Supply Chain Risks

Driving Blindfolded

Last November, a global study of 3,000 small and mid-size enterprises (SMEs) found that only one in seven SMEs think their business would be significantly affected if they lost their main supplier.

Overall, 39 percent of SMEs consider themselves at risk from the loss of their main supplier, yet 55 percent believe it would not influence their day-to-day business.

Meanwhile, the “2015 Supply Chain Resilience Study” by Zurich and the Business Continuity Institute (BCI) found that while 74 percent of companies experienced at least one supply chain disruption in the last year, only half of those disruptions were known to originate from Tier 1 (immediate) suppliers, and 72 percent of respondents admitted they did not have full visibility into their supply chain.

“Supply chain risk is a blind spot for a lot of organizations.” — Karl Bryant, senior vice president at Marsh Risk Consulting

“This makes us believe that SMEs probably underestimate their supply chains risk exposure, and we urge them to reassess this,” said Nick Wildgoose, Zurich’s global supply chain product leader. He added that visibility and resilience along supply chains are major sources of competitive advantage.

BCI warned that organizations could be “driving blindfolded into a disaster.”

Companies at most risk are those reliant on “sole source” suppliers — one-of-a-kind manufacturers whose components are either of unique quality or are unavailable elsewhere in the market.

In today’s lean manufacturing era, fewer companies keep spare inventory, so if a critical component ceases to be available it can quickly prevent a company from producing its core product or service, leading to lost revenue, diminished service, dissatisfied customers and, in extreme cases, business closure.

Lurking Risks

Supply chain risk lurks in many forms. According to the BCI, IT and telecoms outages, adverse weather, and for the first time, cyber attacks/data breaches are

the top three causes of supply chain disruption. Another emerging risk is “business ethics,” which placed in the top 10 for first time.

“Supply chain risk is a blind spot for a lot of organizations,” said Karl Bryant, senior vice president at Marsh Risk Consulting.

Complacency that suppliers have everything under control can be a problem, said

Ken Katz, property risk control director at Travelers.

“When a risk exists outside your own four walls and you are focusing on your core business there is reduced visibility to the potential destruction it can cause,” Katz said.

To make matters worse for SMEs, smaller companies are likely to feel the effects of a supply shortage first as suppliers will invariably prioritize their biggest accounts if outflow is reduced.

An obvious risk mitigation strategy is to have a stockpile of spare inventory, but such an approach is not popular in these austere times.

An obvious risk mitigation strategy is to have a stockpile of spare inventory, but such an approach is not popular in these austere times.

“I’d love to see companies with six months’ supply, or matching supply against their expected downtime and their assets, but that’s a losing battle — no one wants inventory these days,” said Bryant.

Former RIMS President Rick Roberts, director of risk management and employee benefits at Ensign-Bickford Industries (EBI), said supply chain disruption is a “huge issue. People who’ve never had a problem often sit back and don’t pay much attention, but up-front work is critical because when a problem hits it can be major.”

Roberts, whose company is both a customer and supplier, said some of EBI’s customers require his company to keep a number of months’ worth of supply as inventory as part of their agreement. However, few SMEs have the leverage to wield this kind of influence.

Risk Assessment

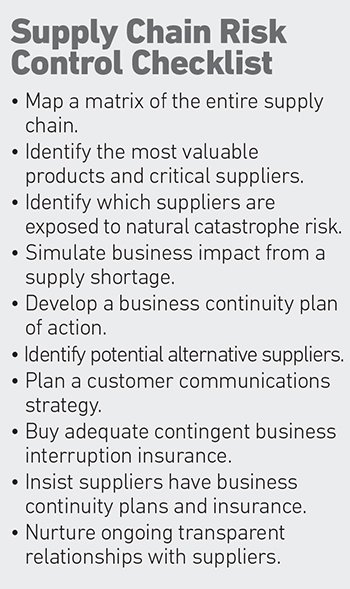

To fully understand their supply chain exposures, Bryant suggested SMEs conduct a “value segmentation” exercise, identifying mission-critical areas of their

business, such as those that generate the highest margins or growth.

Then, Katz said, they should conduct a “business impact analysis,” simulating the repercussions of vital components being undeliverable.

It is also essential for SMEs to get to know their suppliers’ finances and quality of work as best they can, he said.

Bryant said that companies should compile a matrix of their supply chain in as much detail as possible, including suppliers of suppliers, and if possible, the exposure of suppliers’ plants and operations (as opposed to regional offices) to natural catastrophe such as flood or earthquake.

SMEs should ask all their suppliers what business continuity plans and insurance they have in place, and get clarity on exactly how they will be treated should the supplier run into problems.

However, warned Bryant: “It can take a lot of man hours to send out questionnaires, follow up on them and pull the information together in a meaningful way, and many smaller companies don’t have the resources to invest in that kind of process.”

Nevertheless, this is information that empowers risk managers to make informed continuity plans. This could include, for example, finding alternative single source suppliers or new methods of production in case a sole source supplier fails to deliver, or even potentially acquire that supplier to ensure it stays in business.

There must also be a communications strategy for dealing with clients and negotiating delays. “You need a good explanation that is more sophisticated than ‘we can’t help you, I’m sorry’,” said Bryant.

Continuity planning, he said, requires a coordinated approach between risk and operational departments to ensure that gathered data is optimally leveraged. According to the BCI, only 54 percent of SMEs currently have a business continuity plan, compared to 74 percent of large organizations.

It also found that nearly six in 10 SMEs don’t insure losses from supply chain disruption, even though contingent business interruption (CBI) insurance would compensate for lost revenues during a supply problem.

This usually applies only to an insured’s first tier of suppliers, and can only be acquired if the SME has business interruption coverage.

Roberts would like to see more insurers extend coverage to second tier suppliers. “It can be expensive, and you can’t always see the benefits of being proactive — but when you get hit with a loss you’ll wish you had been prepared.” &