COVID-19 Contingent Business Interruption Claims Won’t Be The First Settled. Here’s Why

COVID-19 swept through the world during the first and second quarters of 2020, disrupting global economies and shuttering businesses — both temporarily and permanently. This disruption has resulted in economic, political, legal and regulatory issues aplenty.

And for businesses that are dependent on complex supply chains and industry partnerships to function, their attention is turning toward an insurance avenue that may have garnered less attention in the past — contingent business interruption coverage.

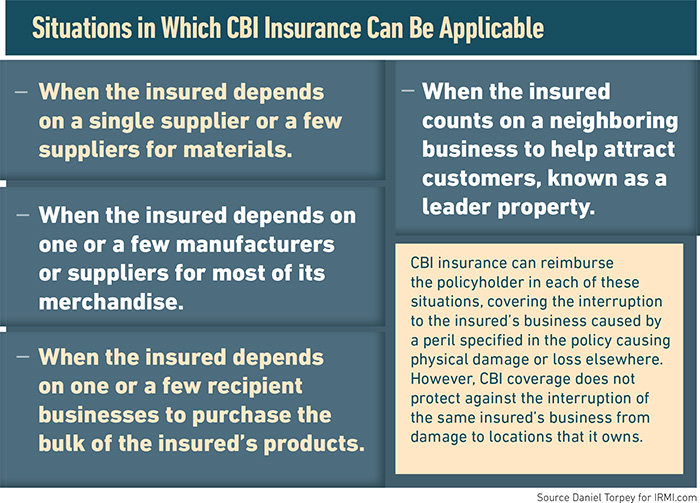

Contingent business interruption coverage is important for any insured that may experience a loss arising from a disruption to their supply chain. That disruption may be caused by a supplier, vendor, logistics provider or key customer that is unable to provide or deliver products or services to the insured.

Adriana Tonelli, vice president of claims and contract specialist at ABD Insurance & Financial Services, said there has been substantial press on the uncertainty of whether COVID-19-related closures are insured events under the “business income and civil authority portions of the business interruption/time element” coverages, but she has seen little attention paid to the often lesser-understood and less-utilized contingent (or dependent) business interruption coverage provided under those same policies.

“That could be because the coverage analysis and coverage issues are similar,” Tonelli said.

Dennis Windscheffel, senior counsel, Akin Gump

“The trigger for coverage under business interruption (BI) and contingent business interruption (CBI) is generally going to be direct physical loss or damage by a covered peril to property that causes an actual loss of income to the insured.” The difference between BI and CBI is the location of the property; for BI it’s on the insured premises and for CBI that property is owned by a third party in the insured’s supply chain.

“The issue of whether COVID-19 causes the requisite ‘damage’ needed to trigger coverage remains, as do the questions regarding applicability of policy exclusions, such as virus exclusion,” Tonelli said.

And although contingent business interruption on its own has received little press, ABD has asked its insureds to let ABD know if a business within their supply chain ceased or decreased operations due to a shelter-in-place order or contamination.

Dennis Windscheffel, senior counsel at Akin Gump, also has not seen contingent business interruption claims receive much attention at this point. However, he does not see this as surprising.

“Numerous direct business interruption claims already have proceeded to litigation. Businesses with potential contingent business interruption claims — which largely hinge on the same issues as the direct claims — may be waiting to see what happens in those cases, rather than immediately incur the costs of pursuing claims now,” Windscheffel said.

“Given the complexities and number of entities and different contractual arrangements involved in many supply chains, contingent business interruption claims also can be much more nuanced and difficult to establish than direct claims, including in terms of valuing the covered losses, determining the period of coverage, and confirming what exactly caused them.”

According to Jill Dalton, group managing director, property risk consulting at Aon, during the pandemic, the attention toward contingent business interruption coverage by both carriers and insureds has been related to increased scrutiny on the part of underwriters during the renewal process.

During COVID-19 recovery, Dalton said valid claims related to disruptions in supply chains due to physical damage are being processed normally. Underwriters are increasingly concerned about accumulated risk levels across multiple accounts and are asking individual clients for more information about their customers and suppliers in order to continue to provide the coverage.

“This underwriting process is being conducted with greater diligence in the general environment of a challenging property market for risk managers and other insurance buyers who are facing rate increases, some new restrictions in terms and conditions, and reduced capacity,” Dalton said.

“The pandemic, along with the ongoing trade battle with China, has heightened awareness around the vulnerability of supply chains.”

Lessons Learned

And as Tonelli explains, like civil authority coverage, contingent business interruption may be particularly beneficial to insureds that do not have documented COVID-19 exposure on their property (so no direct physical loss or damage on their own premises) but can point to loss or damage caused by COVID-19 at a member of their supply chain’s premises.

Following any claim, insurers ask for detailed information in order to adjust the claim. Contingent business interruption claims are inherently more complicated, because the information that insurers seek is dependent on cooperation from the supplier or customer that suffered the physical loss — and this information is not always available or provided in a timely manner.

“The key challenges in resolving CBI claims relate to exact determination of the cause of loss, the indemnity period, the measurement of the actual loss sustained and calculation of percent deductibles if applicable,” Dalton said.

It’s also important to recognize that CBI coverage is generally governed by a chain rule whereby there must be physical damage to a described property by an insured peril identified in the policy that causes a necessary interruption of operations.

“General business people often are not aware of this important technicality,” Dalton said.

“Thus, the most important lesson learned is that the nuances of this coverage must be widely communicated to all stakeholders. Unfortunately, this is an example of the widening in the global protection gap resulting from the disparity between economic losses and insured losses. In effect, a large portion in the amount of economic damages arising from major disasters can often go uninsured.”

Tonelli said the biggest issue facing CBI claims is determining whether an insured actually has a contingent business interruption loss.

Adriana Tonelli, VP of claims and contract specialist, ABD Insurance & Financial Services

“We suggest our insureds document all losses throughout the pandemic and then review those losses to determine what part of the losses, if any, are due to supply chain disruption,” she said.

“Luckily, an insured does not have to do this on their own. Carrier adjusters will look at a business interruption/time element loss and attempt to ascertain which specific coverages are applicable to the loss.”

This often requires the assistance of forensic accountants reviewing financial statements, sales forecasts, inventory reports, invoices/purchase orders, receipts and tax returns. Some policies will pay for the insured to hire their own forensic accountant.

So, what does the future look like for CBI post COVID-19? As Tonelli explained, insureds were already experiencing a hardening market for property insurance prior to COVID-19 and underwriters have had an enhanced concern around supply chain exposures; COVID-19 has only heightened those concerns.

“We have seen underwriters request that insureds provide detailed information including business continuity plans for multiple tiers of the supply chain,” Tonelli said. “Underwriters are also paying closer attention to the geographic distribution of the supply chain, as well as the geographic locations of the alternatives provided in the business continuity plan. The impact of the global pandemic has emphasized the importance of understanding who you do business with and how and where they operate.”

Windscheffel said the COVID-19 crisis has also highlighted the uncertainty as to whether standard property policies cover pandemic-related business interruption losses.

“As currently worded, most policies do not expressly address this situation,” Windscheffel said.

“And exactly how the ‘direct physical loss or damage’ requirement should apply in the pandemic context is unclear. Going forward, we think both insurers and insureds will want clearer policy language — which, after all, would be to everyone’s benefit.

“Insurers would have the certainty of not facing coverage lawsuits in which insureds argue that their policies are ambiguous. And insureds would have the benefit of knowing for certain that they either do or do not have coverage for pandemic-related losses.” &