5 Ways Robots Reshape (and Improve) Workers’ Comp

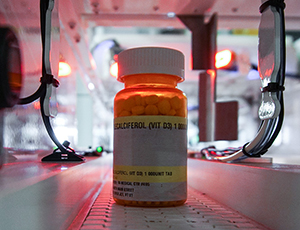

Robotic pharmacies are virtually eliminating costs related to medication dispensing errors. Image: Susan Merrell/UCSF

Robots have been in the workplace since 1956, but it’s stunning how the machines have evolved since then. Robots and cobots in the workplace are boosting productivity as well as safety in a broad range of workplace environments. They’re also poised to have an impact on the workers’ comp field in a variety of ways. In the not-so-distant future, robots may impact your safety and workers’ comp programs in ways we couldn’t have imagined even 10 years ago.

1) Helping injured workers heal

A prototype robot for sports therapy has been developed in Singapore, aimed at providing a high quality, repeatable treatment routine to improve sports recovery.

The robot, named Emma — Expert Manipulative Massage Automation — treated 50 patients in early trials, including professional athletes with conditions including tennis elbow, stiff neck and shoulders and lower back pain.

Emma uses sensors and diagnostic functions to measure the response of a patient and the stiffness of a particular muscle or tendon. The detailed diagnostics are analyzed and uploaded to the cloud so that treatment and recovery can be measured and monitored by physicians and therapists. Treatment programs can be adjusted based on recovery progress.

Emma is undergoing user trials at Kin Teck Tong, a medical institution with a chain of clinics that offer sports injury rehabilitation and pain management through the integration of advanced sports science and traditional Chinese medicine.

Emma’s success has the potential to open a broad range of opportunities across the injury rehab and pain management industries.

Meanwhile in Poland, a robot named Luna is helping to enhance physical therapy for injured patients as they work to regain muscle strength. Luna uses electromyography, or EMG, to identify electrical currents as patients bend their arms or legs.

By detecting muscle tension not immediately visible to the human eye, Luna can help therapists choose the best exercises for patients, as well as provide them with real-time information about patient progress.

2) Enabling advanced solutions for traumatic injuries

Robotic exoskeletons are achieving great things for paraplegic patients with permanent injuries. But they are also becoming a vital piece of the recovery strategy for spinal injury patients that have the potential to walk again.

Technology like the Swiss-developed RYSEN harness can adapt as the injured worker recovers. The harness is attached to the ceiling, and uses a deep neural network algorithm that can “learn” where a particular patient needs the most support. This enables injured workers to regain their gait and balance at the right pace as their bodies heal.

Traditional rehab harnesses pull upward, making the patient shift their body weight backward — an unnatural condition for walking. RYSEN uses a computational model that can simulate normal walking by predicting the right configuration of forces to be applied to the patient’s trunk.

The harness learns how a person moves and where they tend to shift their weight and adjusts accordingly. It can also be used to move in multiple dimensions rather than simply forward, which lets patients practice a variety of movements such as moving between obstacles.

3) Packaging prescriptions for injured workers

Dispensing medication is a task well suited to machines. A robotic system receives a script from the physicians or the pharmacist, the robot picks the correct dose and quantity, packages it up and hands it over to an individual.

Some human pharmacists may be wary of the technology, but employers and payers have cause to embrace it. A 2012 study done at a Houston hospital found that for every 100,000 prescriptions, pharmacists made an average of five errors. The Office of National Drug Control Policy reported to the Washington Post that as many as 5 percent of the 5 billion prescriptions filled each year are incorrect.

The Institute of Medicine’s Committee on Identifying and Preventing Medication Errors estimate that there are at least 1.5 million preventable adverse drug effects in the United States each year.

Robotic pharmacy systems are consistently bringing those figures close to zero around the globe.

UC San Francisco’s medical center and other hospitals have sustained long-term error-free dispensing with pharmacy automation systems. Image: Cornerstone Automation Systems

Nearly 70 percent of community pharmacies in Denmark use automated or robotic dispensing technology. The UK’s Wirral University Teaching Hospital NHS Foundation Trust reported a 50 percent reduction of dispensing errors in the four months after implementing a pharmacy robot.

In the U.S., the medical center at the University of California San Francisco is operating a proof-of-concept pharmacy at two hospitals, and the project has been working — 100 percent error free — for more than five years.

Pharmacy automation systems are increasingly being installed by various end-users such as hospital pharmacies, clinic pharmacies, retail pharmacies, mail-order pharmacies and pharmaceutical SMEs.

According to a recent Future Market Insights report, the global pharmacy automation systems market was valued at $3.3 billion in 2016 and is expected to register a compound annual growth rate of 6.2 percent from 2017 to 2027.

4) Adjusting injured workers’ claims

Well, no — robots can’t really replace adjusters. What they can do is take over the most clerical and transactional aspects of claims adjusting and allow human adjusters to focus on how they can add value to the claims experience from a claimant engagement standpoint.

Robotic process automation, or RPA, can enhance speed, accuracy, transparency and level of service … everything that matters most to injured workers.

The Office of National Drug Control Policy reported to the Washington Post that as many as 5 percent of the 5 billion prescriptions filled each year are incorrect.

Automation can ensure the right information ends up in the right systems and attached to the right claims, allowing human adjusters to act more efficiently. Automation is particularly effective for pulling data from standard fields on medical bills and for transferring and converting data across older claims systems into newer enterprise systems.

RPA can optimize claimant communication so that the right type of contact is made with the injured worker at the right time and through the right communication medium.

Robots can also quickly run quality assurance checks on entire populations of forms and payments to ensure accuracy. Anomalies and payment errors can potentially be flagged before the check ever goes out rather than being discovered by auditors after the fact.

As more carriers adopt mobile applications to streamline the claimant experience, these functions can be integrated with robotic process automation. Integrated chatbots can handle many routine communications tasks, including notifications of settlements and customer inquiries into claim status and payment status.

5) Freeing up lawyers to better leverage their expertise

In complex cases, it can take a large team of lawyers and paralegals to pore over every document related to the discovery process. However, that’s a task that can be accomplished via artificial intelligence at a fraction of the speed and cost it would take otherwise.

Machine learning is the foundation of the predictive coding technology that has transformed eDiscovery, reducing the amount of data that need to be reviewed by upwards of 80 percent in some matters.

eDiscovery platforms are now using AI to substantially improve the discovery process. Discovery-related AIs find important documents, facts and issues with minimal effort at lightning speed. Lawyers and legal teams are able to identify key documents quickly and benefit from an automated recommendation engine without the need to be experts in advanced analytics.

In this case, it’s not about replacing humans with robots. It’s about to taking a job that’s potentially tedious, headache-inducing and at risk for oversight errors and shifting it to machines that are better suited to scanning and sifting through terabytes of data. This frees up lawyers and paralegals to spend their billable hours on high-value tasks. &