The Value of Reps & Warranties Insurance: A Comprehensive Review Going Into 2019

Representations and warranties (R&W) insurance is designed to provide insurance coverage for breaches of reps & warranties made by the seller in a purchase agreement.

The popularity of this insurance has increased dramatically over the last five years for three basic reasons: (1) recognition of the product as a mainstream way of dealing with indemnification obligations, especially in the private equity community; (2) global M&A volume; and (3) increasing acceptance of the product by corporate purchasers, many of whom are now repeat users of the product.

The R&W insurance product was developed in 1999, but its potential was not evident until recently. (See the charts below on M&A activity and Reps & Warranties insurance placed.) The placement estimates are our own after considerable dialogue with market leaders. Note that M&A volume is up 60 percent in 2014 to 2018 compared to 2009 to 2013. We estimate R&W policy placements up 30 percent in 2018.

Also driving popularity of R&W is the quality of the policy improved, while pricing has declined significantly. With 25 carriers currently in the R&W marketplace, finding committed carriers with proven willingness to address and pay claims is important. For 2019, we expect substantial submission growth over the roughly 4,000 submissions delivered this year.

Although subject to underwriting parameters, such as deal structure, industry, deductible, deal value and types of representations made, most pricing indications begin at about 2.7 percent of limit with a retention of 0.75 percent to 1 percent of deal value — depending on deal size.

Many sellers view the cost of insurance as a preferred option to putting up capital and deferring payments to investors. R&W insurance has been used to facilitate deals ranging in size from $5 million to $5 billion.

R&W Claim Frequency and Severity

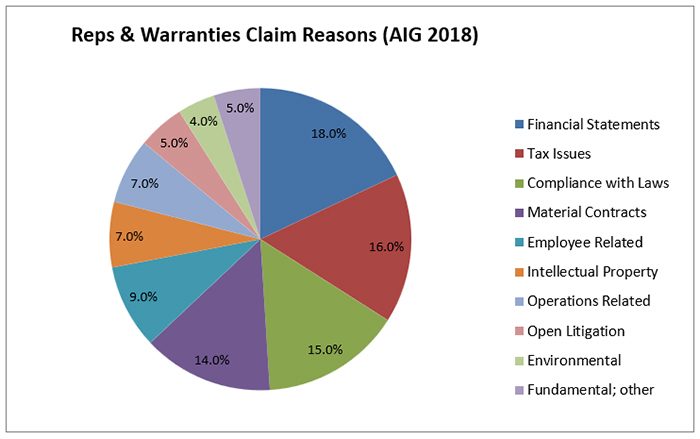

AIG published a very informative whitepaper, Global M&A Claims Study 2018, that included a categorization for the reasons for R&W claims (see the below pie-chart for details), noting that one-third of all claims frequency comes from financial statements and (related) tax issues.

Information on claim severity is more limited.

The AIG report does give some clues, stating that 8 percent of material claims exceed $10 million in cost. Their charts appear to put materiality at ~$100,000.

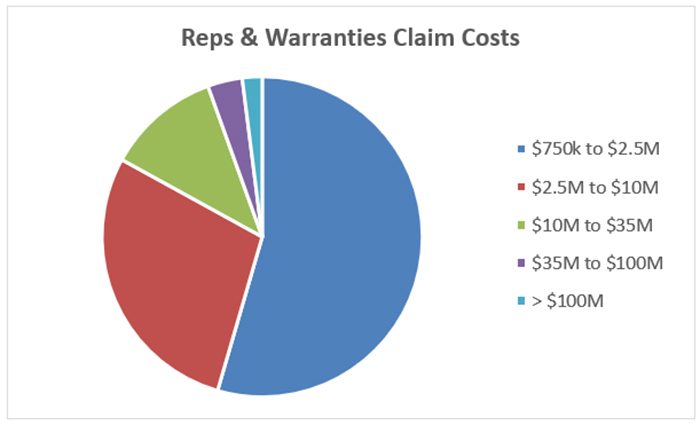

We built our own database conditioned on the claim cost exceeding $750,000 (removing more noise from claims typically less than the deductible).

Thus we built a second pie chart based on R&W claim cost estimates:

First of all, yes, there are claim costs in excess of $100 million that have been paid by carriers — we confirmed this with at least two carriers. Second, it is indeed a rare event to exceed $35 million in claim costs.

First of all, yes, there are claim costs in excess of $100 million that have been paid by carriers — we confirmed this with at least two carriers. Second, it is indeed a rare event to exceed $35 million in claim costs.

When measuring the value of R&W insurance for a deal, we need to look at both the “actuarial” value that compares the premium to the probability of a claim above the retention, as well as the intangibles, such as deal facilitation, balance sheet protection and the ability of the insurance to often extend the life of the representations and warranties for up to 6 years.

Traditional escrow arrangements lasting one year would not catch the 40 percent of claims that are reported more than one year after the close.

Our conclusion is to suggest that the sweet spot for this insurance product will continue to be for all size deals, but especially for those with valuations in excess of $50 million. &