Talent Shortage

Global Talent Troubles

There’s a real irony at work in today’s global insurance industry — so much opportunity for growth, and yet that growth is threatened by a shortage of talent where it’s needed most. Historically, insurers rarely endured the war for talent that other industries fought, but those days are over. Today, insurers are banking on growth in markets where the talent to deliver it is thin.

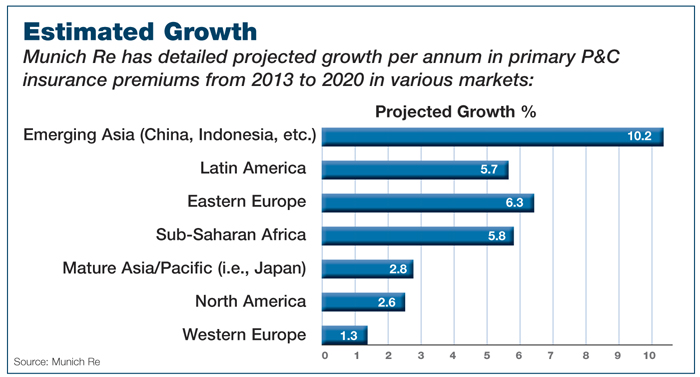

Insurance-industry growth is forecast to come primarily in emerging markets — mainly China, India and Brazil — as populations on those countries age, the middle classes swell and urban development soars. But finding the talent to serve those markets is a daunting task.

According to Mercer’s 2013 Insurance Industry External Labor Market Analysis, China’s current talent pool of some 16,800 insurance sales agents will require an additional 10,000 to match demand by 2018, while Brazil’s current pool of 40,000 agents will require 18,000 more.

But a 2013 State Street Insurance Survey (conducted by the Economist Intelligence Unit) finds that addressing talent shortages is not among the top strategic priorities of today’s insurers, focused as they are on enhancing product offerings, strengthening distribution models and proactively managing capital to improve their ROI. The issue of talent remains largely under the radar.

A look at some hard numbers helps paint the picture. Premium growth in the mature markets is unexceptional. According to market statistics from Axco, the United States has maintained 2 percent annual premium growth, to slightly above or below $1.6 trillion, since 2007, while the EU-15 countries and the UK have steadily declined since then.

Meanwhile, China saw 20 percent annual premium growth since 2007, to more than $200 billion; Brazil saw 26 percent annual growth since 2007, to nearly $75 billion in 2011; and India notched 14 percent annual growth since 2007, also to about $75 billion. Mexico held to 3 percent annual premium growth since 2006.

These numbers reflect the broad, macroeconomic reality, but the competitive landscape is a little more complex. Emerging market growth may lead that of the mature markets, but the opportunity for profit in those markets is even larger, because insurance has only begun to penetrate in the emerging world. Axco’s statistics reveal that, as of 2011, market premiums were a low percentage of GDP in the emerging nations: 1.9 percent in Mexico and 3.7 percent in China, India and Brazil, compared to 10.7 percent in the United States and 11.6 percent in the UK. As those percentages inevitably increase in the emerging regions, the competitive advantage will go to those firms that can recruit, develop, reward and retain the talent required for growth.

Supply and Demand

But realizing that advantage isn’t so easy. For example, the growth in demand for insurance talent in emerging markets such as China and Brazil is outpacing the talent pool. And the need for insurance sales agents, claims adjusters and underwriters is substantial in both countries. Local market knowledge is critical in the industry, thus adequate in-country workforces are essential to sustain business growth.

At the same time, insurers in mature markets have a relatively adequate supply of key talent, but competition for talent is quickly increasing. Insurers compete with sectors such as banking for key talent, yet tend to compensate talent less. The result is an insurance industry poorly positioned to win the talent war. The numbers can seem daunting: In the United States alone, the predicted number of skilled workers in the job market points to an insurance industry talent shortage of 21 percent for financial managers, 14 percent for sales agents, and 7 percent for actuaries, according to the U.S. Bureau of Labor Statistics’ most recent Occupational Outlook Handbook.

Regardless of geography, winning the talent war on the ground requires the right strategy, and there’s no overstating the need for putting the right people in the right places. Competing successfully in emerging markets calls for local knowledge of regulations, financial instruments, customer needs, cultural issues and more. Counting on expatriate talent from, say, Canada or Great Britain to serve markets such as India or Malaysia carries large costs and obvious risks. Insurers need to pay appropriate attention to the attraction and development of talent within the markets they want to serve.

Another looming talent challenge is linked to the increasing transformation of how insurance products are devised, sold and supported. As in many other industries, the focus is on big data and predictive analytics to garner customer insights for developing new products that are matched to ever more refined segments of the buying market — for example, property/casualty products that match the scale and risks of entrepreneurial business in the various emerging markets, or life products that reflect the needs of shifting demographics, such as older populations in mature nations and younger populations in the emerging markets.

These new skills and capabilities that go hand-in-hand with new products and distribution models do not need to be in the same countries as the insurance consumer. The increasingly hot competition for big-data talent is global, and coexists with the need for the right regional talent.

The Long Game

The insurers that can get ahead of these challenges by developing good strategies for talent development will win in the global marketplace. To the extent that insurers tend to pay less than other financial industry sectors, they may not be well-positioned to recruit desirable talent, which raises the familiar talent issue of “build vs. buy.”

Insurers may need to partner with educational institutions, trade associations and governments in individual countries to connect with and develop future talent for the industry.

Depending on the country — and especially in the mature economies — buying talent in the external marketplace can be difficult and expensive. Thus, insurers that can’t compete for talent simply by paying for it need to create strategies for attracting and developing, or “building” talent. They can do so by investing in partnerships with educational institutions, trade associations and governments in individual countries to connect with and develop future talent for the industry, and by changing how they manage their own workforces to create needed talent from within.

Playing that long game of talent development makes strategic sense, since it takes into consideration big-data trends that can point insurers toward talent markets that can help them thrive. For example, in a recent study from the World Economic Forum (The Human Capital Report, in collaboration with Mercer), 122 countries were ranked according to four pillars that contribute to (or inhibit) the development and deployment of a healthy and productive workforce. Those pillars — education, health and wellness, workforce and employment, and enabling environment — vary significantly across mature and emerging economies, but some significant trends stand out that can be helpful strategic markers.

Look, for example, at some of the growth markets for the insurance industry. The WEF report’s Human Capital Index ranks China at a lofty 14th among the 122 surveyed countries in terms of how much of its population (between the ages of 15 and 64) is in the labor force, while Mexico ranks far below, at 86th, in the same measure. And yet the rankings reverse somewhat in tertiary education (post-high school), with Mexico at 45 and China at 77. The strategic inference to draw from that data is worth emphasizing: Most of China’s college-educated or highly skilled workers are already occupied in its labor force, which makes it more difficult to recruit the skills required by the insurance industry in China, while Mexico’s college-educated/highly skilled population is, overall, less employed despite a higher tertiary education ranking than China.

This suggests that insurers with an eye on the expanding middle classes of the emerging markets would have a greater opportunity to immediately recruit experienced, skilled employees into the insurance workforce in Mexico rather than in China, where it may have to rely more heavily on building talent.

Strategic business decisions — where to expand operations, where to pursue M&A opportunities, sustainable growth targets — can only be nourished by data that shows where the right talent is most available for recruitment and development.

In the long run, the insurance organizations that bring a laser-like focus to their future talent needs will be the big winners, as the global talent wars of the 21st century continue to take their toll.