According to this COO, Advanced Analytics Can Give Insurance Companies a Competitive Advantage

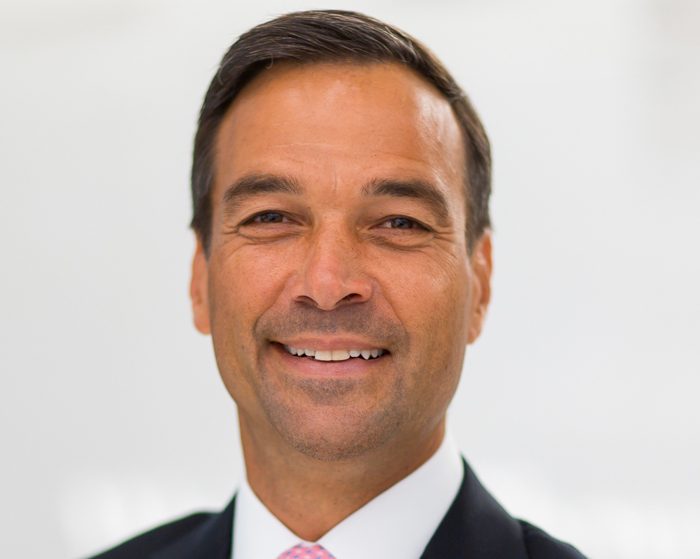

Michael Costonis, a 26-year veteran of the digital consulting firm Accenture, is taking on an important new role with CNA.

As chief operations officer, Costonis is charged with leading all information technology, analytics and operations functions across the company.

Given his background, the role appears to be a perfect fit for Costonis. He was the global insurance practice leader for Accenture and is credited, while there, with pioneering a patented analytical method for optimizing claims outcomes.

Like others, many others, Costonis is aware the commercial insurance industry is at a crossroads, as it seeks to shake its reputation as a sector slow to innovate and tries to take advantage of analytics in providing the best coverages and claims service possible.

“The insurance industry is at a unique time in its history,” Costonis said.

“The remarkable evolution of technologies and advanced analytics is creating tremendous opportunity to enhance the entire insurance value chain. From expert customer digital interfaces to machine learning pricing, underwriting and claims algorithms, meaningful competitive advantage will be secured by the insurers that optimize this unprecedented evolution,” he said.

Costonis added he thinks CNA has the horses to gain that competitive advantage.

“I’m grateful to be a part of a company with such a long and storied history, one that is rooted in relationships, superior service and a deep commitment to our agents, brokers and customers,” Costonis said.

“I look forward to collaborating and empowering our people to continue servicing our markets with excellence and achieving the next level of performance.

“If you’re not failing in innovation, you’re not taking enough risks,” he said. &