Empirical Evidence: Reputation Risk Disclosure Boosts Equity Returns

A single case is just an anecdote; truth emerges when the same pattern appears again and again and again. Three companies to date have seen their equity values climb after disclosing reputation risk governance or insurance initiatives. The bottom line: managing, governing, insuring and disclosing reputation risk creates shareholder value.

Apollo Global Management, AstraZeneca and UnitedHealth Group saw their stock rise on average 3.1% on the day of their announcement, and 9.5% by day 28; adjusting for background market changes, they outperformed their respective peer indices on those two dates by an average of 2.3% and 5.9% respectively (Figure 1).

This value boost aligns with previously published reports, and complements recently noted benefits of reputation risk governance and insurance including stronger compliance risk management, enhanced board prudence, and more complete D&O financial protection.

Figure 1. Equity market outperformance in the days following all three known examples of companies disclosing initiatives in reputation risk management, governance, and insurance. Calculated by subtracting the peer groups’ returns from the companies’ returns. Peer Groups. Apollo Global Management = S&P 500 Asset Management & Custody Banks Sub Index (SP500.40203010); AstraZeneca = S&P 500 Pharmaceuticals Industry Index (SP500.352020); and UnitedHealth Group = S&P 500 Managed Health Care Sub Industry Index (SP500.35102030). UnitedHealth Group’s announcement will reach 8-week maturity on October 16, 2025.

Changing Landscape for Reputation Risk and Its Governance

In our current business climate, complex risk prevails, intangibles influence cash flow, emotions often drive equity value, and figuratively gunning for directors is a feature.” This shifting landscape of social and cultural norms described by the New York Times as “our awful era of intimidation and political violence[i]” has made reputation risk — which threatens liquidity — more prevalent, costly to firms, and personal to corporate leadership.

Risk managers are now describing reputation risk as a threat to resilience rather than a PR problem, while communications executives are using new reputation risk governance and management intelligence tools for enterprise risk management and enhanced governance. Legal and governance thought leaders are also weighing in. Both the American Law Institute and the DCRO Risk Governance Institute are recommending reputation insurance for companies and their boards.

These many changes have transformed the role of reputation insurance two ways. First, historical concerns about signaling moral hazards have become irrelevant, just as they did with liability insurance in the mid-1980s. Second, because qualifying for it is a non-trivial exercise, reputation insurance has become an indicator of quality governance

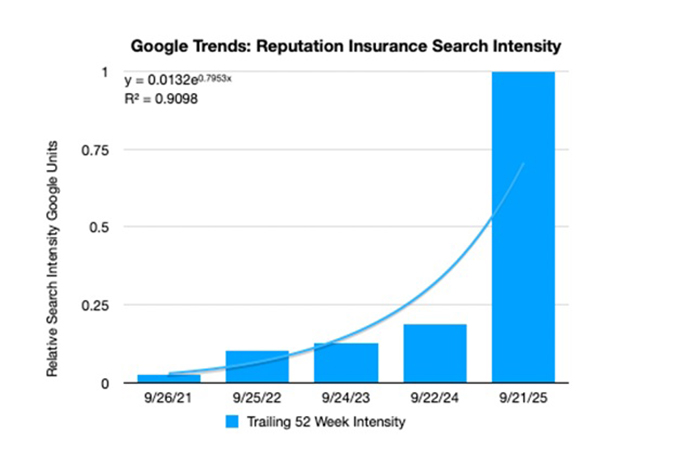

Internet searches for reputation insurance this past year are 3900% of what they were five years ago (Figure 2). This exponential growth reflects something the Financial Times observed some years back: “Corporate names are resilient: when their images get damaged, a change of management or strategy will often revive their fortunes. But personal reputations are fragile: mess with them and it can be fatal.” [ii]

Figure 2. Cumulative values for each of the trailing 12-month periods over the past 5 years. Source: Google Trends for search frequency of “Reputation Insurance.” United States web searches. Note: Raw Google Trends data represent search interest relative to the highest point on the chart for the given region and time. A value of 1 is the peak popularity for the term. A value of 0.5 means that the term is half as popular. A score of 0 means there was not enough data for this term. Queried September 21, 2025.

Reputation Risk Is the Cost of Aggrieved Stakeholders

Reputation risk is the exposure of both a firm and its leadership to long-tail financially material cash flow impairment, triggered by stakeholder behavior shifts — often emotionally charged — arising from unmet expectations.[1] More colorfully, stakeholders with grievances may boycott, strike, dump equity shares, raise credit costs, increase regulatory scrutiny, or deny social licenses to operate. This is especially true if stakeholders feel betrayed.

Negative PR is an amplifier, but is also a confounder. A few extremely agitated stakeholders can capture the media’s attention and distract management from what may be a core operational problem.

Cracker Barrel, for example, sought to refresh its concept after three years of reputation value decline. When it rolled out an updated logo and more modern restaurant design, some stakeholder saw it as a cultural conspiracy. In the ensuing media circus, the U.S. president weighed in.

Rather than sorting out reputation risk issues and their costs, the company quickly reversed its $700m rebranding, bringing it back to its core problem … without a clear strategy.

Is Any Company Immune from Reputation Risk?

While the recent Jimmy Kimmel affair left Disney in an existential crisis, according to Newsweek, the elements are not unique. Even the breathtaking speed within which a corporate decision became a crisis is becoming routine.

Tesla has seen its sales drop 13% year-over-year as its liberal-leaning clientele was angered by its chief executive, Elon Musk, embracing President Donald Trump and far-right politicians abroad. On the flip side, Bud Light saw its sales decline by $1.4 billion and the company’s market capitalization drop by $27 billion following a 2023 boycott of the brand by conservatives angry over its use of a transgender comedian in an advertising campaign.

Emotional outrage from political differences is also manifesting through lawfare. Over the past three years, 45 companies with a combined market value of almost $10 trillion have been targeted by conservative activists for “unlawful practices.”

Experts expect the government will continue to step in on the coattails of private-sector complaints. The Trump administration will likely go after companies that are high profile and have made strong statements in support of DEI in the past, reported Bloomberg, cautioning, “If you go running from DEI in a very public way, after having embraced it over the last three years, you might be hit by traffic going both ways.”

Many companies are vulnerable on this basis alone. In August 2019, the Business Roundtable published a new Statement on the Purpose of a Corporation signed by 181 CEOs who committed to lead their companies for the benefit of all stakeholders – customers, employees, suppliers, communities and shareholders. To many, this and the numerous proclamations that followed, all read as endorsements of DEI.

Is Any Director Immune from Reputation Risk?

Described elsewhere in some detail, securities class action, derivative litigation, and activist campaigns this past year against Disney, Southwest Airlines, Target, Meta, and Wells Fargo all seemed to go out of their way to humiliate board members.

Asset managers, activists, and regulators are using personal disparagement to damage a director’s reputation and career prospects to advance strategically their own agendas. These vary, ranging from punishment for equity underperformance, succession disputes, adverse litigation outcomes, or more commonly, identity-based criticisms (e.g., “male, pale & stale,” “DEI”), and politics.

The Risk Is Public — So Must Be the Insurance Solution

Enterprise risk management can mitigate and immunize against reputation risk; and it can help reduce the duration and costs of a crisis. Crisis communications experts and communications professionals are now sharing data with risk professionals. It is telling that thought leaders in governance and law who do not benefit from insurance products are recommending reputation insurance.

The reasons are both practical and strategic. In the Guiding Principles for Reputation Risk Governance: Essential principles for Boards of Directors released in June 2025, the DCRO Institute says: “As stakeholder expectations and legal standards evolve, so does the threshold for prudent oversight. Boards must understand their personal exposure and consider tools such as reputation insurance alongside D&O liability insurance to protect both the organization and its directors.”[iii]

Reputational risk insurance telegraphs higher governance quality. Because it requires certain standards to be met and imply third-party risk oversight like certain forms of cyber insurance, Principles of the Law, Compliance and Enforcement for Organizations published this past March by the American Law Institute note that, reputation risk insurance and its providers are recognized as tools that can help mitigate legal and compliance risk.

2025 Rhymes with 1985

Corporate reputation risk is no longer at the top of board member surveys. But with 60% reporting between Aug. 26 and Sept. 5, 2025 that interference from the executive branch or reputation risk are among their top 3 concerns, thoughts of personal reputation risk cannot be far off. Because liability insurance does not cover the negative cash flow impact of personal disparagement, for good governance and shareholder value creation, reputation insurance for directors needs to be part of a comprehensive risk management strategy. &

[1] Abstracted from DCRO Institute Reputation Risk Governance Council. Guiding Principles for Reputation Risk Governance. Essential Principles for Boards of Directors. DCRO Institute, June 2025. P9.

[i]French D. 2025 This Is No Way to Run a Country, New York Times Aug. 7. Available at https://www.nytimes.com/2025/08/07/opinion/judges-courts-threats-fear.htm

[ii] Gapper, J. 2016. Your brand is more fragile than you think. Financial Times, August 3.

[iii] DCRO Institute Reputation Risk Governance Council. Guiding Principles for Reputation Risk Governance. Essential Principles for Boards of Directors. DCRO Institute, June 2025. p20.