The Chief Risk Officer for the State of Montana Shares What the Risk Profession Can Do to Welcome More Young Professionals

R&I: What was your first job?

I began working at the age of 13. I grew up in a small town in Syracuse, Utah. I began working for Black Island Farms where I learned to pick asparagus and beats by hand. I was paid by the bushel. So, of course, I learned to work fast and efficiently, because my paycheck depended on it.

R&I: How did you come to work in risk management?

I think, like a lot of us in this field, I fell into risk management. At the completion of my graduate work at Brigham Young University, I accepted a position as the vice president of support services at psychiatric hospital Shoal Creek Hospital in Austin, Texas. One of my responsibilities there was quality assurance and risk management.

When I first began my career there in hospital administration, risk management was a new and emerging discipline in psychiatric health care. And it quickly became an accreditation issue for hospitals that weren’t doing it. So, I was charged with the responsibility of getting the risk management program up and going for accreditation.

R&I: What’s been the biggest change in risk management and the insurance industry since you’ve been in it?

I’ve seen a paradigm shift from the management of safety and compliance risks, which is more traditional risk management, to a more enterprise-oriented risk management.

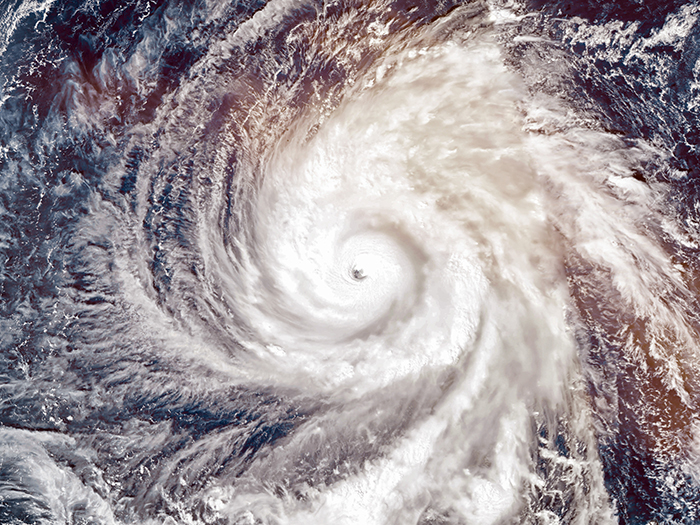

That includes a broader focus on cyber information security, political events and foreign travel. Many of our state and university employees are abroad for different reasons. Certainly, workplace violence prevention and active shooting is another new and emerging threat. And then there is also environmental litigation, natural disasters and aging infrastructure.

R&I: What’s the biggest challenge you’ve faced in your career?

That’s an easy one — relevance. I think risk managers, traditionally and historically, have been on the compliance safety side. For me, the fight has been to be relevant and to be at the table. Risk managers must look for opportunities to sell their skills to senior management.

For example, in July of 2013, historic flash floods pummeled Montana’s Bannack State Park with torrential rain. We have some aging and old structures out there that are historic. And 66 of those 80 structures were inundated with water, mud and debris. Some of our elected officials and key stakeholders wondered if it would ever recover.

Bannack was visited by various historical figures, from Henry Plummer and his badge of vigilantes to Big Nose Kate and others. It was important for us to get back up and running. I’m proud to say the insurance and property recovery programs that our office had put into place, with Belfor Restoration, Alliant Insurance and Lloyd’s of London, had experts on the ground at the site within 48-hours to begin the restoration.

Those lost income streams were fully insured, and the park reopened within six weeks. Our elected officials, in all branches of government, and our employees of Fish, Wildlife and Parks were very surprised. But that was a success for risk management in showing our skills. And I believe that success begets success. The promotion of those successes, coupled with effective programs, is vital in establishing credibility with key stakeholders.

R&I: Has the COVID-19 pandemic impacted the way risk is being approached in the public sector?

The COVID-19 pandemic has been historic and unprecedented. None of us were really prepared for it. I believe COVID-19 will affect the way risk is managed in the public sector moving forward.

But we are vitally concerned about our infrastructure; our public and higher education infrastructure. Many of the universities have closed and are offering virtual and online classes. Our agencies and all of our employees are working remotely from home. So, most of our buildings are unoccupied. And therefore, may be a little more susceptible to vandalism or arson, flood or fire, or other catastrophic losses.

I would say that some of the commercial excess insurance policies we have in place for Montana state government and our university clients provide limited coverage for cleanup and business income losses. However, we recognize that won’t be enough to address all business losses, which tally in the hundreds of millions.

We’ve primarily focused on our infrastructure and doing what we can to assist our clients in different ways, to step up our game and offer loss mitigation assistance. For example, we provide them with funding to cover the additional cost of security patrols, electronic surveillance and various and other sundry expenses. We really can’t afford, in this hard market, to have a large and uninsured loss right now.

R&I: Who has been your mentor(s) and why?

This may surprise you, but no one specifically comes to mind professionally.

What I can tell you is, I’ve learned a great deal by attending national conferences, sponsored by PRIMA — Public Risk and Insurance Management Association — RIMS — the risk management society — and our national association, STRIMA — State Risk and Insurance Management Association. Articles in leading trade publications, like Risk & Insurance®, and others, have really inspired me to adopt and to adhere to best practice approaches as well.

I would add my mother, who passed away early in my life, was a great mentor for me growing up. She encouraged me to be my best self, to treat everyone with respect.

R&I: What is the risk management community doing right?

Many things. I think more colleges and universities than ever before are offering degrees in risk management. I believe that associations and society conferences are better than ever. And those that I attend offer timely and relevant information or resources to assist risk management professionals. I believe that local chapters of national associations are improving and flourishing. We’ve made progress. Those are all good things and great strides in the right direction.

R&I: What could the risk management community be doing a better job of?

We could promote risk management as a career path in a better way for the up-and-coming generations. I have children that are millennials, and I’ve learned they’re data driven and more concerned about work-life balance, interesting and challenging work and making a difference in the world than I was. I believe many of their generation would be interested in a career path like what risk management and insurance offers. Certainly, risk management positions are in demand. They’re stable during economic downturns. And I believe they offer meaningful work that often impacts an organization’s ability to thrive and survive.

So in my mind, failure to effectively reach out to that younger generation and/or develop and encourage those we mentor to pursue such careers may result in lesser qualified individuals filling open roles in the future. We as a profession can do a little bit better in promoting the importance of what we do and the excitement and the fun of how cool of a career it is.

R&I: How would you say technology has impacted the risk management profession?

Risk management professionals must demonstrate that their programs are impactful and effective. I remember, as a new and budding risk manager for the state of Montana way back in 1989, much to my chagrin back then, I quickly learned that our data consisted of ledgers and spreadsheets. Because we had no analytics or technology, we were initially ineffective in persuading the Montana legislature that we needed to address unfunded liabilities and funding shortfalls.

Since that time, we’ve developed comprehensive and effective analytical capabilities and data platforms to provide our stakeholders with real-time accurate information about their enterprise risks, ensured assets and loss trends. Technology now, and analytics, have made a big impact.

R&I: What’s your favorite book or movie?

I love The Shawshank Redemption. Morgan Freeman is an amazing and inspiring actor

R&I: What is your favorite drink?

My daughter got me started on this, but I love Rockstar Recovery Orange. I probably drink a few too many, but I look forward to raising a glass of that every day. I love it.

R&I: What have you accomplished that you are proudest of?

Watching our business partners and our employees achieve new heights in their personal lives and in their careers. Collectively, we’ve won many national and worldwide awards. And we have very little turnover. So it gives me great satisfaction where I’m at in my career to watch the people who were with me on this wonderful journey, in this great profession, achieve successes in their own rights. That’s very rewarding to me.

R&I: What is the riskiest activity you’ve ever engaged in?

Becoming the first state in the nation to implement a comprehensive cyber information security insurance program. Our IT team kind of drug me into that program kicking and screaming. They were saying, “Well, if not you, then who?”

So, we put a program together, and we put it out there only to have it tested barely a year later when hackers infiltrated state information systems. This was back in 2013. It became the largest HIPAA breach in U.S. history at that time. But it performed well. Our carriers and business partners and all their vendors did a wonderful job.

I put myself out there and I remember being called over to the governor’s office after the breach, and simply put, I was asked, “Is this going to work, Mr. Dahl?” And to very important people, of course you want to be able to say yes. Luckily, I was confident in what we had created, and I knew it would succeed. I was able to confidently tell the people at very high levels, “It’s a great program. We’re confident that the vendors and the people who we put in place are going to respond and respond well.” There were no surprises along the way. We were very pleased with how that turned out.

But it was somewhat of a risk, putting myself out there as one of the first states to do it and then having it tested barely nine months later. &