2014 Teddy Awards

Roosevelt’s Vision in Action

In January 1908, President Theodore Roosevelt addressed Congress to explain why a system of workers’ compensation was a national imperative.

“Under the present law an injured workman … has no remedy, and the entire burden of the accident falls on the helpless man, his wife, and his young children,” wrote Roosevelt.

“This is an outrage. It is a matter of humiliation to the Nation that there should not be on our statute books provision to meet and partially to atone for cruel misfortune when it comes upon a man through no fault of his own … .”

Clearly, though, Roosevelt thought that preventing those “cruel misfortunes” from happening was too much to hope for. Workers’ compensation, he said, places “upon the employer the burden of accident insurance against injuries which are sure to occur.”

Fast forward a century or so, and Roosevelt himself would be amazed by what workers’ comp and risk management professionals are accomplishing on a daily basis. Workplace injuries and fatalities are no longer thought of as an unavoidable cost of doing business, and the injury-free workplace is the Holy Grail that employers strive to achieve. Some are even managing it, too. Teddy would be gobsmacked.

Employers large and small, across the spectrum of industries, are thinking creatively, maximizing their resources, and otherwise moving mountains to preserve the safety and well-being of their employees while simultaneously looking out for their organizations’ bottom lines. Dedicated workers’ comp and health and safety teams are constantly raising the bar on what it means to achieve excellence.

Part of what drives that progress is the continual sharing of ideas and strategies that work. In conferences and networking events, in books and magazines and online, workers’ comp professionals are learning from their peers, and finding success by adapting strategies to their own workplaces. At its core, that is what the Theodore Roosevelt Workers’ Compensation and Disability Management Awards are all about.

Employers large and small, across the spectrum of industries, are thinking creatively and maximizing their resources to preserve the safety and well-being of their employees while simultaneously looking out for their organizations’ bottom lines.

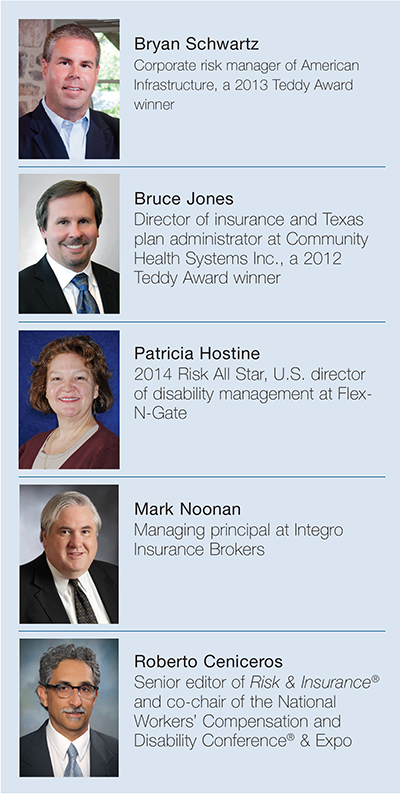

There are multitudes of impressive programs out there. It’s not easy to decide which ones to introduce to readers as Teddy Award winners. To help with the task, we enlisted the help of a panel of experts with decades of experience.

This year’s panel included Bryan Schwartz, corporate risk manager of American Infrastructure, a 2013 Teddy Award winner; Bruce Jones, director of insurance and Texas plan administrator at Community Health Systems Inc., a 2012 Teddy Award winner; 2014 Risk All Star Patricia Hostine, U.S. director of disability management at Flex-N-Gate; Mark Noonan, managing principal at Integro Insurance Brokers; and Roberto Ceniceros, senior editor of Risk & Insurance® and co-chair of the National Workers’ Compensation and Disability Conference® & Expo.

Judges reviewed applications independently, and then gathered via conference call to share their thoughts and opinions. Each finalist was then rated numerically in five separate categories to determine the winners of the Teddy Awards, which are sponsored by Sedgwick Claims Management Services Inc.

The Elements of a Winner

Any analysis of Teddy Award contenders probably starts with the numbers. Injury frequency, lost time, and medical and indemnity cost data is carefully evaluated with an eye toward year-over-year improvement in performance. Judges factor in fluctuations in staffing levels and other factors that may have influenced outcomes.

Program longevity is also taken into consideration when looking at the numbers. A newly minted program may put up eye-popping performance numbers in its early years. However, a program that’s been in place for a decade or more that shows modest, steady gains may be equally impressive.

Hazard levels and complexity are considered as well — a window manufacturing plant faces a vastly different set of exposures than a housewares retailer.

But the numbers never tell the whole story. Judges evaluated the finalists through the lens of their own experience, with an eye toward what makes for a program that is not only successful today, but has the tools in place to remain successful for the long haul.

But the numbers never tell the whole story. Judges evaluated the finalists through the lens of their own experience, with an eye toward what makes for a program that is not only successful today, but has the tools in place to remain successful for the long haul.

Flexible, sustainable programs have the infrastructure in place that can adapt if the company grows, shrinks, merges with another company, launches new product lines or even alters its business model.

Compass Group North America, for instance, has seen a remarkable 31 percent increase in staffing levels in the past five years. And yet because of the programs and infrastructure they’ve put in place, they have managed a 30 percent decrease in medical-only claims in the past two years as well as a drop in lost-time claims.

Teddy Award winners distinguish themselves by applying a holistic approach to risk that addresses the entire pre-injury through post-injury spectrum. Their programs contain elements addressing safety culture, injury prevention, training and wellness strategies while also finding ways to manage medical costs, ensure the best recovery outcomes, minimize lost time, and get injured associates back to work swiftly and safely. These programs have an impressive number of moving parts, each one evaluated and measured on a regular basis in order to ensure that there is continued forward motion at every level.

These programs are typically designed to start reducing risks from the earliest possible point. Honda of South Carolina, for example, starts by eliminating exposures before they can ever occur. They maintain a proven process that helps engineer out hazards for each product long before a single factory worker touches it.

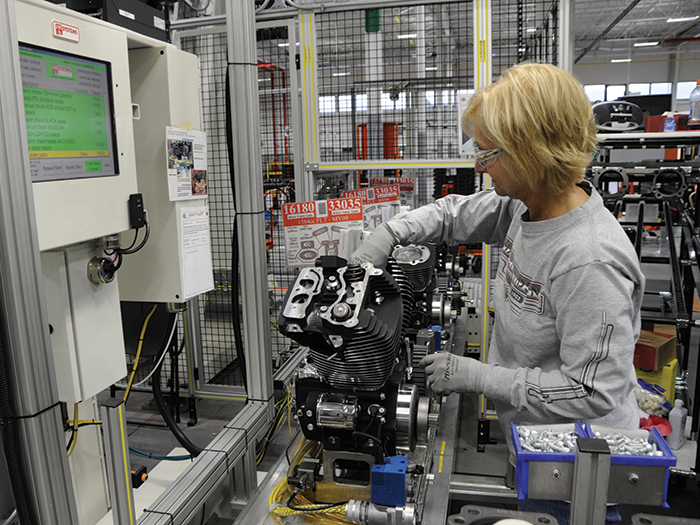

Harley-Davidson, meanwhile, uses a medical screening process along with a post-offer employment test to ensure that every worker can safely perform the specific physical tasks of the position before they’re officially hired.

Teddy Award winners also exemplify the “it takes a village” paradigm in their approach to collaboration, and have painstakingly forged teams — either internally or including third parties — with the risk expertise and skills to make their programs successful.

Top organizations such as Harley-Davidson have had to work through the challenges of replacing multiple vendors and hand-selecting the TPA staff to find just the right mix capable of meeting the company’s high standards. Weekly conference calls help ensure that all stakeholders maintain open lines of communications and share goals.

Focus on the Positive

Lost time is the enemy of both employers and injured workers. The longer an injured person remains out of work, the less likely it is that he or she will ever be able to return. Lost time is a huge obstacle to recovery and can contribute to comorbid conditions such as obesity. In the meantime, employers are short a valuable team member, while paying disability costs on top of labor replacement costs. That’s why the effectiveness of return-to-work programs is closely examined.

Not all return-to-work programs are created equally. Putting a recovering employee in a stockroom to count paper clips, does not benefit the employer or the employee.

Effective return-to-work programs require the right mind-set. It is not enough to rely on a doctor’s restrictions stating what the person can’t do. Instead, employers must look at what an injured worker can do independently or with some type of accommodation. That opens up the field to creative thinking and helps employers find productive work that benefits the organization while keeping injured employees engaged, active, and motivated to heal.

At Cold Spring Hills Center for Nursing and Rehabilitation, an employee confined to a wheelchair after spinal fusion surgery was enlisted to perform meaningful work helping to care for residents and accomplish other essential tasks.

At Harley-Davidson, an employee was casted and unable to drive or walk. The company didn’t merely locate a job her capabilities would allow, it provided transportation to get her to and from work and a wheeled scooter so she could navigate the facility.

Compass Group modified an operation to accommodate an employee without the use of one hand. It also allowed her to job-shadow other employees in order to broaden the possibilities for tasks she could perform one-handed.

Sprinkled among the application narratives was something else Teddy Roosevelt would have been heartened to see. Successful employers are building health, safety and workers’ comp programs with a genuine goal of caring for their people. Honda of South Carolina wrote earnestly that the “I Care” attitude shown to its associates is the underlying core that drives its health and safety and workers’ comp programs.

Writing of its approach to return-to-work, Cold Spring Hills noted that its policy not only minimizes the exposure of claims but also ensured that “the employee felt loved and cared for by her employer!”

This clear level of caring was not lost on this year’s judges. If you focus on what’s best for employees, judges said during their conference call, the cost savings will follow.

If that is the trend that guides the next century of workers’ comp professionals, Roosevelt’s legacy will be far greater than he ever dared to dream.

_______________________________________________________

Read more about all of the 2014 Teddy Award winners:

Building Value with Trust: Honda of South Carolina boosted its involvement with injured worker cases, making a positive first impression on employees and health care providers.

Building Value with Trust: Honda of South Carolina boosted its involvement with injured worker cases, making a positive first impression on employees and health care providers.

The TLC Behind the Roar: A proactive and holistic approach to employees’ well-being has resulted in huge reductions in work-related injury claims for Harley-Davidson.

The TLC Behind the Roar: A proactive and holistic approach to employees’ well-being has resulted in huge reductions in work-related injury claims for Harley-Davidson.

Quick to Act: Compass Group is lauded for its safety initiatives and for a return-to-work program that incorporates all of its business lines.

Quick to Act: Compass Group is lauded for its safety initiatives and for a return-to-work program that incorporates all of its business lines.

Healing the Healers: Teddy Award winner Cold Spring Hills Center for Nursing and Rehabilitation proved that even small organizations can make a huge difference in their employees’ lives.

Healing the Healers: Teddy Award winner Cold Spring Hills Center for Nursing and Rehabilitation proved that even small organizations can make a huge difference in their employees’ lives.