that slowing. The biggest risk is the growing exposure, so the most important thing for insurers is to price accurately.” &