A Duty to Protect: How Travel Insurance Can Address a Riskier World

At night, scrolling through social media on his phone, Christopher Chao is acutely aware of any global events that might affect his business travel clients.

As a broker and senior vice president at Aon, Chao has helped a number of clients navigate business travel risks and purchase insurance policies to cover these exposures. So when he sees images from the war in Ukraine circulating on social media, he first thinks of his clients’ risks.

“I immediately get in contact with our brokers on our team and any clients that I know have exposure there, and try to get ahead of the curve,” Chao said.

And let’s face it, the world has thrown a number of curveballs his way over the last few years. Between a global pandemic, global political instability and shifting climate risks, navigating business travel insurance markets has grown increasingly challenging for insureds.

Companies want traveling employees to be safe, but the strategies for protecting them are already different than just a few years ago. Ongoing geopolitical conflicts, a global pandemic and other risks have fundamentally shifted the level of business travel risk, especially as compared to 2019, our last “normal” year.

As insureds navigate this tenuous risk environment, they may come to rely more on risk management solutions like 24/7 travel assistance programs to keep them apprised of shifting exposures. Others might take advantage of a soft market to purchase additional coverages to ensure that their road warriors are safe while traveling for business.

Same Risks, Greater Frequency

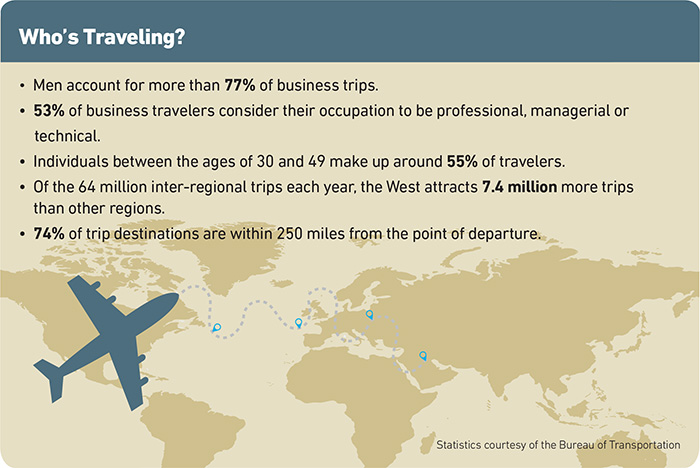

There are two basic exposures businesses contend with when they send employees out on a company trip: workers’ compensation injuries and damages to company property.

Christopher Chao, senior vice president, Aon

If someone falls ill or is injured, they may need medical care; if their physical safety is threatened, they might need an emergency evacuation or other form of transport home. On the property end, if a company car is damaged during an accident or if a computer is hacked whilst in another country, there are unique challenges a business might have to overcome, including navigating local insurance laws and negotiating with cyber criminals from afar.

These two risks have remained largely stable over time. Rarely are there emerging business travel concerns (future pandemics notwithstanding). The frequency with which claims occur, however, is constantly in flux.

“The younger population is definitely pressing their employers, ‘What are you doing for me if I get in trouble on a business travel trip?’ ” — Christopher Chao, senior vice president, Aon

In 2020, claims volume plummeted as businesses halted travel and pivoted to video conferences. Now, as face-to-face meetings are steadily rebounding, claims too will likely increase.

World events, like geopolitical conflicts or an uptick in natural disasters, can increase the odds that a claim occurs whilst an employee is traveling. On the geopolitical side, experts are saying we’re faced with the most tense environment we have in years as war continues in Ukraine and the Middle East. One security firm estimated it helped consulting firms, finance companies, technology firms and construction companies evacuate 4,000 people from Ukraine in March 2022.

Climate risks, too, are becoming unpredictable. A wildfire, hurricane or other natural disaster can threaten the safety of a business traveler. They can also cause flight delays and other issues that disrupt travel.

“Climate change-induced natural disasters, including hurricanes, wildfires and floods, pose significant challenges, lead[ing] to travel disruptions and safety concerns,” said Jim Villa, senior vice president of accident and health at Arch Insurance.

Added to these risks is the fact that employees are changing the way they conduct business travel. With the rising popularity of remote work, a traveling employee might tack on a few days of work-from-Sicily time at the end of a business trip to Europe or they might spend a few extra days in Florida after a company conference. If they get hurt during their pleasure travel, that may be covered under the policy.

Chao said many policies allow for 14 additional days of coverage to account for this flux period. “If someone gets hurt or injured or sick, the only reason is because they’re traveling at the direction of the policyholder, of the employer. So that has to be covered,” he said.

Some might ask why not return to virtual meetings, in the face of such persistent risks? After all, video calls got us through the pandemic. Executives argue that there’s a benefit to in-person meetings. Relationship-building occurs over business dinners and coffee chats that can’t occur via a sterile Zoom screen. Business travel spend rebounded to 77% of pre-pandemic levels for domestic travel and 74% for international trips last year, per a Global Business Travel Association survey.

“A lot of meetings can be replaced with virtual meetings,” Mark Kurland, middle market senior director of underwriting for multi-industry and technology, Liberty Mutual, allowed.

“I think there is a need to get out and meet customers and get back to face-to-face meetings and travel, but on a more limited and managed basis.”

Villa agreed: “Industries reliant on face-to-face interactions, such as sales, consulting, and client management, have demonstrated a greater willingness to resume travel activities as they seek to rebuild relationships and pursue new opportunities,” he said.

A New Cohort of Business Travelers

Facing elevated business travel risks, many employees are asking their companies what they’re doing to protect them during company trips.

Younger workers, in particular, are concerned about remaining safe during travel.

Forty-two percent of millennial business travelers say they have adjusted travel plans due to political instability or health risks, a 2019 survey by Wakefield Research found. Only 36% of Gen X and 23% of baby boomers said the same.

“The younger population is definitely pressing their employers, ‘What are you doing for me if I get in trouble on a business travel trip?’ ” Chao said.

One way businesses are showing younger workers they care is through 24/7 travel assistance services. These programs “can help locate medical care, coordinate payment during an emergency, arrange transportation back home, and perform many other services that can help ease anxiety during a stressful time,” Villa said.

One way businesses are showing younger workers they care is through 24/7 travel assistance services. These programs “can help locate medical care, coordinate payment during an emergency, arrange transportation back home, and perform many other services that can help ease anxiety during a stressful time,” Villa said.

These risk management services are available for both domestic and international trips, though “they’re typically just bought for overseas travel,” Kurland said.

With international trips, business travelers might feel less certain about what to do in an emergency. In their home country, they might feel more confident in their ability to get in touch with emergency services on their own.

Even in those cases, employers should consider travel assistance services plans. Someone who is severely injured several states away from their home, might want a professional to step in and help make medical evacuation arrangements. Employees may also feel relieved to know that there are services in place to help them in the event of an emergency.

The Business Travel Insurance Playbook

Right now, the rates for business travel insurance coverages remain relatively soft and there are few policy exclusions aside from war risks.

So insureds should consider purchasing expanded protections, like travel inconvenience benefits, emergency evacuation or physical damages coverages, in order to ensure employees and company property are protected while abroad.

“I think there is a need to get out and meet customers and get back to face-to-face meetings and travel, but on a more limited and managed basis.” — Mark Kurland, middle market senior director of underwriting for multi-industry and technology, Liberty Mutual

When it comes to auto coverages in particular, these added benefits can be a boon. “For auto rentals overseas, insureds should purchase coverage offered locally. We recommend you purchase the liability coverage, which you may be forced to buy anyway if it’s required. But then we recommend you purchase the physical damage coverage, round up for all perils — stolen vehicle, damaged vehicle,” Kurland said. “You just don’t want to deal with having to adjust that claim overseas.”

Mark Kurland, middle market senior director of underwriting for multi-industry and technology, Liberty Mutual

Multinational corporations should ensure that workers traveling from different countries have the same scope of coverage. If a company has employees from several different nations traveling to meet at one conference and an insured event occurs they need to have similar protections in place for each individual worker.

“Employees from different countries are going to travel together,” Chao said. “If they’re involved in the same accident, and they’ve got all this piecemeal type of coverage that’s a big problem.”

If companies have questions about their business travel exposures, Chao offered a simple piece of advice: “Talk to your broker, and say, what are our challenges?” If they’re proactive, they’ll be able to guide you through today’s risks. &