Black Swan

The Day the Dike Breaks

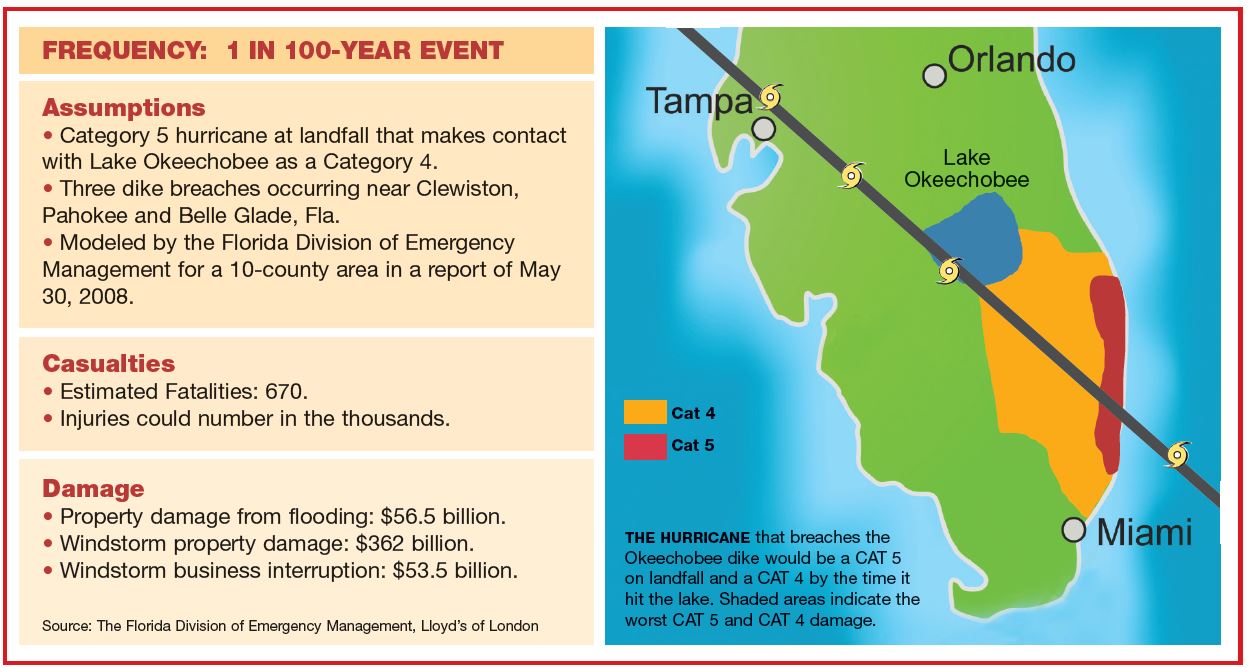

Hurricane Otto, a Category 5 hurricane, makes landfall at 3 p.m. ET on Tuesday, Sept. 12, 2014, just north of Fort Lauderdale. The storm travels northwestward across the state, maintaining Category 4 strength as it touches the southwest reaches of Lake Okeechobee, the 10th largest lake in the United States and the largest lake in the South.

The driving rains cause the water levels on the lake to rise, which creates a breach in the lake’s protective barrier, the Herbert Hoover Dike, in the vicinity of Clewiston. Tornados spawned by the hurricane also touch down on the dike, causing two more breaches, near the towns of Pahokee and Belle Glade.

The lake, at 730 square miles and an average depth of only 10 feet, begins to flood the surrounding communities.

Eventually, much of South Florida will be inundated.

U.S. highways 441 and 98, and state roads 715 and 80 are destroyed by the slow-moving water.

Geographically, there is nothing to stop the wall of water as it spreads out from Lake Okeechobee toward the Atlantic Ocean. It will be weeks before the flood waters recede.

Evacuations began in heavily populated Broward, Miami-Dade and Palm Beach counties when the hurricane’s landfall became a certainty.

But there wasn’t much time.

Once the dike is breached, the more than 640,000 evacuees in Broward have less than 14 hours to move. Miami-Dade’s more than 936,000 evacuees have less than 13 hours to get out. In Palm Beach County, the window is less than 16 hours and more than 448,000 people need to leave.

The number of evacuees in the 10 low-lying Florida counties south of the lake totals nearly 2.9 million people. And that doesn’t count the handful of counties to the North and East that are also affected.

But whether the residents will be able to evacuate is in doubt. In Miami-Dade County, the inundation puts 212 miles of evacuation routes under 2 feet or more of water. In Palm Beach County, 180 miles of flooded roadways could trap residents attending to flee.

Fatalities number close to 670. The property damage from the flooding and the windstorm that caused it run into the hundreds of billions of dollars.

The flood will have a devastating impact on businesses, families and Florida’s famous Everglades, which would suffer massive environmental damage.

The lake sediment contains decades worth of chemical runoff from local farms. Much of that sediment will contain toxic chemicals from the days when farmers weren’t as careful about what they put into the ground.

Flood cleanup costs will be amplified by debris, amounting to tens of millions of cubic yards, that will accumulate in heavily populated Broward, Miami-Dade and Palm Beach counties. According to a report by the Florida Division of Emergency Management, an Okeechobee dike breach scenario acompanied by a Cat 5 hurricane would produce 75.8 million cubic yards of debris. The U.S. Army Corps of Engineers estimates that Hurricane Andrew in 1992 produced 15 million cubic yards of debris and Hurricane Katrina in 2005 produced 118 million cubic yards of debris.

In that 10-county area, 62 percent of commercial properties suffer minor or major damage and 22 percent of commercial properties are destroyed.

This in an area where the pre-storm business-related structure values are some $62 billion.

Business interruption losses for that region are at some $53.5 billion.

It’s also not a good time for pet lovers. There are 3.8 million of them in the affected area and there won’t be enough time to take all of them to safety.

Who Saw This One Coming?

To the question, “Who saw this one coming?” the answer is, nearly everyone who was paying any attention.

The above situation has already been envisioned by the Florida Division of Emergency Management, which published just such a scenario for emergency planning purposes in May of 2008.

Other agencies in Florida are also on the case.

A study commissioned in 2006 by the South Florida Water Management District concluded that the Herbert Hoover Dike, which holds back the lake water, poses a “grave and imminent” danger of collapse.

The problem, according to an analysis of the situation by Lloyd’s of London, is that the dike is performing a task for which it was never intended. The dike is composed of earth next to Lake Okeechobee that was merely shoveled up into walls as high as 30 feet.

The decision was made in the 1970s to use the lake as a drinking water reservoir. This called for the maintenance of much higher water levels than the dike was ever intended to hold.

According to Lloyd’s, the Herbert Hoover Dike is being asked to function as a reservoir dam, when from a technical perspective, it isn’t a dam.

“The Herbert Hoover Dike was built as a levee to protect the local area from flooding,” Lloyd’s researchers wrote in a report about the dike’s weaknesses.

“It is made entirely from earth dredged up from around the lake and assembled into a huge mound,” the Lloyd’s report stated.

The engineering requirements to classify an impoundment as a dam are much more stringent than those for a dike, the report added.

The U.S. Army Corps of Engineers is maintaining a water level in the lake of between 13 feet and 15 feet above sea level. Should a Cat 5 or Cat 4 hit the lake, estimates are that the water level in Okeechobee would rise to 20 feet above sea level.

Those who are studying the issue closely say that there is no way the aged, decrepit structure would hold if that happens. The Corps, which in published statements pushes aside concerns about worst-case scenarios at Okeechobee, is currently pouring hundreds of millions of dollars into dike reinforcement efforts.

Of all U.S. flood risks, the Hurricane Research Center at Florida International University ranks Lake Okeechobee second behind only New Orleans in terms of vulnerability.

And hurricanes have hit Lake Okeechobee and caused breaches to the dike before. The 1926 Miami hurricane made landfall as a Category 4 and the high water levels in the lake breached a levee, leading to the deaths of 386 people.

Just two years later, the first Category 5 hurricane in the history of the Atlantic basin pushed even more destruction onto the unlucky residents in the vicinity of the lake. That storm caused a breach in a small dike at the south end of the lake and the resulting flood is believed to have led to the deaths of more than 3,000 people.

According to Lloyd’s, the only storm that killed more people in this country was the infamous Galveston Hurricane of 1900, the death toll from which is estimated at some 8,000. Hurricane Katrina is believed to have killed 1,833 people in 2005.

According to a 2006 report commissioned by the International Hurricane Research Center, there are similarities between what happened when the levees failed during Hurricane Katrina in New Orleans and the potential failure of the Herbert Hoover Dike.

The stability failure of foundation soils underneath the earthen dike and levees would be the culprit.

An Enormous Recovery Effort

Cleanup costs for the Everglades could range as high as $100 million. The geography and topography of the area would make this already catastrophic event even worse because water already tends to move slowly in the adjacent canals and through the marshy Everglades.

That means floodwaters could take several weeks to recede (much like they did after the 1928 hurricane). That would impede emergency crews, residents and claims adjusters.

Robert P. Hartwig, president of the Insurance Information Institute, said that the many home and business owners would suffer uncovered losses, since the majority of losses from flooding, especially to residential structures, would not be covered by standard homeowners’ insurance or business property insurance policies.

Homes would be covered by the National Flood Insurance Program — although many people in the area don’t opt for it.

“While many homeowners have flood coverage in Florida, many do not, even in known flood zones surrounding the Lake Okeechobee area,” said Hartwig.

While the insurance industry at large may be positioned to cover the storm, one company would be in serious jeopardy — Citizens Property Insurance Corp., a state-run, not-for-profit insurance company. It’s the largest property insurer in Florida.

If a hurricane caused Lake Okeechobee to flood, Citizens — and its claimants — would be in very deep trouble.

“Residual markets are supposed to be markets of last resort,” said Julie Rochman, the president of Institute for Business and Home Safety, which is based in Tampa, Fla.

IBHS is a national nonprofit association funded by the insurance industry. It works to reduce the social and economic effects of natural disasters and other property loss events by conducting research and advocating improved construction, maintenance and preparation practices.

If a large storm hit, “they definitely won’t have enough money to pay the claims,” she said.

If Citizens or some of the smaller insurers are taken out by a Lake Okeechobee flood, then we can expect resentment from a Florida populace that already mistrusts the insurance industry.