5 Lessons Tesla’s Embattled Safety Program Can Teach Us All

2018 has been a painfully rocky year for Tesla. The company weathered missed production goals, Autopilot crashes, bankruptcy speculation and executive shakeups. CEO Elon Musk was forced to step down as chairman following a Department of Justice investigation into a tweet that Musk made about taking the company public.

Tesla is also in the crosshairs between the media and regulators over safety and compliance issues at its Fremont, Calif. plant. Reveal, the digital and podcast arm of The Center for Investigative Reporting, published an exposé in April alleging egregiously unsafe factory conditions and blatant under-reporting of injuries. Reveal followed up with a podcast on Nov. 3 that adds negligent medical treatment of injured workers to the list of accusations. Cal-OSHA opened three new investigations into the Fremont plant in September alone, bringing the current total of open investigations to six.

All of these accusations are at odds with public statements made by Tesla’ VP for environmental, health, and safety, Laurie Shelby, who says the company’s goal is to have “the safest car factory in the world.”

What’s the real truth about safety and workers’ comp at Tesla? It remains to be seen. But the company’s predicament offers insight into how Tesla missed key opportunities to better manage its safety and workers’ comp programs and communicate them internally and externally.

1) The tone from the top can be an asset … or a liability.

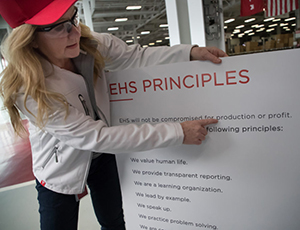

Despite a poster at the plant that says “EHS will not be compromised for production or profit,” multiple reports include allegations from current and former Tesla employees that company leaders put production first and pressure managers to enforce that priority.

Laurie Shelby, VP for environment, health and safety at Tesla, points to the principles of her department listed on a placard at Tesla’s Fremont, Calif. plant. Image: Paul Kuroda/Reveal

Several sources also specifically pointed to the influence of Musk, alluding to personal quirks that compromised plant safety — like disapproving of the color yellow and disliking the loud warning beeps made by vehicles reversing. Whether or not those claims are valid, it’s pretty obvious that mixed and conflicting messages are an issue at the Fremont plant.

Leadership’s open and consistent commitment to health and safety is paramount. Leaders must hold themselves accountable for worker safety and communicate that message company-wide. It also can’t be just talk. Policies and procedures should be in alignment. Empowering workers to halt an assembly line if unsafe conditions arise, for instance, tells workers, “Your safety comes first, no exceptions.”

2) Don’t skip the due diligence during vendor selection.

Following the first Tesla exposé, the company hired Access Omnicare to run its on-site medical clinic. In short order, allegations against the clinic began to arise, including failure to treat, failure to record injuries, a blanket ban on calling 911 or using an ambulance even for serious injuries.

Some believe these practices stem from pressure put on the clinic owner by Tesla. Both Tesla and Access Omnicare deny any claim of wrongdoing and insist all decisions are made based on clinical judgment.

Many risk managers and workers’ comp directors say that when deliberating between vendor proposals, don’t ignore your gut. It shouldn’t take more than one meeting to pick up a sense of whether the vendor’s goals, values and priorities are aligned with your organization. Back up your gut reaction with research. Ask for client references. Talk to peers who may have worked with or interacted with the vendor in the past. Search online for any public comments that might raise red flags.

After you’ve made your selection, dedicate time to ensuring every person who might interact with your account understands your mission, your goals and your expectations. Some companies take the step of formally educating vendors with seminars or certification programs.American Airlines, a 2015 Teddy Award winner, organized a two-day summit for its internal workers’ comp team, its broker, its TPA and all of its vendors, to ensure that every person understood and was able to act upon the company’s goals. Likewise, Starbucks Coffee Company did something similar, training its TPA Genex Services in the ‘Starbucks way,’ earning the coffee giant a 2018 Teddy Award.

If any external team member fails to meet expectations or works counter to the company’s values, ask that they be replaced promptly.

3) Be absolutely transparent.

Tesla and its on-site clinic are taking heat for practices that appear negligent, whether or not the intent of the practice is grounded in sound reasoning.

The clinic owner has stated that, in his clinical judgment, emergency responders are not required unless an injury is genuinely life-threatening. (Workers who don’t’ need life support are typically sent to the hospital via Lyft).

Good policy or bad, it was never explained to employees, leaving its reasoning open to interpretation. Most assume the motivation is money or part of a strategy to avoid recordable injuries. Consider that 911 logs become public records, and first responders, unlike Lyft drivers, are legally required to report severe work injuries to Cal-OSHA. Whether or not it’s a valid practice, it certainly does look sketchy on the surface.

When deliberating between vendor proposals, don’t ignore your gut. It shouldn’t take more than one meeting to pick up a sense of whether the vendor’s goals, values and priorities are aligned with your organization.

Make sure workers know what to expect if they’re injured. Some employers issue an informational workers’ comp packet at the time of hire or time of injury, or both.

Include the “whys” in your documentation where appropriate. For example, if you’re operating in a state that allows you to direct medical care, explain you’ve chosen your preferred providers, because they have a solid track record of getting injured workers back to their lives and back to work as quickly and safely as possible. Without that information, you run the risk employees will assume — as some of Tesla’s employees did — that the company prioritizes cost-cutting over quality of care.

4) Prioritize return-to-work.

In a Feb. 4 blog post, Tesla’s Shelby touted the company’s new return-to-work program, where injured workers in light-duty positions would receive their regular wages during recovery.

Shelby added, “If Tesla is unable to accommodate an injured employee within the company, we’re now temporarily placing them with nonprofits and local organizations like YMCA, libraries or food pantries where they can help the community and receive their regular compensation.”

Those are best practices that companies across a variety of industries are employing. But Tesla’s critics paint a very different picture — of seriously ill or injured workers sent right back to work, of an on-site clinic that denies work restrictions and other problematic conditions.

If the latter were true, it wouldn’t just be ethically questionable, it would be fiscally questionable. Decades of examples bear out how a well-crafted return-to-work program can produce significant cost savings and reduce lost time while improving both recovery outcomes and employee morale. It’s a win from every angle, especially for high-risk sectors like manufacturing.

In spite of the advantages, half of employers surveyed for a 2017 Prudential report offered no return-to-work program. It’s unclear what passes for a return-to-work program inside Tesla’s doors, but if they haven’t launched a formal program, no time like the present.

5) Manage your message.

Hopefully your safety and workers’ comp programs will never be under the kind of scrutiny that Tesla is facing right now, but these days, you never know. One disgruntled, injured employee is all it takes to set off a social media circus.

As with any other type of risk your company faces, a crisis communication plan is vital. It’s important to respond quickly, calmly and appropriately. Faced with a report that’s credible and thoroughly researched, from a source as well respected as The Center for Investigative Reporting, a proactive response might have been to reiterate Tesla’s commitment to health and safety, assure the public that the allegations were being taken seriously and pledge to launch an immediate investigation into the claims.

But that’s not what happened. On the day that the first exposé was published, Tesla posted on its blog that the report was “an ideologically motivated attack by an extremist organization working directly with union supporters to create a calculated disinformation campaign against Tesla,” a defensive posture likely to fan the flames even further in addition to sounding a little bit like a zealous conspiracy theorist. A month later, Musk replied to a question about the report by dismissing the investigative journalists as “just some rich kids in Berkeley who took their political science prof too seriously.”

Both actions were missed opportunities to take control of the conversation and re-cast the story as that of a company taking responsibility for the situation and committed to getting to the bottom of it. &