Climate Change Liability

Expanding the Definition of Expected Risks

Insurance exists to replace losses due to unforeseen circumstances. Many perils fall within that definition, but several major underwriters are taking the position that weather-related losses no longer do so.

To be sure, direct damage from a tornado or hurricane is very much still covered. But carriers are starting to argue that in the era of climate change, the basic assumption should be that there will be storms that cause damage so that risk managers for insureds have an obligation to have sound contingency plans.

This developing position was laid out in a paper from FM Global titled Prepare for the Expected: Achieving Business Resiliency in an Era of Severe Natural Disasters.

In it, the carrier states that “there is no excuse for downplaying the risk of a natural disaster simply because the likelihood seems minute. The preservation of the physical infrastructure and the ongoing viability of the global supply chain can indeed be managed. As a business, the focus should always be on what you can prevent or control. CEOs should understand and accept that natural disaster risk is grounded in science and can unleash its worst upon any organization. The goal is to ascertain whether or not the business has adequately identified, assessed, managed and mitigated the financial exposure.”

FM Global cited a report released by the United Nations Office for Disaster Risk Reduction in May 2013. It details that “since 2000, economic losses from natural disasters are estimated at $2.5 trillion globally — 50 percent more in damage than previously expected.”

The paper also notes that weather events in 2011 combined to cost the United States roughly $55 billion.

All of these indicate a change in thinking about weather-related risks.

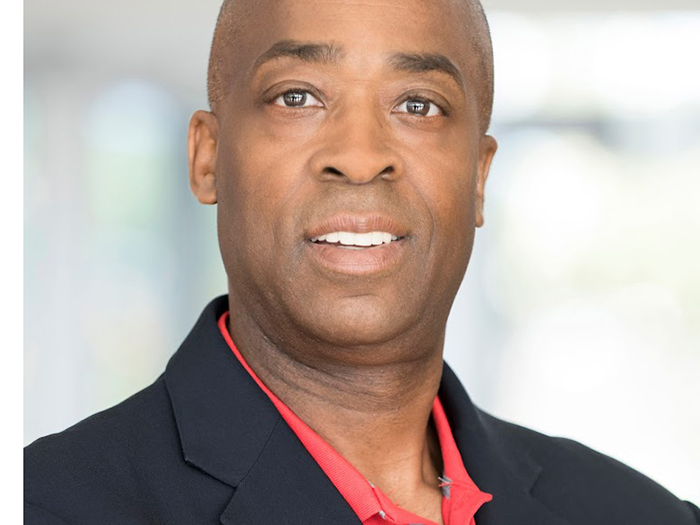

“Natural hazards are not some mystical thing,” said Brion Callori, senior vice president of research and engineering at FM Global. “The goal for risk managers is to get to the position of being able to make informed decisions about contingency. … You don’t want to have to report to your board or your shareholders about a problem that should have been foreseen and mitigated.”

One key focus is on supply chain risk assessment. Callori said that a tornado that damages a facility is one thing, but a tornado that damages a supplier’s facility cutting off access to key components is another.

He said risk managers should be working with key suppliers on their risk management challenges, but acknowledged it might be impractical to deal directly with second-, third- and further level suppliers.

Sometimes, it might be best just to hold some inventory of important materials, despite the focus on just-in-time delivery. “That could be an easy decision to make, once you have the full supply-chain and cost picture,” said Callori.

A paper published by Allianz last year posited that “just-in-time” and “lean manufacturing” combined with a rise in disruptive natural catastrophes has led to growth in business interruption and contingent business interruption, “a trend which has both insurers and businesses concerned.”

In its paper, Allianz put some onus on risk managers.

“… dependence on insurance alone is a risky strategy. Coverage for financial losses does not take account of a loss of market share, declines in investor confidence, or share price losses caused by the failure of a key supplier. The impact of these blows can be just as devastating, if not more so, to a business than financial losses on their own.”