Can Accident & Health Coverage Keep Rising Health Care Costs at Bay?

Businesses have a few insurance options to help shield themselves from liability and pay for medical expenses stemming from injuries incurred on their property or caused by one of their products.

If the injured party is an employee — and the injury is work-related — there is, of course, workers’ compensation. General liability policies will kick in to cover medical payments and legal expenses stemming from injuries to third parties. In many cases, injured persons also have their own personal health insurance to offset some of the costs.

Today, however, the scenario often doesn’t play out so cleanly. Depending on who was injured, how they were injured and the severity of their injuries, there are a number of variables that could complicate a claim and leave insureds on the hook for more than they anticipated.

Both employer and non-employer groups are taking greater advantage of accident and health (A&H) coverage to fill in gaps left by other policies and attenuate the potential for lawsuits that arises out of claim disputes.

There are key differences, however, between these two groups that influence their need for A&H coverage.

A&H Takes the Burden Off GL

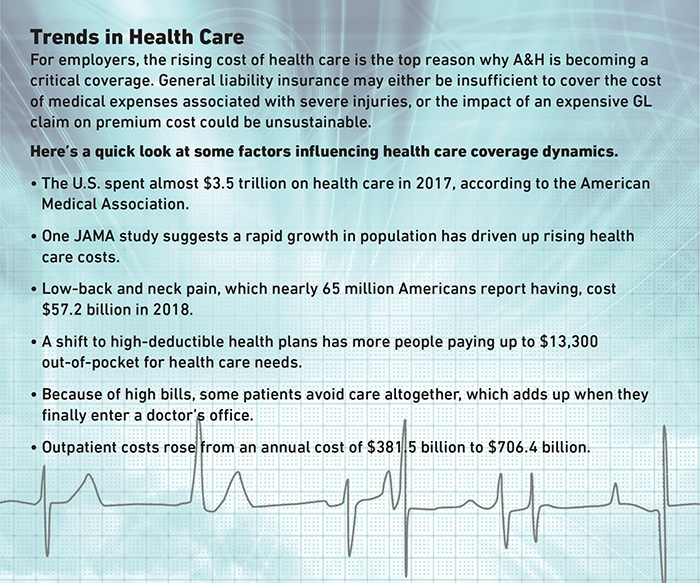

For employers, the rising cost of health care is the top reason why A&H is becoming a critical coverage. General liability insurance may either be insufficient to cover the cost of medical expenses associated with severe injuries, or the impact of an expensive GL claim on premium cost could be unsustainable.

Even minor injuries incur costs high enough to drive consideration of a new insurance strategy.

Ed Ramos, VP of underwriting, accident & health insurance for the Americas, AXA XL

Say a job applicant comes in for an interview, and on their way out they slip and fall down the stairs. “You’re looking at medical bills of at least a few thousand dollars,” said Ed Ramos, vice president of underwriting, accident & health insurance for the Americas at AXA XL.

A simple ankle sprain may cost around $2,000 to treat. But a broken bone? After accounting for X-rays; surgery; medical equipment like crutches, pain medications, follow-up care and physical therapy; you could be looking at a bill north of $10,000.

The medical payments coverage under a general liability policy might pay for that, but this coverage “is usually intended for minor injuries as the limit is typically low,” said James Walloga, Chubb’s head of accident & health, North America.

An accident and health policy would act as the primary layer of coverage in this scenario, which benefits insureds in two ways.

First, it reduces utilization of the general liability policy and results in a more favorable claim history.

“Having A&H coverage respond first results in a smaller general liability claim, which in turn helps to control the premium. General liability insurance is far more expensive, and A&H helps to offset that cost for the policyholder,” Ramos said.

A&H policies are also designed to respond quickly, without the need to establish fault. This helps insureds minimize the injured party’s incentive to sue.

“It’s no secret that we live in the most litigious country in the world,” Ramos said. “People sue for personal injury after spilling hot coffee on their laps. When the injury is more severe, motivation to sue is even higher because people know how expensive the treatment is going to be.”

Impact of the Rising Cost of Care

According to a 2019 benchmark Employer Health Benefits Survey by the Kaiser Family Foundation, 82% of individuals covered through their employer have a deductible. For individuals, the average deductible stands at $1,655, though the number varies widely depending on the size of the employer and the state of the health care market.

eHealth, a private online health insurance exchange, arrived at vastly different numbers: an average $4,358 deductible for individuals and $7,983 for families. Both agreed, however, that the cost of health care is rising faster than wages and that employees are bearing more and more of those costs.

“As deductibles for medical care grow, injured parties will increasingly face large out-of-pocket expenses. These ‘shock’ expenses can in many cases create instant financial hardship and could result in lawsuits and related liability claims,” Walloga said.

Michael Flood, vice president, Accident & Health Division,

Being able to step in quickly and offer payment for these expenses assuages the fear and anger that motivate liability lawsuits.

“In more serious injury claims, such as an accident that renders a volunteer a paraplegic, A&H accident policies can also provide monthly indemnity payments to help cover the cost of non-medical expenses, such as installing ramps in a home or traveling in a wheelchair-accessible vehicle,” Walloga said.

A&H policies are typically a voluntary coverage, and many businesses don’t recognize their value until they land in the middle of a lawsuit and an expensive GL claim. However, rising rates for liability coverages are starting to drive more interest in accident policies as a way to maintain a high level of protection at a lower cost.

The Role of Duty of Care

Non-employer policyholders face a unique set of risks. These entities that fall into this category are wide-ranging. They include youth sports leagues, volunteer organizations, trade unions, churches and community centers, and colleges or universities, with regard to student-athletes.

Although every industry considers itself a “people” business, these organizations bear increased liability risk because their core functions revolve around serving others. People are literally the foundation for their existence. For that reason, their duty of care to their participants is often higher than an employer’s duty of care to employees.

“Non-employer groups do feel that sense of duty of care. People who volunteer or participate in their events and programs aren’t getting paid to be there. So they’re a little more proactive about having this additional protection in place,” Ramos said.

“Both not-for-profit and for-profit entities that sponsor or organize various types of activities now recognize there is a relationship being built between the entity and the participants. Someone can have an accident during the sponsored activity and the sponsoring entity does not want the accident to harm that relationship,” said Michael Flood, vice president, Accident & Health Division of Philadelphia Insurance Companies.

Flood and Ramos agreed that youth sports leagues and schools sponsoring athletic teams are especially in need of an additional layer of coverage. Whenever sports are involved, the risk of injury is really more of a certainty. And protective parents may be more inclined to take legal action in the event of a severe injury.

“While there are several different exposures at a school that we need to be concerned with, the athletic exposure is typically the area where claim frequency and severity is highest — particularly when a school sponsors contact sports such as tackle football, soccer and lacrosse,” Flood said.

“Injuries can result in medical charges both small and large and, while not too common, we’ve seen claim payments into the millions of dollars for the most severe injuries. The ISO CG001 Commercial General Liability Coverage form, however, excludes medical payments to athletic participants. In this case, an accident policy is necessary to reimburse the family for eligible medical expenses they incur as a result of a covered accident,” he added.

For this reason, general liability insurers of non-employer groups often require the purchase of an accident & health policy to supplement their GL coverage.

There is also a reputational benefit to obtaining accident and health coverage for both employer and non-employer groups.

“Securing an accident policy and being able to help pay for out of pocket medical expenses is a demonstrable sign that the entity cares about a participant’s welfare,” Flood said. &