How the Current War in Ukraine Is Supercharging the Always Pressing Need for Political Risk Insurance

On February 24, countries around the world watched in shock as Russia began its military attacks on Ukraine.

The appalling assault is one of the largest military actions in Europe since World War II and the greatest threat to political stability on the continent since the Cold War

This war already has far-reaching consequences. First and foremost, it has displaced millions of people and cost the lives of thousands, many of them innocent civilians. Everyone from governments to businesses to individual people will feel the consequences of this war.

When the conflict eventually reaches an end, political risk insurance policies will be there to make what they can whole again. These policies will step in to take care of physical damage to properties and some of the economic losses caused by the war.

Reawakening the Beast

Political risk insurance as we know it today started taking shape after World War II. Back then, the U.S. government started issuing long-term political risk guaranties in order to encourage American investment and to assist in rebuilding Europe after the war under the Marshall Plan.

These policies sought to ease companies’ concerns over currency inconvertibility issues that may arise from investing in developing or rebuilding nations.

From there, private political risk insurance developed in the 1970s to cover currency inconvertibility, expropriation and physical losses to property stemming from war and political violence. Insureds can also build in coverages for cancellation of critical licenses or concession agreements they may need to operate and forced divestiture.

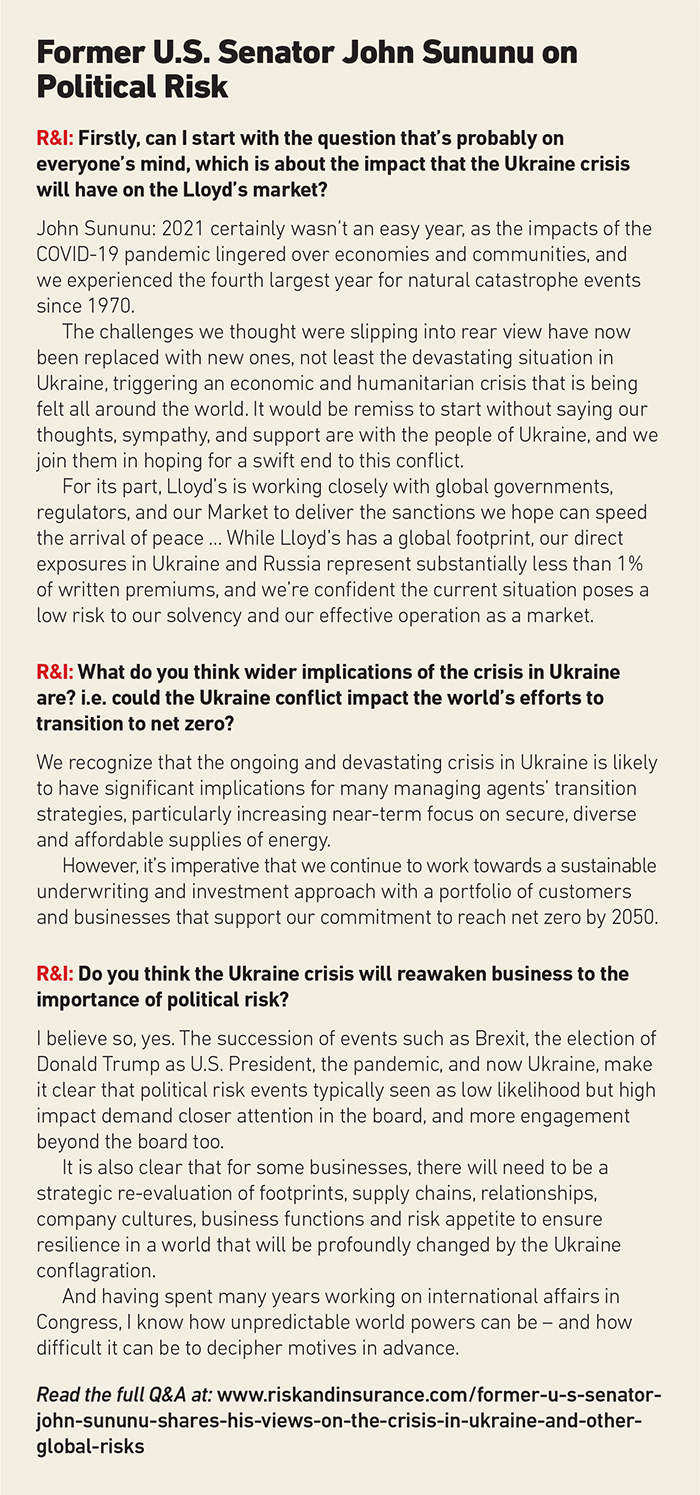

Historically, said Stephen Kay, managing director of Marsh credit specialties and political risk, clients purchased political risk insurance to protect assets in developing nations where they perceived the risks of war, expropriation or currency restrictions to be high.

But the unpredictability of recent events — the stress of the pandemic, rising inflation, increasing political tensions between the U.S. and its rivals, and, of course, Russia’s invasion of Ukraine — have brought an increased interest in political risk insurance policies.

“Last year, I can say that our political risk book grew by about 50%,” Kay said. “There’s been a major shift where political risk was always there, and people were aware of it, and they were buying insurance for it. But I think the pace of that really picked up in the last two years.”

Political Risk Claims from the War in Ukraine

Samir Brahimi, head of EMEA, Riskline

No recent event has thrown the need for political risk insurance more squarely in the spotlight than Russia’s recent invasion of Ukraine.

It is impossible to understate the human costs of this war for Ukraine. As of April 25, the United Nations has confirmed 2,665 civilian deaths and 3,053 injuries, CNBC reports, over 5 million people have fled the country and become refugees.

Several multinational corporations suspended operations and evacuated employees in order to keep their workers safe as Russia bombs fuel plants, schools, and even a maternity ward, the New York Times and NPR have reported.

“We were advising people to evacuate from Ukraine, at least in the week before the invasion happened,” said Samir Brahimi, head of EMEA at Riskline. “Major damage took place in Kyiv and other major cities due to the Russian offensive.”

Though we won’t know the complete civilian, physical and economic losses for many months, insurers anticipate there will be claims in each of the three main categories political risk insurance policies cover.

Russia has already seized hundreds of commercial jets owned by U.S. and European leasing companies, CNN reported. Economic sanctions have limited Russia’s access to the approximately $630 billion in U.S. dollars the country keeps in foreign currency reserves. Consequently, the country may try to limit foreign companies’ ability to convert rubles to USD, resulting in currency inconvertibility claims.

“There’s a game of economic warfare going on between Russia and the western countries who have imposed sanctions on Russia, where the Russian central bank is trying to bolster the ruble by limiting capital flows out of the country. So they’re trying to keep as much money in Russia right now,” said Lian Phua, head of Americas, political risk, credit and bond at AXA XL.

“I think you’re going to see currency inconvertibility claims in relation to any foreign investor insured who’s operating in Russia if they’re unable to transfer money or dividends back to their host country, particularly if their host country is a Western nation”

Lian Phua, head of Americas, political risk, credit and bond, AXA XL

Multinational companies are likely to have purchased political risk policies to cover any exposures they have in Russia or Ukraine, according to Dr. Michel Léonard, chief economist for the Insurance Information Institute (Triple-I). Though there has been relative peace in the region since the Cold War ended, Russia’s invasion and subsequent annexation of Crimea in 2014 caused corporations to reevaluate their risks in the region.

“Even before Crimea, there were troubles in Ukraine, so exposure was slowly but surely reduced,” Léonard said.

The brunt of claims from the present day conflict in the region will be felt by European insurance markets, but it may not account for large shares of their books of business. Lloyds of London reported that direct exposures in Russia and Ukraine represent less than 1% of written premiums, though Léonard estimates that losses from the war could be in the billions.

“The specifics, the images are horrible,” Léonard said. “Companies may not [have been as] exposed, but that certainly does not take anything away from the tragedy.”

Travel Risk Abounds

The violence in the region has also increased business travel risks.

“There’s a lot of consideration on international travel at this moment,” Jim Wetekamp, CEO of Riskonnect, said.

“I think you’ve got a lot of consideration on the essentialness of travel. It’s even more of a pause now than it was during COVID-19 in terms of the risk to employees in international travel scenarios.”

Airlines have canceled flights to Russia, and planes are taking longer routes to avoid the conflict, increasing fuel costs, CNBC reported.

“The aviation industry has been severely affected by this conflict,” Brahimi said.

“Airlines have canceled loads of flights between Europe and Asia, flights which may pass over Russia or Ukraine or neighboring states. Some have been rerouted and take longer. Other routes have just been suspended entirely.”

Physical safety of employees is obviously paramount. Companies with employees who may be traveling in regions where there may be violence need to have medical care and evacuation plans in place as part of their risk management strategies. Don’t wait until the last minute.

“Lots of things obviously go into an evacuation plan. Sometimes I think the temptation is to postpone until the very last minute, when the situation has become so bad that staying is no longer an option. But what you saw after Russia decided to invade on the 24th of February was that evacuation became a lot more difficult,” Brahimi said.

“Railway stations were blocked in Kyiv and other main cities, just from the large number of people trying to leave. Traffic was gridlocked for miles.”

But an employee’s physical safety may not be the only thing at risk while traveling. Travelers are often prime targets for cyberattacks since they may be distracted. This risk is especially acute for businesses whose operations may be of interest to Russian attackers.

“The geopolitical piece plays a big part. If your company handles critical energy, or water infrastructure for the U.S., for example, you should be more careful,” Tiago Henriques, director of engineering, security and data collection, Coalition, Inc.

Secondary Impacts: Supply Chain and Cyber

Beyond the primary political risk claims and the increase in travel risks, businesses will likely see increased supply chain and cyber exposures as a result of the war in Ukraine.

Much attention has been paid to fuel shortages and the subsequent rise in gas prices in the U.S., but Russian and Ukraine are both large suppliers of grains, which could lead to food supply chain issues.

Russia and Ukraine supply 30% or more of grain products to at least 50 countries, per Marsh’s “Food and Energy Inflation Will Drive Increased Political Risk” report.

“Some of those commodity prices have just skyrocketed,” Kay said, “stoking inflation and discontent in emerging markets already reeling from the pandemic.”

This change will likely impact smaller companies more than larger ones: “Larger corporates will have more buying power. If there is a scarcity in products, they are likely to have deeper pockets to follow the cost increases,” said Srdjan Todorovic, head of crisis management, regional unit, London, for Allianz Global Corporate & Specialty (AGCS).

Developing countries, including those in North Africa, Asia and the Near East are some of the most dependent on these countries for these critical food supplies. A lack of grains and other critical food supplies can exacerbate public anger and lead to abrupt policy changes in which governments expropriate assets to try to keep their people fed, creating a snowball effect of political risk in these developing countries.

“One of the triggers I often look out for is rising food prices; that can have an impact on the risk of political violence in some countries,” Todorovic said. “There is potential for protests, riots and civil commotion because of issues relating to food scarcity and affordability.”

Additionally, Russia has not been shy about its willingness to engage in cyber warfare. In the weeks leading up to the military invasion of Ukraine, six separate Russia-aligned nation-state cyber criminals launched more than 237 attacks against Ukraine, attacking both government agencies and businesses, a Microsoft report that investigated the situation found.

Now both sides are actively engaging in cyber warfare. In early March, there were at least 33 different cyber threat actor groups actively launching attacks as part of the conflict, with 22 groups aiding Ukraine and 9 aiding Russia, a CyberCube report found.

As Russia buckles under the pressure of economic sanctions, cyberattacks on the U.S. and European Union nations are likely to follow, though they have not occured yet.

“Many people including myself, did think that Russia would be likely to launch some kind of a cyber attack against U.S. interests, possibly including the private sector, in response to economic sanctions,” said Mike McNerney, SVP of security for Resilience Cyber Insurance.

“What we’re seeing today is really more of a normal level of criminal activity and less of the expected bump in nation-state attacks.”

Per William Altman, principal cybersecurity consultant with CyberCube, companies that play an important role in food or agribusiness and those in alternative energy could be prime targets. A move that could indicate that Russia is trying to exacerbate supply chain issues.

“The cyber threat landscape has fundamentally shifted as a result of the invasion of Ukraine,” Altman said.

“The majority of companies are not at risk of being directly targeted by politically motivated cyber threat actors and especially by state-sponsored threat actors. Risk managers should be aware of their company’s threat modeling exercises and whether or not state actors are included.”

Given the already hardening cyber insurance market, insurers may write exclusions for cyberattacks launched by a nation state, if they haven’t already. The burden of proving that attacks were launched by a nation state would likely fall on the insurer in these cases.

“It has brought the threat of cyber attack into sharper relief,” McNerney said. &