Sponsored Content by Nearmap

How Aerial Intelligence Is Helping Insurers Minimize Exposures and Safeguard the Future

They say, “a picture is worth a thousand words.” For insurers that have access to aerial imagery with pixel resolutions high enough to capture what’s really happening on the ground in their books of business, pictures are turning out to be worth millions.

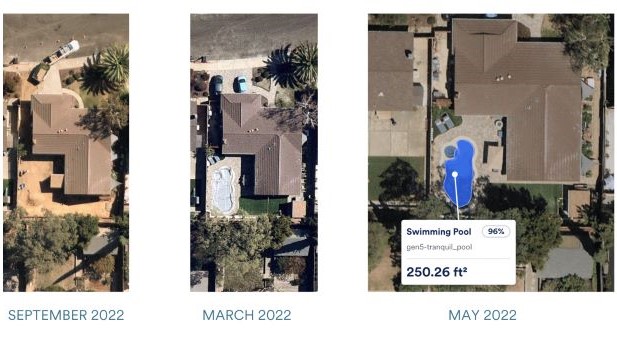

Take the case of a U.S. carrier covering California properties with tens of thousands of newly installed, undisclosed pools. The add-ons are courtesy of the surge in demand for at-home amenities that came about as many of us were limited to our home spaces during pandemic shutdowns.

With most property owners not disclosing these upgrades to the insurer many carriers found themselves with increased exposures at renewals; exposures they hadn’t factored into their premium rates.

One insurer was able to bridge this coverage gap by tapping into images and insights captured over the span of three years by Nearmap aerial imaging.

Kevin Tulp, Senior Solutions Engineer at Nearmap

“The original name for the project was COVID pools,” said Kevin Tulp, senior solutions engineer at Nearmap.

By using application programming interfacing (APIs), Tulp’s team, with the help of Artificial Intelligence-created models, pulled high-resolution images of nearly 1 million properties on the carrier’s book from 2019 to 2021 and found that 80,000 pools, or about 8% of its book of business, had been built.

“Can you even imagine the premium leak on 80,000 pools?” Tulp shared.

Not only did identifying these pools give the carriers the opportunity to help the property owners make sure their pools are being maintained properly, but it also recovered a substantial portion of that lost premium.

Aircraft equipped with the company’s advanced camera systems continuously capture cities across the US as well as ad-hoc post-catastrophe event imagery; all of which consistently replenishes the imagery database.

Being able to see over time what’s been happening on the ground is one part of the equation. Using deep-learning AI models, Nearmap extracts and digitizes property features such as roof materials and vegetation that provide insurers with an in-depth look at a building’s footprints. That visibility can strengthen risk reduction, (think vegetation management in wildfire-prone areas) and assist risk engineers and contractors in bolstering structural integrity.

“Since we’re capturing [images] so often, on the underwriting piece they can reference prior images to understand the property beyond [what’s seen from] a human looking at it,” Tulp said. “And then we’re also driving our own machine learning, so we’re quantifying what we’re seeing.

“We’re able to provide a cost-effective way to understand a carrier’s entire book of business,” he added.

High-res Imagery Combined with AI Changes the Underwriting Game

Getting a clear picture of damages after severe weather events and catastrophes is invaluable for first responders and government contractors, for sure.

But when it comes to commercial and personal lines insurance, underwriters say that having the ability to fully integrate high-level location intelligence into their platforms changes the game for their operations.

Even for carriers with GIS experts and catastrophe modelers on staff, aerial intelligence helps their data analytics teams get out of the Excel spreadsheets and sharpen their focus on the real risks they’re underwriting.

“We actually really rely on it to look back at the time series of information,” said Bryan Adams, SVP, head of catastrophe analytics, Arch Insurance. His team has fully integrated aerial imagery and AI by Nearmap into its platform to help drive underwriting performance.

“We actually really rely on it to look back at the time series of information,” said Bryan Adams, SVP, head of catastrophe analytics, Arch Insurance. His team has fully integrated aerial imagery and AI by Nearmap into its platform to help drive underwriting performance.

“We don’t need to go out to a secondary system and look at locations … When the underwriters look at it, they’re able to look at all that information quickly and easily on every single building that we underwrite,” he said.

Being able to seamlessly compose a complete picture of how a property has changed over time in terms of roof conditions, landscaping, or proximity to the coast, for example, “that’s very, very powerful,” Adams said.

“So not only can [underwriters] reference images of the property in question, but we’re also giving them tabular information to say, here’s the square footage; here’s any damage we’re seeing on the roof; here’s how tall the trees are on the property; this is the makeup of the ground around that area,” Tulp gave as examples.

And Tulp sees Nearmap’s continued refinement of its scoring and assessment system helping insurers make underwriting more efficient by quickly accessing deep dive into a property’s risk level: “We can break it all the way down, very granularly in things that would’ve required either [countless] phone calls or boots on the ground to confirm that information.”

Getting More from the Claims Experience

As insurance pushes to be more than a commodity, carriers who use aerial intelligence are differentiating themselves among customers by providing faster turnaround times on claims.

The more intense storms and wildfires become, the more difficult it will be to get vehicles on roads and experienced adjusters to assess damages after catastrophic events.

Insurers that cover areas prone to severe weather events are increasingly relying upon aerial imagery to help them expediate the claims triage process. As one Florida-based carrier said, “it’s helpful to be able to use [Nearmap’s technology] to help adjusters work more efficiently.” Having the analytical capability to identify the worst claims first, adjusters can be matched with the insureds most in need.

“When property owners incur massive amounts of damage to their properties, it would take months to actually confirm all of that,” Tulp said. “We’re turning that into days with our machine learning technology and our imagery to be able to see and quantify the damage.”

“When property owners incur massive amounts of damage to their properties, it would take months to actually confirm all of that,” Tulp said. “We’re turning that into days with our machine learning technology and our imagery to be able to see and quantify the damage.”

Applying artificial intelligence to claims data and imagery after historic events like the Marshall fire that devoured acres of Colorado in 2021, helps insurers work with insureds to prevent future events.

One of Tulp’s most rewarding use cases was examining Marshall’s aftermath on a scenic Colorado neighborhood surrounded by abundant wildlife. As the fire rushed through, all of the houses near high tree canopy were destroyed.

“So we did a retroactive study and pulled our AI imagery from the recent capture we had, which was three months prior to the [Marshall fire], and we were able to see each one of those houses that was destroyed and the ones that weren’t, and see if there was any predictive signal as to what could have happened,” Tulp explained.

“And sure enough, with about 95% accuracy, we saw that homes with tree overhang or medium-high vegetation within a certain threshold were burned by the wildfire … And then the ones that didn’t have those attributes, say in a newer neighborhood, they survived it.

Ultimately, the carrier used Nearmap visuals and analysis to quantify the claims and damages and improve its loss control and prevention services for insured property owners.

As Tulp reflects on what his team learned from its review of the claim data and imagery coming out of Marshall, the question for him boils down to “can we prevent future destruction, according to what we’re seeing on the ground and what we are able to include in our studies?”

And from his vantage point, the answer is clear: “Yes, we can.”

For more information, please visit Nearmap at www.nearmap.com/insurance.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Nearmap. The editorial staff of Risk & Insurance had no role in its preparation.