5 Industry Insights from a CEO and COO

Economic, technological and demographic changes are all converging to reshape the insurance marketplace, bring new opportunities and new challenges for carriers. We sat down with the CEO and COO of QBE North America to get their take on changing market conditions, evolving technology and the talent crunch. Here are the 5 key takeaways from our conversation:

1) We’re entering a market no one has seen before.

“Rates are up for the first time in a long time,” said Russ Johnston, CEO, QBE North America. “But this hardening looks very different from the traditional cycles of the past.”

“This isn’t the hard market of 2001 and 2002 where pricing doubled or tripled and capacity disappeared,” said Dan Franzetti, COO and Chief Claims Officer, QBE North America.

At $700 billion, plenty of capital still exists in the market. And underwriters are exercising greater caution in pricing in an effort to maintain stability when the market softens again. Certain segments have also experienced greater loss inflation than others, meaning that pricing adjustments have varied by line.

“This market isn’t one where all boats rise with the tide,” Johnston said. “Public D&O is responding more profoundly. And the E&S market has likewise seen rising rates and tightening terms and conditions, but there’s an influx of opportunity into that space. It really depends on what chair you’re sitting in.”

The universal fact, however, is that “a lot of underwriters and brokers have never experienced a market like this,” Johnston said. “The market is trying to make itself healthier and find a new equilibrium. It requires a different mindset, and it will be interesting to see how people behave.”

2) Cyber insurance growth represents a dynamic shift in profitability.

Cyber is one of the fastest-growing lines in the world, but one that the industry is still figuring out. According to Johnston, the key to growing a line of business is by marketing it to the broadest base of constituents. In this case, that would be small and medium-sized businesses. For these companies, a cyber event could effectively put them out of business.

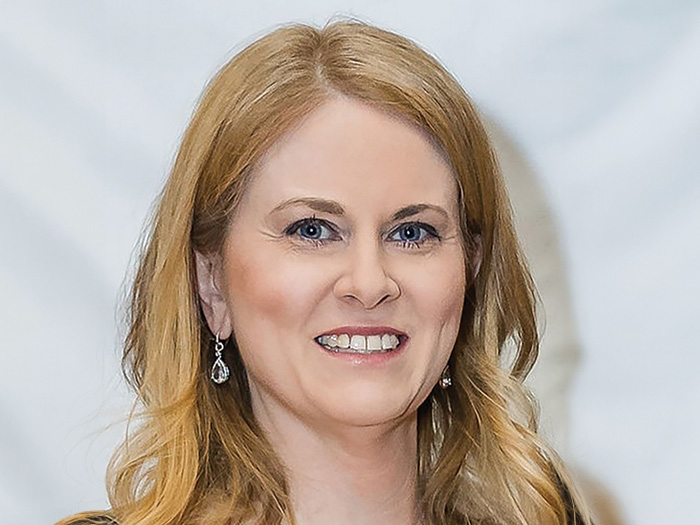

Russ Johnston, Chief Executive Officer, QBE North America

And yet, “small and medium-sized businesses are massively unprotected,” Johnston said. “We are working to help our customers by educating them about their exposures and the financial consequences of a data breach, malware attack, or system failure.

“While more data is available every day, the industry itself is continuing to learn about new cyber risks as they evolve. Effective cyber coverage requires a degree of specialized expertise and room for flexibility.”

“Cyber will grow as a standalone line because the risk is always evolving, and the industry is trying to figure out how to solve problems as they arise.” Johnston said. “Most innovation comes about as a monoline rather than an embedded play.”

Over time, Johnston and Franzetti said cyber will supplant some of the current largest lines of business, including auto. “In the next 10 years, cyber could be one of the three largest lines, globally.

That will be a pretty dynamic shift for the industry, and not all carriers will be positioned to take advantage of it,” Johnston said.

3) Technology adoption is slow and purposeful – not disruptive.

Though initially billed as the great disruptor of the insurance industry, Insurtech is more of an enabler of efficiency. Johnston pointed to the financial services sector as a model. Fintech never set out to replace big banks, but rather picked apart the different value elements that banks deliver and figured out ways to do them better, which ultimately benefitted Fintech companies as well as the banks themselves.

“It’s similar in insurance,” he said. “There’s too much capital required and too many regulatory challenges for Insurtechs to replace insurers, but we do view them as a source of innovation. We’ve forged joint ventures with firms we’re interested in, all the way up to equity stakes. At the end of the day, they are looking for a company to partner with and help them scale up.”

“Two or three years ago we set aside $50 million for a venture fund to make equity investments in Insurtech. So far, we’ve partnered with six. We evaluate Insurtech in three ways: will it improve the customer experience, increase our efficiency, or increase effectiveness.” Johnston said.

Franzetti added, “The most impactful applications of Insurtech so far have been in the area of customer experience. For example, in claims, we have had many opportunities to leverage Insurtech for better service. QBE has adopted virtual loss adjusting, which eliminates the need to send an adjuster out to a site, significantly speeds up the claim process and gets a check in the customer’s hands faster.”

Though slower in adoption, technology also has great potential for more specific and error-free underwriting.

“We are also utilizing an AI platform that learns contract language. In the long run, this will help us pair the claim information we get against contract language to develop more tailored policy wording and ultimately deliver better products,” Franzetti said.

4. Closing the talent gap requires a multi-generational approach.

Talent recruitment and retention has become one of the most critical risks facing the insurance industry. Much of the discussion has centered on how to attract Millennials and Generation Z into the workforce as Baby Boomers retire, but closing the gap will require a broader approach.

“There may be up to five generations in the workforce at the same time, and they all have different needs. A person in their 20s is looking for something different than a person in their 40s or 60s. They are all important constituents, and organizations have to be able to align their value proposition for each group,” Johnston said.

Offering flexibility and the ability to work remotely is one way to improve employee satisfaction and retention. Organizations should also look for opportunities to leverage their workers’ skill sets beyond their current role, creating more horizontal career paths.

“The industry needs to do more to create experiences that demonstrate it’s not all about vertical growth, it’s about horizontal growth. How do we keep people? Look at them through a broad skillset lens rather than a specific technical capability lens.” – Dan Franzetti, COO and Chief Claims Officer, QBE North America

“We are doing a lot in talent management to look at individuals through competencies rather than specific technical attributes. This will help us build a pool of people who can provide value to the organization in many ways, and ultimately helps to develop well-rounded leaders,” Johnston said.

Dan Franzetti, Chief Operating Officer, QBE North America

“The industry needs to do more to create experiences that demonstrate it’s not all about vertical growth, it’s about horizontal growth. How do we keep people? Look at them through a broad skillset lens rather than a specific technical capability lens. Over the past 20 years, I’ve taken lateral opportunities as often as upward ones,” Franzetti said.

In particular Franzetti emphasized the value of mentors and the need for self-directed career advancement plans. “I am always mentoring people and we encourage all our employees to create development plans and hold regular feedback sessions with their managers and peers,” he said. “At the end of the day, there’s no better learning method than asking for constructive feedback. You just need the courage to ask, listen and act upon it.”

5. Employee centricity is the unsung hero of success.

Most public companies would agree that making shareholders happy is their number one priority, so it’s a bit radical for the CEO of such a company to say that his employees actually come first.

“QBE is committed to providing an experience of excellence for customers. To do that, you need to create a culture that attracts and retains great people,” Johnston said.

“To make shareholders happy, you have to make customers happy, and to make customers happy you have to make employees happy. Show me a company that has delivered well on its shareholder promise that has low employee engagement, high turnover, and a bad value proposition. At the end of the day you need talented and motivated people, and shareholders get it.” Johnston said.

For QBE, the employee-centric approach is grounded in its identity as an integrated specialist insurer.

“Other insurers start with products. Their focus goes into developing and delivering products. But in order for us to act as an extension of our customers’ risk management teams, we have to engage with them differently. It’s a people-focused approach, and we can’t execute that without empowering our people first,” Johnston said.