12 Steps to Consider to Manage Burgeoning Claims

No business or organization can afford to unknowingly take responsibility for a contractor’s negligence. While nuclear claims and settlements capture headlines, the steady stream of “everyday” claims are also increasing in cost and severity. With aggressive plaintiff attorney tactics, societal mistrust of institutions and third-party litigation financing, claims that may have been quickly resolved in the past now can grow into lengthy and costly losses.

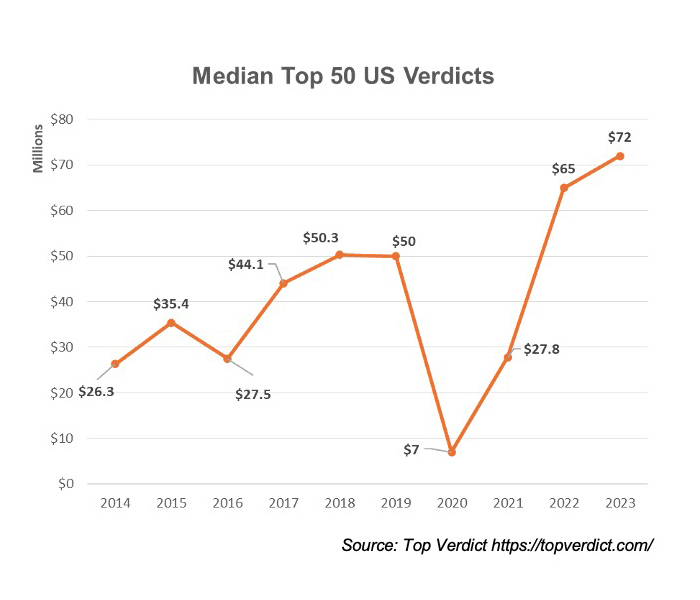

The growth in the median top 50 verdicts in the US over the last 10 years from $26.3 million to $72 million tells us a lot (even as we allow for the dip during COVID when courts were closed.)

Budgetary belt-tightening makes it more important than ever to strengthen your contracts to help protect your organization from third-party injuries that are out of your control.

Focusing on fundamentals like contracting helps mitigate these risks.

Proper contract language, insurance requirements and sound policies can better protect your organization. Here are 12 steps to help better manage risk without spending more money.

1) Require Proof of Insurance

To confirm a contractor has finances to pay for losses, request a certificate of insurance. The certificate should include:

- Name, address, and phone number for the agent and insured

- The insurance companies’ names and policy line, number, and limits

- The organization listed as a certificate holder

- A requirement that the insured provide a renewal certificate to the organization at least 15 days prior to expiration of any policies listed

2) Require an Additional Insured Endorsement

To gain coverage under another party’s commercial general liability (CGL) policy, ask to be named as an additional insured. Generally, organizations or institutions can become an additional insured:

- By adding an endorsement to the other party’s policy that names the your company as an additional insured.

- Through language in the other party’s policy stating an additional insured is “anyone to whom policyholder is contractually obligated to provide liability insurance” — policies with this type of language are known as “broad form” policies.

3) Keep Track of Certificates and Endorsements

You — not the contractor’s insurance broker or the insurance carrier — are responsible for keeping track of a certificate of insurance and an additional insured endorsement.

4) Review the Other Party’s Insurance Policies

Your organization’s status as an additional insured is only as valuable as the coverage of the underlying CGL policy. If the other party’s policy doesn’t cover the risks likeliest to occur under the contract, you get little to no insurance protection.

5) Inform Potential Contracting Parties About Insurance Requirements

Advance notice of insurance requirements will help attract contracting parties that can meet your requirements and prevent later disqualification.

6) Specify Lines of Insurance

Required lines of insurance typically include:

- CGL

- Auto

- Workers’ compensation

- Employers’ legal liability

- Professional liability

- Property

7) Require Stable Insurers and Consider Minimum Policy Limits

If the other party’s insurers are financially stable, they are likelier to be solvent to cover third-party claims. Consider requiring the other party’s insurers to have a particular financial strength rating by a nationally recognized financial rating organization such as AM Best. Consider setting minimum policy limits for each line of insurance and potentially excess insurance to reflect the potential risk of loss from the contract’s activities.

8) Use the Contract to Reinforce Insurance Requirements. While never guaranteed, a contractor’s insurer is likelier to assume coverage for a claim brought against your organization if:

-

- The contracting party has assumed responsibility for the claim under an enforceable contract.

- The policy has not expired.

- The policy covers the claim

9) Update Your Contract Forms

Having template contracts that incorporate these ideas makes it convenient for others across the organization to follow these tips. Update any form contracts your organization uses to include the model indemnity language. If you use a checklist to review agreements, include the model indemnity provision in the checklist and require contract reviewers to look for that provision in contracts under consideration.

10) Receive and Review Insurance Documents Prior to Signing the Contract

Before signing the contract, try to get and review all documentation about that party’s insurance coverage. Spend ample time evaluating the:

-

- Certificate of insurance

- Additional insured endorsement

- Other party’s CGL policy

11) For Multiyear Contracts, Confirm Insurance Requirements

Insurance coverage may change over time or even expire. Periodically review a contracting party’s insurance documents.

12) Get it in Writing

There is a reason this business adage is timeless. No written agreement leaves your organization unnecessarily exposed and can be a costly mistake.

Just like using a seatbelt, secure contracting practices can help protect you in an accident. &